U of G researchers track changes in Ontario and Saskatchewan farmers’ fertilizer application rates

By Nicholas Bannon and Alfons Weersink

Department of Food, Agriculture and Resource Economics

University of Guelph

Our recent article explored the changes in Ontario acreage on which farmers applied nutrients between 1971 and 2016. Aside from an increase in the area of application in the 1970s due to an expansion in the amount of corn planted, the area of application remained constant in the subsequent years. But has the total amount of fertilizer applied changed?

Efforts such as the 4R initiative to improve fertilizer management suggests that fertilizer use has increased but no official record exists of the amount of fertilizer Canadian farmers use. In this article, we estimate the changes in the total amount of fertilizer Ontario and Saskatchewan farmers applied between 2002 and 2018.

Statistics Canada collects data at the provincial level on the amount of money farmers spent on fertilizer and other farm inputs.

In order to get an amount of fertilizer in physical units, we divided the dollar value spent on fertilizer by its price. Statistics Canada has an annual Farm Input Price Index for fertilizer and uses 2012 as the base year equal to 100. We converted this index to an actual price by assuming the 2019 price of fertilizer is $1.26/kg, which is the price estimated in OMAFRA’s 2019 Field Crop Budget.

Our method of deriving the estimated total use of fertilizer provides a reasonable representation of the overall trends. The actual amount of fertilizer depends on actual price but the underlying trends would not change if we used a different base price.

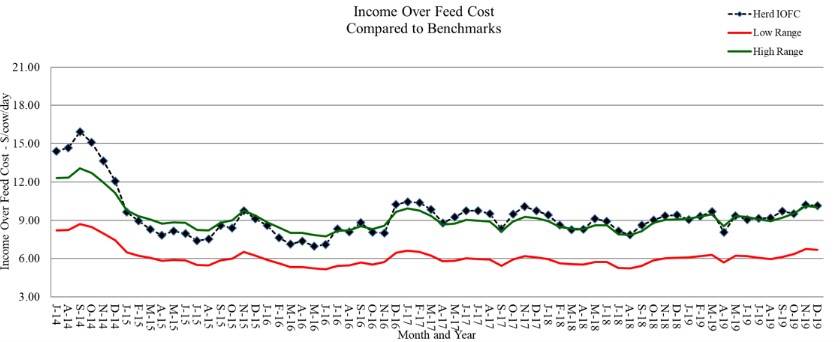

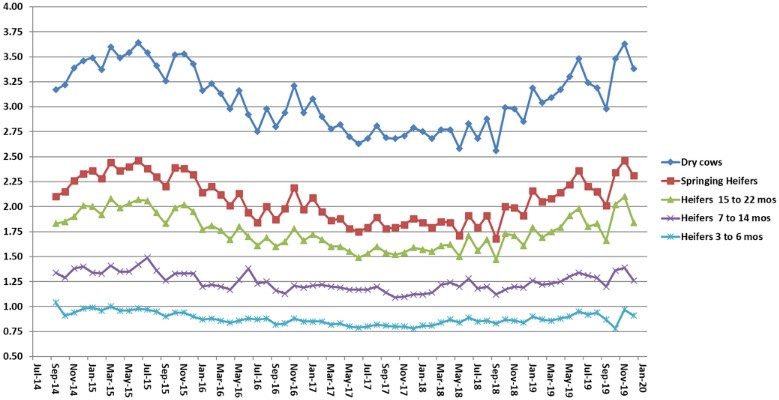

The trends in fertilizer use in kilotonnes (KT) are illustrated from 2002 to 2018 for Ontario in Figure 1 and for Saskatchewan in Figure 2.

FIGURE 1: Estimated fertilizer use (metric tons) in Ontario from 2002 to 2018

Ontario producers’ fertilizer use by declined steadily from approximately 650 KT in 2002 to a low over the 16-year period of less than 400 KT in 2008.

The amount of fertilizer increased by 60 per cent from 2008 to 2010 and then steadily rose to close to 800 KT in 2016 and 2017. These highs represent a near doubling from the levels applied in 2008.

Use declined again in 2018.

The trends over the period coincide with lagged movements in crop commodity prices and the Ontario trends are like the trends in the provinces further east.

Western Canada provinces, however, do not follow the same trends as Ontario.

FIGURE 2: Estimated fertilizer use (metric tons) in Saskatchewan from 2002 to 2018

In Saskatchewan, farmers’ total fertilizer use was relatively constant at around 1,000 KT annually from 2002 to 2007.

As in Ontario, Saskatchewan farmers’ use dropped significantly in 2008 to less than 800 KT. Since that year, usage rose steadily to a high in 2017 of nearly 1,700 KT. Use also dropped in Saskatchewan in 2018.

Two differences and one major similarity exist between fertilizer use in Ontario and Saskatchewan. First, total use is approximately double in Saskatchewan than in Ontario, reflecting the greater amount of cropland in the Prairie provinces. Second, the amount of fertilizer Western Canadian farmers applied did not decline in the early part of this century, likely due to the significant conversion of summer fallow land into cropland.

The commonality in the Ontario and Saskatchewan trends is the near doubling in fertilizer use since the low of 2008 and the slight decline in 2018. The increase in farmers’ fertilizer usage suggests opportunities exists for initiatives such as the 4Rs to encourage producers to improve the efficiency of their fertilizer applications.