The free tool allows producers to look at soil, weather and yield data

By Diego Flammini

News Reporter

Farms.com

Growers in Atlantic Canada will have access to a research tool that allows them to look at extensive data from past growing seasons.

The online application developed by Agriculture and Agri-Food Canada (AAFC) is available for free on the Atlantic Grains Council’s website. It features field data for several crops and includes fungicide timing, row spacing and weather changes. The field data is available for many counties across the Atlantic provinces.

The tool should help producers make better decisions, according to Allan Ling, president of the Atlantic Grains Council.

Researchers planted soybean test sites with three different seeding rates. Producers can consult those test results to have a better idea of what populations could work on their farms.

“A farmer can look up one of the test sites and it shows which is the most economical rate to use,” he told Farms.com today. “And let’s say it’s a dry year, the farmer can look up weather data and, based on some past weather, it may not be worth it to spend money on a fungicide.”

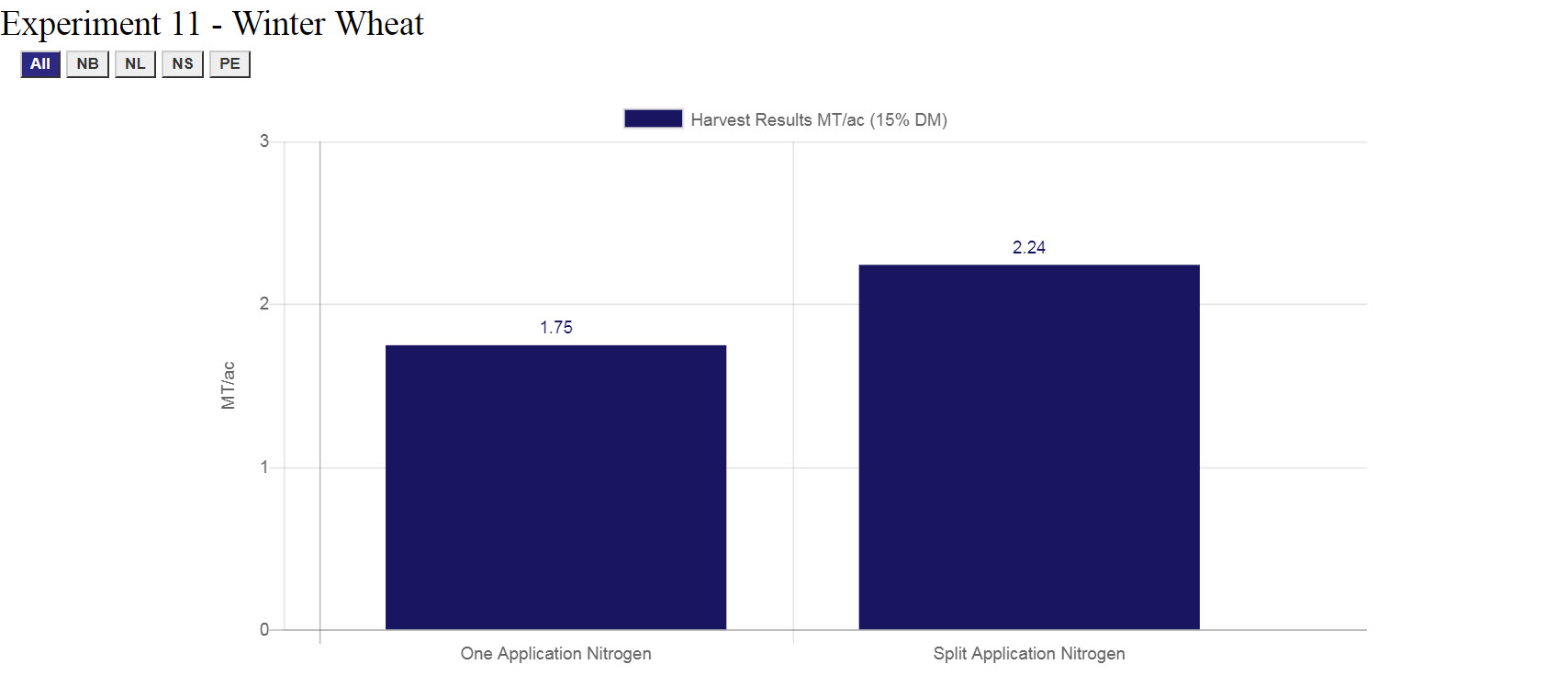

Screenshot of the Atlantic Grains Council's online tool.

By making better decisions, farmers can save money on input costs while potentially increasing yields.

The tool “gives farmers an advantage going into the growing season. As the season moves forward, it could save them some money as they … decide what they may or may not want to do in their fields,” Ling said.

AAFC scientists helped develop the online resource with joint funding from local growers and the federal government.

The more field data farmers are willing to share, the more detailed the tool can be, according to Aaron Mills, a research scientist with AAFC.

"As growers become more comfortable with their yield data being part of this tool, then we can put that data on top of it as a layer," he told CBC yesterday.