Country Heritage Park Future of Food and Farming Forum: 2041 Changes & Choices, highlights change in Focus

By Denise Faguy, Farms.com

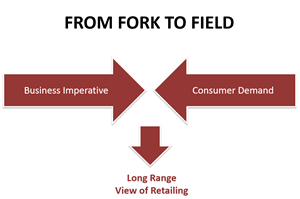

It’s not just a play on words, but a major change in perspective. The historical perspective on the supply chain is “Field to Fork”, but Paul Uys, Senior Director, External, The Food Institute of the University of Guelph, challenged everyone to awaken to the new reality that “Fork to Field” is currently a dominant factor and that consumers are now driving demand for changes in the food supply system.

Uys shared his perspective with the audience at the Future of Food and Farming Conference at Country Heritage Park on October 6th. He noted that consumers are feeling that they are part of the value chain and that “they have a vote”.

The rise of the socially conscience consumer has been very strong in Europe, and is also present in Canada. As a former Loblaws executive, Uys shared some valuable customer insights. When asked what topics should be a priority for large retailers, consumers ranked the following in order of importance:

- 47% Local Sourcing – local has a broad definition to consumers

- 44% Healthier Choices

- 35% Reduction in Packaging

- 34% Waste Reduction

Of medium importance, between 20 to 29% were the following issues:

- Sustainable Seafood

- Animal Welfare

- Environmentally-friendly consumer products

- Organically Grown Foods

- Food Waste

- Fair Trade Products

Even lower in importance (10 to 19%) to consumers were the following:

- Energy Efficiency and Renewable Energy

- Water Conservation

- Climate Change

- Donations

- Healthy Living Programs

Uys also stated that the three pillars of focus for retailers have changed dramatically since the change in consumer attitudes, they are now as follows:

- Well-being – food safety, health & wellness, Animal welfare (ideologically speaking, not just science), fair-trade, and the omnivores dilemma

- Ecological Efficiency – local, carbon footprint, water footprint, environmental degradation & sustainable sourcing, waste footprint, packaging and paper

- Market Forces – ethnic influences (for example, the rise of Halal meat to meet the needs of the 1 million Canadian Muslims), fresh foods, convenience, global demand, and food prices (consumers continue to place competitive demands regarding food prices)

Uys shared the dilemma that food retailers currently face regarding the reduction of waste. As other speakers throughout the day at the Food & Farming forum pointed out, a large portion of the challenge of feeding the 9 billion people expected to live on the planet in the next 25 years could be achieved by reducing waste. But he pointed out that concept is a double-edge sword for food retailers, “will they need to sell less to waste less?”

For more information on Country Heritage Park’s Food & Farming Forum: http://www.countryheritagepark.com/whats-happening/our-blog/country-heritage-parks-first-future-of-food-farming-forum-a-resounding-success/