Overview

Corn, soybeans, and wheat were up; cotton was down for the week.

This week, nearby corn futures set a new high at $5.53 ¾. Continued strong export sales, particularly to China, fueled the increase. Nearby soybean futures recovered some of the losses from the previous week, but closed 66 cents off the recent contract high. Based on tight ending stocks, strong demand, the delayed South American harvest, and uncertain Brazil and Argentina production there is likely to be continued volatility in corn and soybean markets, but a major nearby futures price decline in the short-term seems unlikely.

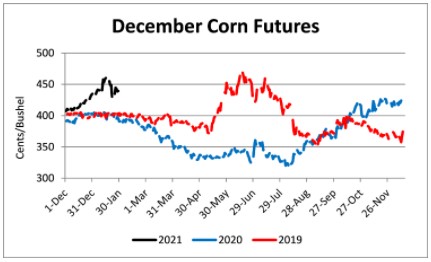

December corn and November soybeans have started to move sideways. Corn has traded between $4.23 and $4.65 and soybeans between $10.97 and $12.03 in January. Harvest futures prices in February will be very important to Tennessee producers as daily closing futures prices will determine projected prices for crop insurance for spring planted crops.

Since January 1, 2014 the December cotton contract has closed above 78 cents on 236 trading days out of 1,837 or 12.8% of the daily closes. Based on current price offerings, 77-78 cents, it is advisable to get 25-50% of 2021 production priced (depends on individual farm circumstances, risk tolerance, and marketing strategy). Exceeding 50% priced prior to planting can result in selling your way out of an extended rally (not being able to continue sales during the growing season due to the risk of pricing more than your projected production).

July wheat futures have closed above $6.00 16.1% of the time since July 1, 2014 (318 out of 1,971 trading days). Many producers likely priced some production in October when July 2021 wheat futures first breached $6.00 (which was a prudent risk management decision). Depending on the amount of production priced, producers could consider increasing production up to 50% of projected 2021 production or hold off to determine if any winter losses to production occur in February. Ability to store the crop beyond the harvest interval should be factored into pricing decisions.

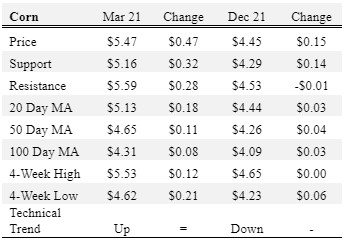

Corn

Ethanol production for the week ending January 22 was 0.933 million barrels per day, down 12,000 barrels from the previous week. Ethanol stocks were 23.602 million barrels, down 0.026 million barrels compared to last week. Corn net sales reported by exporters for January 15-21 were up compared to last week with net sales of 72.8 million bushels for the 2020/21 marketing year. Exports for the same time period were up 60% from last week at 55.7 million bushels. Corn export sales and commitments were 75% of the USDA estimated total exports for the 2020/21 marketing year (September 1 to August 31) compared to the previous 5-year average of 58%. Across Tennessee, average corn basis (cash price-nearby futures price) weakened at Mississippi River and West-Central and strengthened or remained unchanged at Northwest, North-Central, and West elevators and barge points. Overall, basis for the week ranged from 5 over to 39 over, with an average of 23 over the March futures at elevators and barge points. March 2021 corn futures closed at $5.47, up 47 cents since last Friday. For the week, March 2021 corn futures traded between $4.92 and $5.53. Mar/May and Mar/Dec future spreads were 0 and -102 cents. May 2021 corn futures closed at $5.47, up 44 cents since last Friday.

December 2021 corn futures closed at $4.45, up 15 cents since last Friday. Downside price protection could be obtained by purchasing a $4.50 December 2021 Put Option costing 47 cents establishing a $4.03 futures floor.

