High costs low prices and trade decisions to shape corn markets

The National Corn Growers Association (NCGA) today released its economic outlook for 2026 outlining six key forces expected to drive corn prices and farm margins in the year ahead. The forecast underscores the need for new and expanded markets for corn growers.

Source: national corn growers association

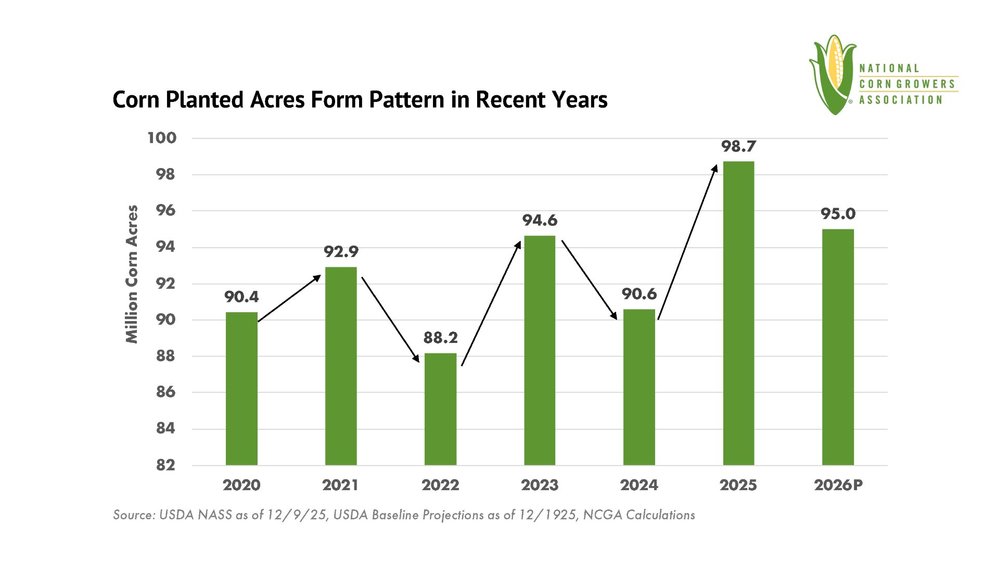

According to report author and NCGA Chief Economist Krista Swanson, the report shows, U.S. corn production is increasing with sustained high corn acres and productivity gains. Global corn production is at a record and growing. Without a shift in demand, rising domestic and global corn supply adds downward pressure on corn prices for U.S. farmers unless new demand materializes.

Source: national corn growers association

U.S. farmers planted nearly 99 million corn acres in 2025, leading to record production levels. High acreage is also expected in 2026, which may continue to increase supply and put pressure on market prices if demand does not rise.

Source: national corn growers association

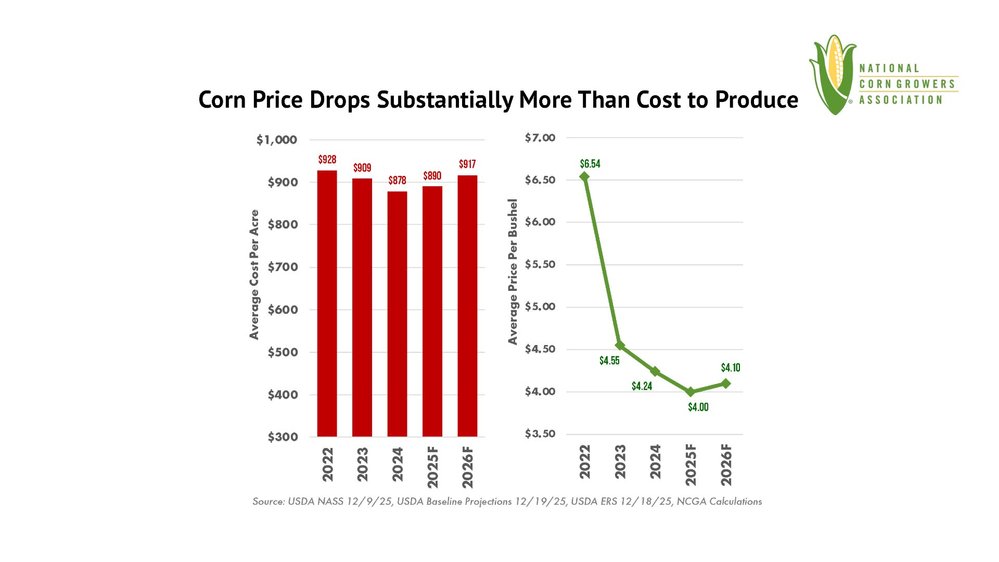

Financial challenges remain a major concern. The average cost to grow an acre of corn in 2026 is forecast at $917, while the expected corn price is only $4.10 per bushel. This price is much lower than previous years, causing many farmers to face potential losses and tighter cash flow.

