By Pierson Doyle

Peace could mean bearish grains, a positive outlook for fertilizer prices and a headwind for crude oil prices

Earlier this week it was looking hopeful that a peace framework — backed by the United States — would end the four-year war between Ukraine and Russia. While it is certainly looking less hopeful now, there could still be some cards to play to get a deal.

If a deal is struck, what would the impact be on Grain, Fertilizer and Energy Markets?

The US-backed 28-point plan

The U.S. proposed 28-point plan, calls for a comprehensive non-aggression agreement between Russia, Ukraine, and European countries, centered on a U.S.-backed security guarantee that would treat any attack on Ukraine as an attack on the entire transatlantic community.

It includes a cap on Ukraine’s armed forces at approximately 600,000 personnel and, in exchange, requires Ukraine to relinquish certain territorial claims, including recognition of Russian control over Crimea and parts of the eastern regions.

The plan further prohibits Ukraine from joining NATO or hosting NATO troops, while also envisioning long-term reconstruction and economic cooperation through reparations, humanitarian assistance, and post-war rebuilding efforts.

Revisions and Progress

After strong pushback from Ukraine and European partners, the draft plan was revised during Geneva talks, narrowing its scope and altering provisions. European leaders emphasize that any peace deal must uphold Ukraine’s sovereignty and territorial integrity, rejecting terms that legitimize territorial conquest.

Before Putin rejected the most recent deal, Ukraine's President, Volodymyr Zelensky, said there were "many prospects that can make the path to peace real. There is still much work to be done."

Before the recent talks Russia’s Dmitry Peskov said it was "premature" to think that a deal was close, and Putin said the U.S. plan could be ‘the basis’ of a Ukraine deal.

What would a peace agreement mean for the markets?

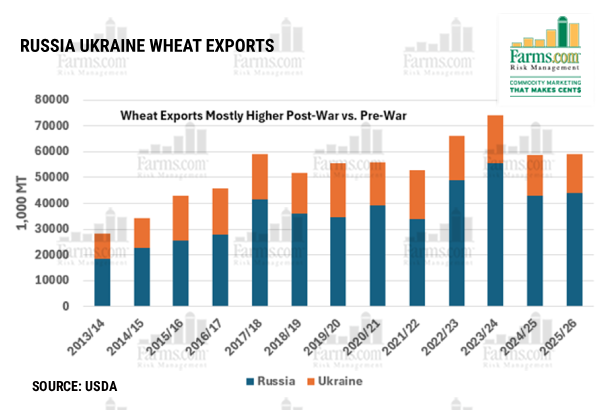

A peace agreement would introduce more production and competition for wheat and corn around the world from the Black Sea region, and would produce bearish grain prices. After a three-year bear market, one has to question if this news already been priced in.

Ukraine could export, longer-term, an additional 5 mmt vs. prewar estimates from 2020 but the Ukrainian recovery will take years based on lost farmland and damaged infrastructure. However, a U.S.-Russia trade deal could offset this since both countries are already exporting above pre-war levels.

A peace framework that reduces geo-political tensions in the Black Sea region would likely exert downward pressure on crude oil prices. Since 2022, oil markets have priced in geo-political risks on Russian supply restrictions, sanctions uncertainty, and the threat of further escalation. A ceasefire or settlement would reduce perceived risk around Russian export stability. It would add to the already global glut of oil supplies.

Potentially it would encourage Western nations to further adjust or soften enforcement of some oil-related sanctions, increasing effective Russian export capacity. And also Improve shipping security, reducing insurance costs for tankers transiting the region. As a result, crude oil prices could fall below $50/barrel during a weak seasonal period of the year Q1 of 2026, and thus provide farmers an opportunity to lock in lower inputs like diesel fuel for 2026.

Russia is a major exporter of nitrogen (urea), potash, and phosphates, while Ukraine plays a smaller but regionally important role. A peace agreement would likely ease global fertilizer prices by reducing supply chain risks, lowering the chance of sanctions disrupting fertilizer or natural gas—the key feedstock for nitrogen—and improving maritime logistics for ammonia and related products.

Stabilized energy markets could also bring down European natural gas prices, boosting fertilizer output and allowing plants currently operating at 75% capacity to return to full production. This would enable more Russian nitrogen exports and cheaper gas-driven production, helping to ease the tight global fertilizer balance sheet. However, meaningful price adjustments could take months, making this more of a 2027 story.

Perhaps it is for some of these reasons, reductions in prices, that Russia is in no hurry to end the war.