By David Fairfield

The U.S. Department of Agriculture’s (USDA) Animal and Plant Health Inspection Service (APHIS) announced May 28 that it has updated its African Swine Fever (ASF) strategic plan and expanded it into a full response plan as part of the agency’s ongoing efforts to strengthen capabilities in the event of an ASF outbreak.

The new plan — USDA APHIS ASF Response Plan: The Red Book May 2020 — is a comprehensive response plan in the event the United States experiences an ASF outbreak. The plan incorporates and supersedes previous versions of USDA’s ASF Disease Response Strategies and details important elements for an effective ASF response, including:

- USDA authorities and APHIS guidance specific to ASF.

- Control and eradication strategies for both domestic and feral swine.

- Specific response actions that will be taken if ASF is detected.

- USDA APHIS National Stop Movement guidance.

- Updated zone, area and premises designations specifically for ASF.

- Comprehensive information on feral swine management.

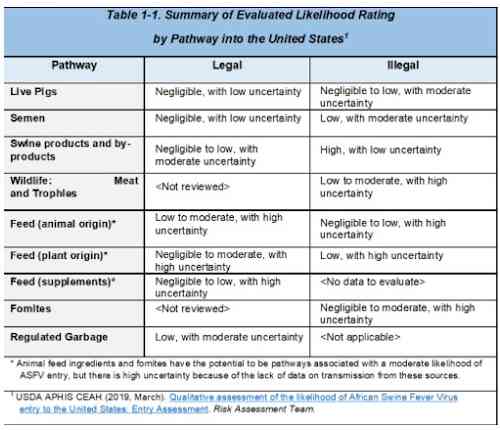

Significantly, the plan also discusses the threat posed by ASF, and includes a summary of the evaluated likelihood ratings of potential pathways for entry of the ASF virus into the United States, which are reflected in the following table.

Click here to see more...