Whey, cheese, lactose and butter continued to lead as U.S. suppliers set multiple September records.

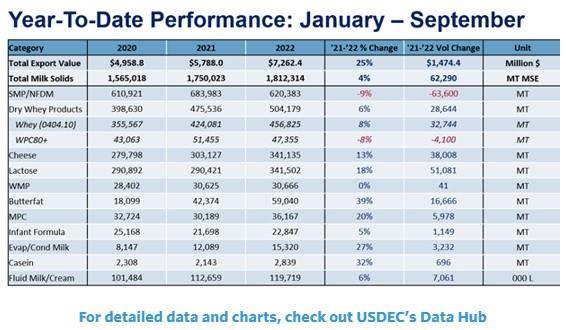

U.S. dairy exports stayed on record pace in September, posting another strong month of growth. Export volume rose 7% (+13,784 MT) on a milk solids equivalent basis. Whey (+18%, +8,897 MT), cheese (+5%, +1,719 MT) and lactose (+32%, +10,135 MT) all set new September highs, while butter shipments increased 49% (+1,598 MT) in what may be one of the last strong months for the fat this year (more on that later).

U.S. nonfat dry milk/skim milk powder (NFDM/SMP) exports fell for the 10th consecutive month in September (-7%, -4,953 MT), and NFDM/SMP remains one of the few products where exports are trailing the prior year. Declines were driven by limited product availability and the continued absence of China, along with a more recent pullback in Southeast Asia (SEA).

While China continues to lag in overall dairy imports, U.S. whey exports to the country climbed significantly (+41%, +8,626 MT) in September thanks to growth in permeate, likely driven by rising pork prices that are incentivizing increased whey use in hog feed.

Exports to Mexico were particularly impressive in September, with NFDM/SMP volume up 22% (+6,138 MT) and cheese up 11% (+969 MT).

Overall, U.S. dairy exports had another great month. With milk production coming back, we expect topline numbers to remain strong through the end of the year.

Now, let’s jump into our two main takeaways.

Strong butter exports, but challenges ahead

Despite the tight butter market leading to exceptionally high prices, the U.S. continued to grow its butter exports in September. Butter shipments jumped 49% (+1,598 MT) for the month, with strong gains to Canada (+126%, +1,451 MT), though shipments to Mexico doubled as well – albeit from a low baseline (+106%, +164 MT). Both countries have lagged in milk production over the last 18 months and have turned more to the U.S. to help bridge the gap. Competitive U.S. butter prices early in the year encouraged the growth in exports as well as importers purchased ahead.

However, since mid-year, U.S. butter prices have trended well above GDT prices and temporarily surpassed European prices to become the most expensive butter of the major exporters on a spot basis—even as futures were more favorable for exports.

Then, over the last week, U.S. spot prices plummeted. Butter prices at the CME fell 59 cents from $3.20 on Oct. 21 to $2.61 yesterday (Nov. 3). The dramatic price correction likely stems from factors such as last week’s cold storage report, which showed a less-than-anticipated draw down in stocks and retailers having secured purchases ahead of the holiday season.

Globally, EU butter saw a similar dramatic drop in price, which put it on par with the U.S. But both the EU and the U.S. are still priced well above the GDT (roughly 30% higher).

With U.S. prices lacking the discount they enjoyed for much of the last 18 months, we can expect U.S. butter exports to slow in the final quarter of 2022 and into early 2023. This is especially true as New Zealand continues to shift more milk to butter production while the U.S. and EU continue to experience tight supplies.

New Zealand butter production has steadily increased throughout the year as the country’s production mix has shifted more milk to the butter/skim stream in the face of lower WMP demand out of China. New Zealand butter production was up 5.5% YTD (January-August) compared to the U.S. being down 2.2% YTD. That increased supply in New Zealand will help keep New Zealand butter priced below the U.S., which creates an additional hurdle for U.S. exports to finish out the year.

Click here to see more...