By Joe Janzen

Department of Agricultural and Consumer Economics

University of Illinois

On Friday June 10, the USDA released its latest World Agricultural Supply and Demand Estimates, or WASDE. The WASDE report provides an updated point of reference for old-crop and new-crop price expectations for corn, soybeans, and wheat. This article discusses changes in the report to US commodity balance sheets and one thing to watch going forward: the US season average price forecasts included in the WASDE.

The June report contained relatively minor adjustments to estimated US and world production, consumption, and exports for these commodities. The market reaction to the report was muted: on Friday, new-crop futures prices were up four cents per bushel for corn, down 14 for soybeans, and down one for soft red winter wheat. This reaction reflects limited available information about the size of the US crop, particularly for corn and soybeans as the late 2022 planting season is just now wrapping up. Markets will closely follow weather conditions and crop progress over the coming months and re-assess planted acreage estimates around the upcoming release of the USDA-NASS Acreage report on June 30. (For analysis of the June Acreage report, register and attend the farmdoc webinar here.

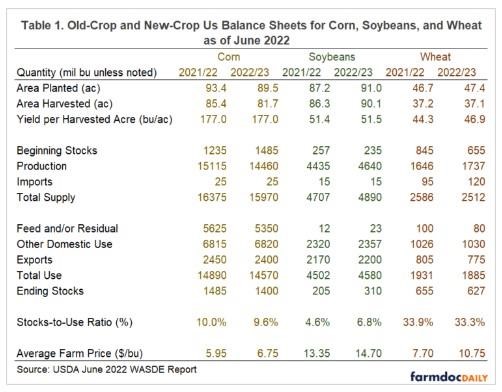

Current USDA Supply and Demand Estimates

Table 1 shows old-crop (2021/22) and new-crop (2022/23) US balance sheets for corn, soybeans, and wheat. Broadly, the overall supply and demand situation remains tight, especially for corn and soybeans. Estimated stocks-to-use ratios at the end of the 2021/22 marketing year are 10.0% for corn and 4.6% for soybeans. These are historically low levels that typically result in elevated price volatility. US corn stocks-to-use has been below 10% in only six years since 1990. US soybean stocks-to-use has been below 5% in only five years over the same period.

As noted above, USDA made only minor changes to the US balance sheets for corn, soybeans, and wheat. Production estimates for 2022 remain largely the same as last month. Corn and soybean acreage and yield are unchanged. Wheat acreage is unchanged and projected wheat yield is 0.3 bushels per acre higher. The report did not include strong reactions to drought conditions in the southern Great Plains and excess moisture in the Dakotas and Minnesota.

New-crop use estimates were largely unchanged. Old-crop use estimates were adjusted slightly with US corn exports lowered 50 million bushels and US soybean exports increased by 30 million bushels relative to the May report. These changes result in similarly modest adjustments to 2021/22 ending stocks with corn stocks higher and soybean stocks lower by comparable amounts.

USDA Season Average Price Forecasts

The WASDE report also contains monthly updated forecasts of the average price received by US farmers for corn, soybeans, wheat, and other commodities. The average farm price given in the report is a marketing year average price received by US farmers. Observed and forecast prices for different times of the marketing year receive weight in the average depending on the previous 5-year average proportion of farm output sold at that time of year. Typically marketing weights are highest immediately following harvest and smaller at other times of year. (More information about the procedure for calculating season average prices can be found here.) While these forecasts play some role in informing price expectations, one important, well-defined function for the season average price is serving as a benchmark for Title I commodity programs under the 2014 and 2018 Farm Bills. Farm program payments under the Price Loss Coverage (PLC) and Agricultural Risk Coverage (ARC) programs are based in whole or in part on the difference between the actual season average price and levels defined by the programs.

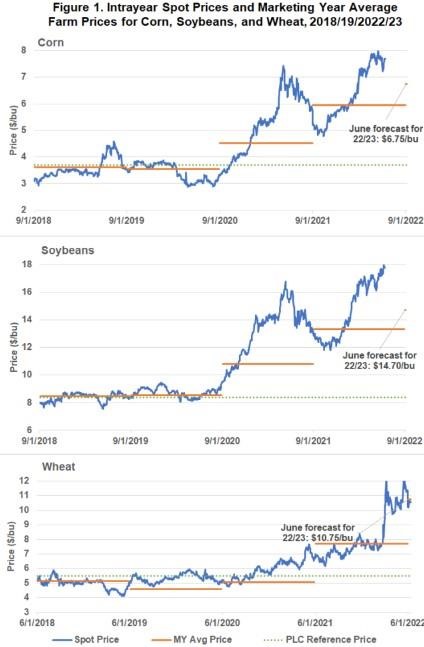

In the June WASDE report, USDA increased 2021/22 season average prices for corn by five cents to $5.95 per bushel and for soybeans by ten cents to $13.35 per bushel. Old-crop wheat price forecasts were unchanged. For 2022/23, season average price forecasts for corn and wheat were unchanged at $6.75 and $10.75 per bushel, respectively. New-crop soybean average price forecasts were 30 cents higher at $14.70 per bushel. Month-to-month changes in season average forecasts are often small relative to day-to-day changes in cash and futures prices.

Figure 1 shows past and current season average price levels relative to the underlying spot price for the commodity. Current 2021/22 and 2022/23 season average price forecasts indicate prices are high relative to previous years and relative to the policy support level defined by the PLC reference price. As noted in earlier farmdoc daily articles, prices are expected to remain a historically high levels in 2022. Farm program payments based on the season average price are unlikely in the 2022/23 marketing year.

The season average price masks considerable intra-year variability in prices, particularly in the current low-stocks, high-volatility market environment. Figure 1 shows that prices can be well above and well below the prevailing season average price. Price risk protection under farm bill programs based on a season average price trigger will not address every observed price decline. Market-based price risk management tools, including forward, futures, and options contracts, are available should grain buyers and sellers want to limit risk related to price declines within the marketing year.

Takeaways

Though the June WASDE report contained limited news about agricultural commodity supply and demand, it highlighted continued tightness in the US supply and demand situation for corn and soybeans. Low inventories indicate the potential for future price volatility, including price reactions to future supply and demand news such as the pending update to USDA acreage estimates on June 30.

Source : illinois.edu