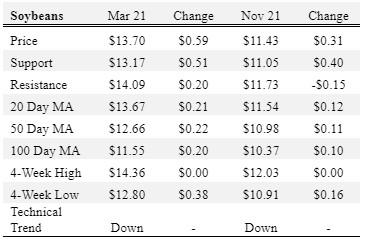

Soybeans

Net sales reported by exporters were down compared to last week with net sales of 17.1 million bushels for the 2020/21 marketing year and 57.5 million bushels for the 2021/22 marketing year. Exports for the same period were down 8% compared to last week at 80.6 million bushels. Soybean export sales and commitments were 95% of the USDA estimated total annual exports for the 2020/21 marketing year (September 1 to August 31), compared to the previous 5-year average of 76%. Across Tennessee, average soybean basis weakened or remained unchanged at West-Central, Mississippi River, West, North-Central, and Northwest elevators and barge points. Basis ranged from 5 under to 33 over the March futures contract. Average basis at the end of the week was 18 over the March futures contract. March 2021 soybean futures closed at $13.70, up 59 cents since last Friday. For the week, March 2021 soybean futures traded between $12.98 and $13.94. Mar/May and Mar/Nov future spreads were -3 and -227 cents. May 2021 soybean futures closed at $13.67, up 56 cents since last Friday. March 2021 soybean-to-corn price ratio was 2.50 at the end of the week.

November 2021 soybean futures closed at $11.43, up 31 cents since last Friday. Downside price protection could be achieved by purchasing an $11.60 November 2021 Put Option which would cost 94 cents and set a $10.66 futures floor. Nov/Dec 2021 soybean-to-corn price ratio was 2.57 at the end of the week.

Cotton

Net sales reported by exporters were up compared to last week with net sales of 322,700 bales for the 2020/21 marketing year and 53,600 bales for the 2021/22 marketing year. Exports for the same time period were down 15% compared to last week at 275,300 bales. Upland cotton export sales were 89% of the USDA estimated total annual exports for the 2020/21 marketing year (August 1 to July 31), compared to the previous 5-year average of 77%. Delta upland cotton spot price quotes for January 28 were 77.93 cents/lb (41-4-34) and 80.18 cents/lb (31-3-35). Adjusted World Price (AWP) increased 0.89 cents to 67.59 cents. March 2021 cotton futures closed at 80.64, down 0.92 cents since last Friday. For the week, March 2021 cotton futures traded between 79.75 and 83.47 cents. Mar/May and Mar/Dec cotton futures spreads were 1.2 cents and -2.95 cents. May 2021 cotton futures closed at 81.84 cents, down 0.82 cents since last Friday.

December 2021 cotton futures closed at 77.69 cents, down 0.78 cents since last Friday. Downside price protection could be obtained by purchasing a 78 cent December 2021 Put Option costing 6.14 cents establishing a 71.86 cent futures floor.

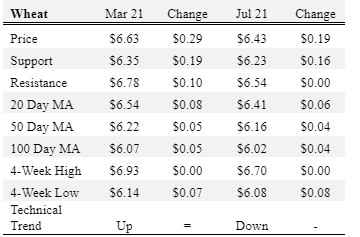

Wheat

Wheat net sales reported by exporters were up compared to last week with net sales of 14.0 million bushels for the 2020/21 marketing year and 7.9 million bushels for the 2021/22 marketing year. Exports for the same time period were up 92% from last week at 18.6 million bushels. Wheat export sales were 82% of the USDA estimated total annual exports for the 2020/21 marketing year (June 1 to May 31), compared to the previous 5-year average of 84%. March 2021 wheat futures closed at $6.63, up 29 cents since last Friday. March 2021 wheat futures traded between $6.24 and $6.72 this week. March wheat-to-corn price ratio was 1.21. Mar/May and Mar/Jul future spreads were -1 and -20 cents. May 2021 wheat futures closed at $6.62, down 26 cents since last Friday.

In Tennessee, new crop wheat cash contracts ranged from $6.19 to $6.83. July 2021 wheat futures closed at $6.43, up 19 cents since last Friday. Downside price protection could be obtained by purchasing a $6.50 July 2021 Put Option costing 57 cents establishing a $5.93 futures floor.

Source : tennessee.edu