Ottawa continues to work on measures to support the industry, a government spokesperson said

By Diego Flammini

Staff Writer

Farms.com

The federal government wants Canadian farmers to know it’s doing all it can to support the ag sector during the COVID-19 pandemic.

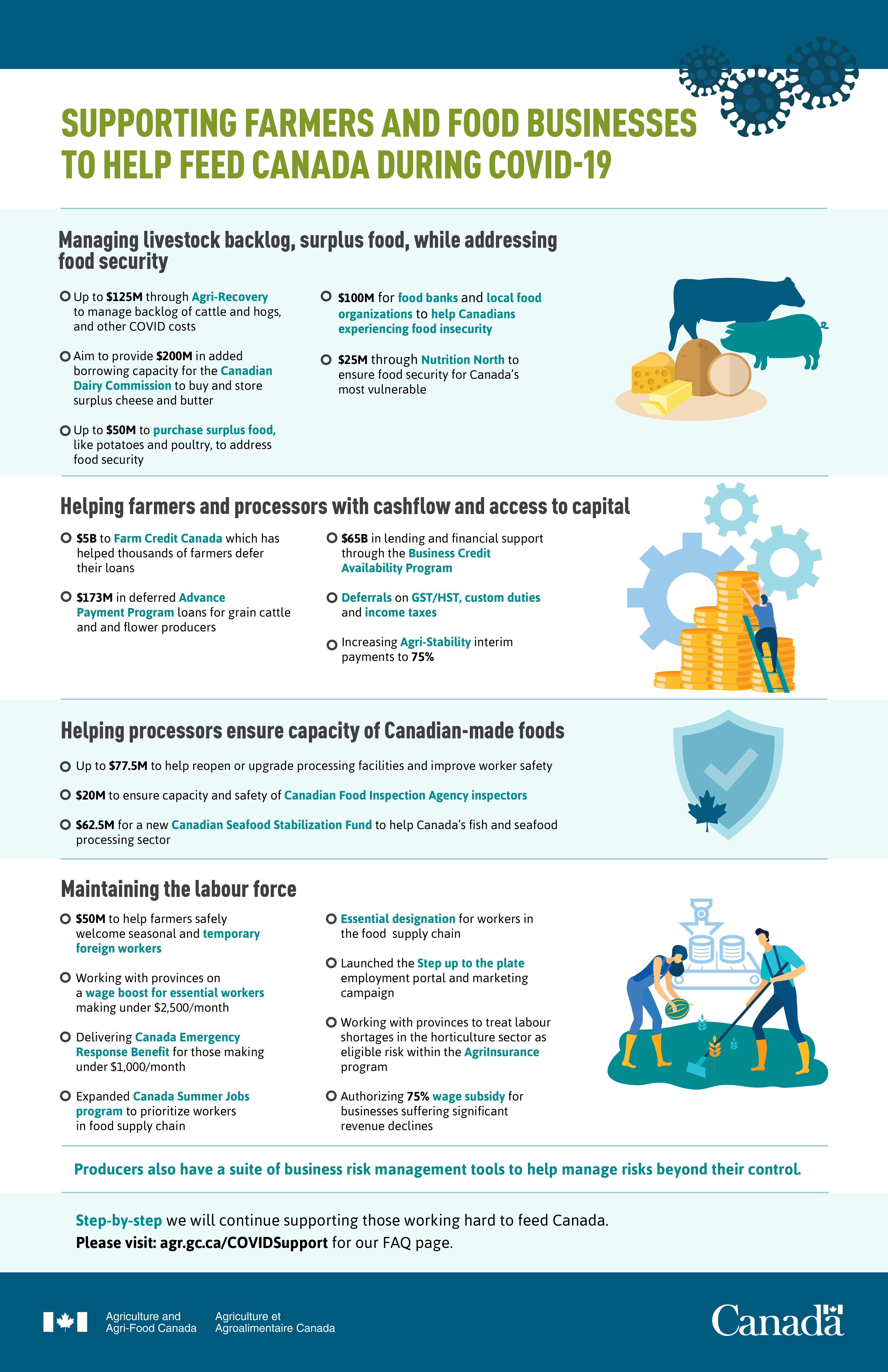

The $252 million in federal assistance Prime Minister Trudeau announced for the sector on May 5 is only part of the plan to support the ag industry, said Oliver Anderson, director of communications for Agriculture and Agri-Food Canada.

“The prime minister’s announcement was perceived by the sector as being the (only) response,” he told Farms.com. “We’re asking farmers not to judge us by the $252-million announcement alone because it doesn’t represent the full scale of the government’s response to the situation.”

The Canadian Federation of Agriculture estimated the sector needs $2.6 billion to help maintain food security during the pandemic.

The May 5 funding announcement included $125 million through AgriRecovery to manage the backlog of cattle and hogs, up to $50 million to purchase surplus food and $77.5 million to help processors purchase protective equipment for employees and adapt to health protocols.

The assistance was in addition to other measures like setting aside $50 million to help farmers access temporary foreign workers and increasing Farm Credit Canada’s (FCC’s) lending capacity to $5 billion.

“There was a feeling that we were already planning on increasing capacity for FCC but that wasn’t the case,” Anderson said. “It was part of a larger government program to help sure up financial institutions so they can pass off those benefits to their customers.”

One additional measure Ottawa is taking is increasing the Canadian Dairy Commission’s (CDC’s) borrowing capacity from $300 million to $500 million to buy and store surplus cheese and butter.

“The (CDC) can buy it off of the processors and it will help stabilize the market because a lot of the milk is being wasted,” Anderson said. “They’ll be able to store $200 million more of cheese and butter and then be able to sell that back into the market.”

Members of Parliament in the House of Commons introduced and passed a bill on Wednesday that amends the Canadian Dairy Commission Act. The Senate passed the bill on Friday.