Top 5 Key Market Movers to Watch for the Week of May 5th, 2024

This week there are 5 key reports to watch that could have significant impacts on commodity markets the week of; This Farms.com column tracks key events in commodity marketing impacting the agriculture industry! The series of article shares issues to watch the following week, issues that may have an impact on commodity prices in the coming week.

By Devin Lashley

Farms.com Risk Management Intern

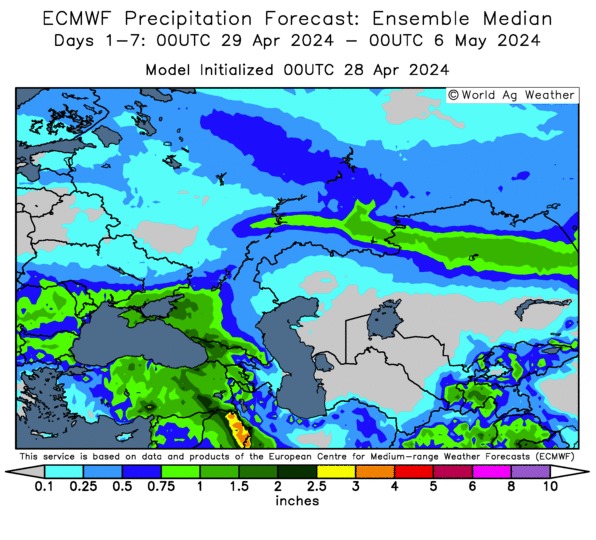

1. The USDA crop progress report comes out Monday May 6th, and will likely show that crop planting progress is behind for the year as precipitation continues to develop across the Mississippi valley and Midwest, further delaying crop planting.

As noted last week, both topsoil and subsoil conditions will be assisted by said rains. U.S. HRW wheat country long-term weather forecast through May 12 is wet, wet and wet, similar to 2019 which was a big prevented plant insurance year! Many farmers will be delayed possibly through May 20th! The 5-year average for next week for U.S. corn planting is 42 percent, soybeans 21 percent, cotton 23 percent, oats 64 percent, and spring wheat 38 percent.

2. Keep an eye on the price of wheat as weather experts are forecasting rain by mid-May for the dry areas of southern Russia that have seen 0 percent precipitation in the last three months. If it does not rain in the month of May in southern Russia, where 70 percent of the wheat production comes from, wheat futures will continue to climb higher. Look for any headline news that says India is importing wheat to rebuild reserves that have fallen to a 16-year low.

3. The U.S. Drought monitor report comes out Thursday May 9th and will likely show improvements across most of the U.S. Midwest, as the wet weather forecast across the Mississippi valley and Midwest has reduced drought across the region. This is great preparation for the La Nina weather pattern that is likely to come in late spring or early summer. But the top corn producer, Iowa still needs a lot more rain to fix the drought deficit from the last four years.

4. The 1st forecast for the 24/25 crop year will be the USDA May WASDE crop report which comes out Thursday May 9th. It shows an increase in 23/24 corn exports of 50 million bushels with the USDA using 90 million lower 2024 U.S. corn acres and ending stocks dropping to 2.3 billion from 2.616 billion bushels. We could finally see the USDA lower its Argentina and Brazil corn crop forecast, as the USDA remains an outlier vs. Brazilian forecasters (CONAB) and private forecasters. A move lower would be a move in the right direction.

5. U.S. meat export federation data will be released May 6 -8, 2024. Look for further strength in U.S. March 2024 pork exports to continue to support higher U.S. hog futures as the U.S. continues to increase its market share vs. high priced European pork and an ASF infected China hog herd. Mexico was the pacesetter last month. U.S. beef had a strong month of February and Mexico remained the bright spot.

For daily information and updates on agriculture commodity marketing and price risk management for North American farmers, producers, and agribusiness visit the Farms.com Risk Management Website to subscribe to the program.