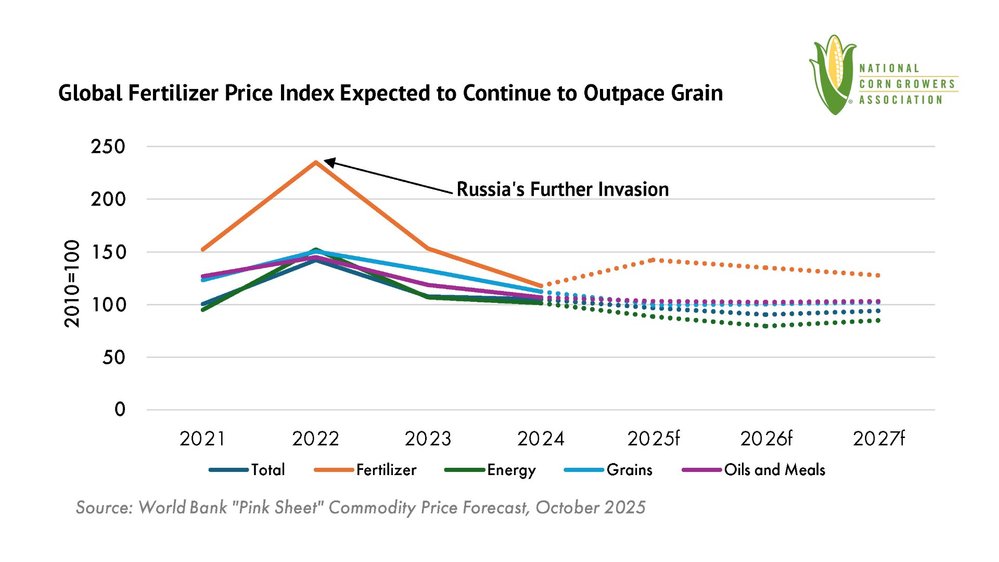

Fertilizer costs also remain high. Global supply limits, trade restrictions, and the ongoing Russia Ukraine conflict continue to affect fertilizer prices, which represent a large part of farm expenses.

Source: national corn growers association

Interest rate changes by the Federal Reserve may influence farm borrowing and overall market demand. These economic conditions will affect both farm input costs and export competitiveness.

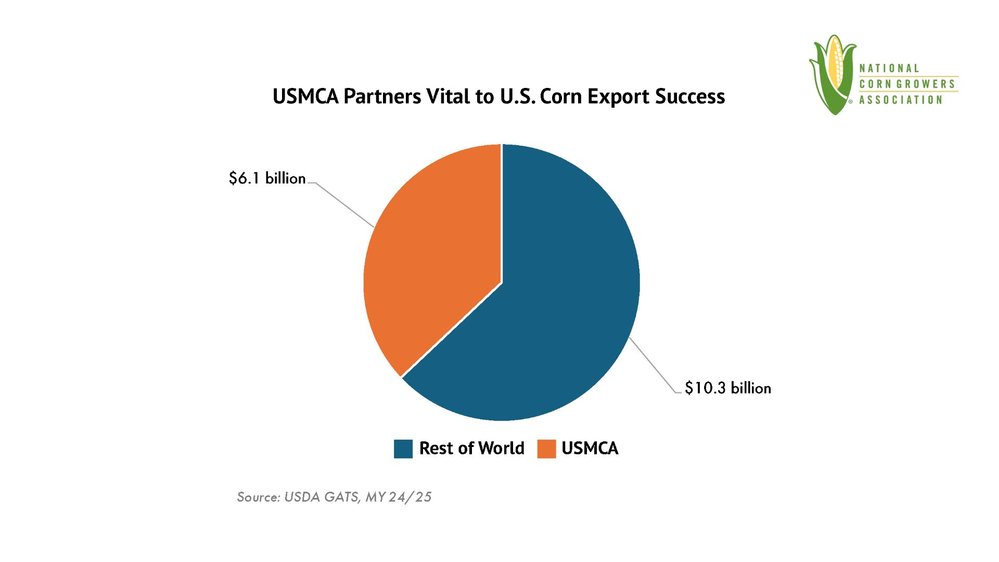

Trade policy remains critical. The United States Mexico Canada Agreement supports a large share of corn exports. NCGA is encouraging renewal of this agreement to protect international market access.

Source: national corn growers association

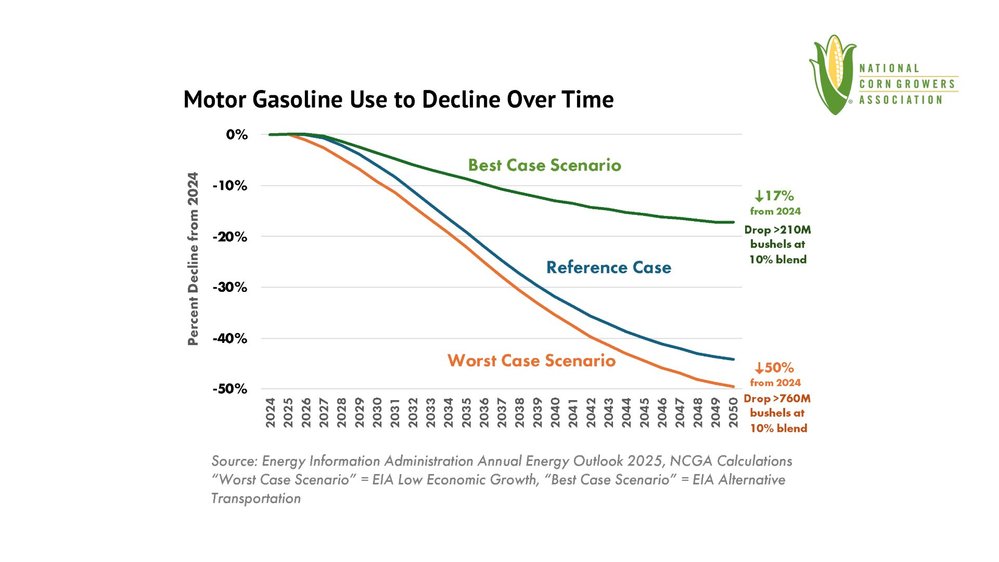

Ethanol remains a key growth opportunity. NCGA is urging approval of year round E15 fuel sales. Expanding ethanol use could significantly increase corn demand, including future uses in aviation fuel and renewable materials.

Despite current challenges, expanding demand through trade and biofuel growth could help stabilize corn prices and protect farm profitability in 2026 and beyond.

Photo Credit: gettyimages-songdech17