What makes dairy so valued that milk alone is in 94 percent of U.S. refrigerators? Nutrition is one factor. So is affordability. But perhaps the greatest value is one that data supports: People trust it.

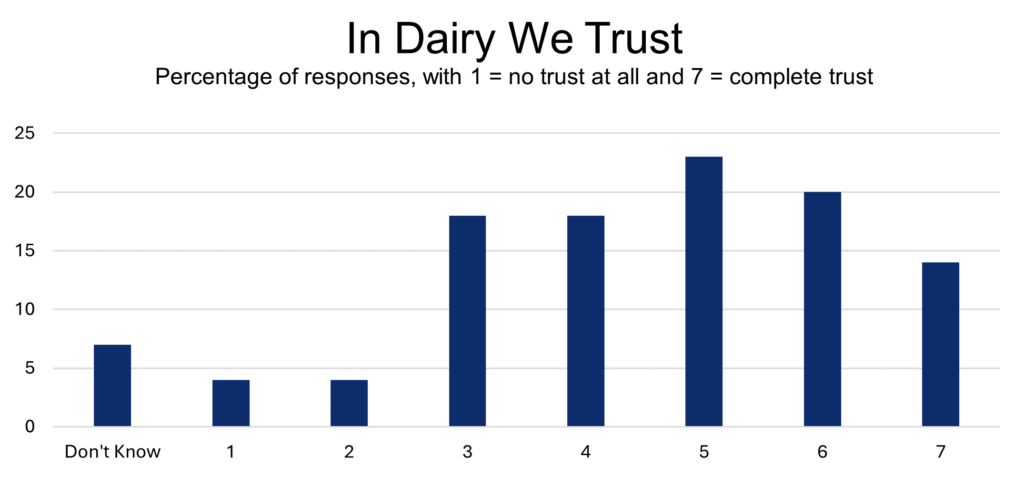

The dairy checkoff’s latest consumer perception tracker, conducted by Kantar Group, shows just how much confidence dairy has from consumers – and it’s a great contrast to the loud braying of the anti-dairy fringe, which takes up more brain space among the sane and grounded than should. Rated on a 1-7 scale of trust, with 1 being none and 7 being total, 58 percent of consumers rated dairy at 5 or above, according to the nationally representative sample of consumers aged 13-65.

That same survey, conducted last November and December, showed 35 percent either strongly or completely trusting dairy, shown by ratings of 6 and 7. That high trust level held across generations. Baby boomers led at 38 percent of strong or complete trust; Generation X, a cohort famed for trusting no one, was lowest at 33 percent. And the future looks stable and bright. About 34 percent of teenagers strongly or completely trusted dairy, with young adults at 35 percent and Millennials at 36. And again, these were the highest ratings of trust – including less-fervent support, clear majorities spanned generations.

Click here to see more...