A British startup developed Tudder for farmers

By Diego Flammini

Staff Writer

Farms.com

A British startup is helping local producers find suitable livestock for breeding.

SellMyLivestock designed Tudder, a free mobile app that “seeks to unite sheepish farm animals with their soulmates.”

The app works like Tinder, the popular dating app.

About 42,000 farms across the UK are using the app.

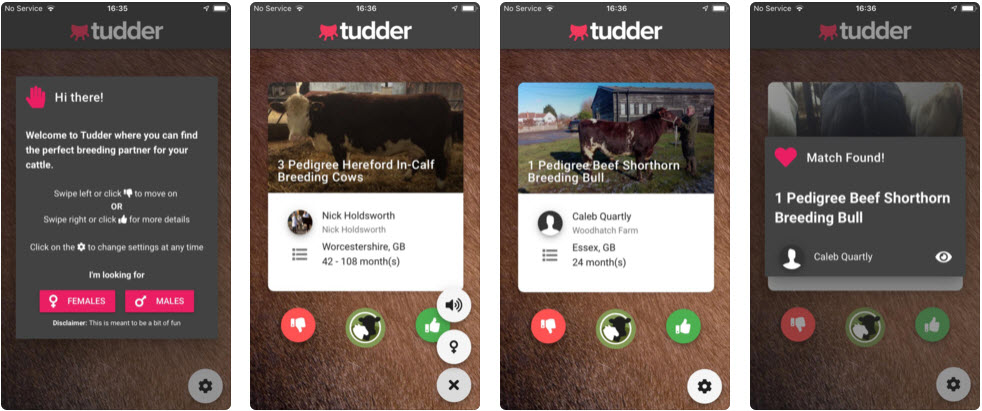

Farmers scroll through images of an individual or group of cows. Swiping right on a profile takes the user to a website where they’ll find information on the animal’s character, health issues and location. Producers can also contact the owner for further details.

Swiping left on a profile moves the user on to the next cow.

Producers who use the app are pleased with how it speeds operations up.

iPhone screenshots

“Going to market is a nuisance,” Marcus Lampard, a Welsh producer with a pedigree beef shorthorn bull listed, told Bloomberg. “If I go to an open market with a bull, and then maybe bring it back, it shuts everything down on the farm for at least two weeks.”

The app isn’t for all livestock producers, however.

It might work for a small operation but not for large commercial farms, said Laura Baxter, an 200-head Angus cattle farmer from Bassano, Alta.

“An app is probably more useful to those who have less numbers to deal with,” she told Farms.com. “And if they’re all purebred, then they know what they’re bringing to the game.

“Everything is hard copy here and we know everything about them from their birth weight. That information we have goes into a database and it calculates expected progeny differences.

“We probably wouldn’t use the app” if it became available to Canadian producers.

Visit the Farms.com apps directory for more apps to help manage your farm.