New app allows farmers to buy and sell grain

By Diego Flammini

Assistant Editor, North American Content

Farms.com

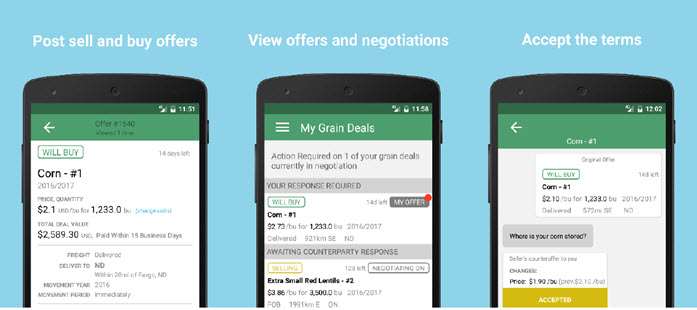

FarmLead released a new mobile app that allows farmers to buy, sell and negotiate grain prices from the palm of their hands.

The FarmLead Marketplace features a deal matching tool, letting farmers locate offers that are closes to them. The app’s chat feature allows buyers and sellers to engage in real-time discussions.

Farmers use social media to connect with each other and equipment dealers. The app appears to be a natural progression of communication.

“Farmers these days use Twitter to get fast fixes for equipment problems. It only makes sense to use a similar tool to buy and sell grain,” said FarmLead user Phil G. in a release. “Why would I sit by the phone and wait for a call when I can negotiate on a deal from the cab of my combine?”

Developers say the app is another tool farmers can rely on to be as successful as possible.

“Among farmers with an eye on ROI and profitability, FarmLead is the easiest and most effective way to find the right grain deal,” said Brennan Turner, founder and CEO of FarmLead, in a release. “Agriculture hasn’t always been analytical, but it’s changing. Tools like FarmLead allow farmers to reduce costs and make more money, levelling the playing field for producers regardless of size.”

The app is currently available for Apple and Android devices.