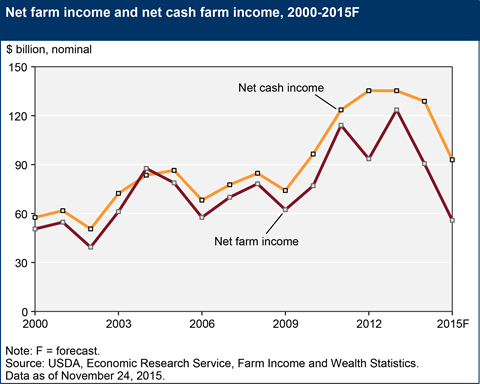

Farm income forecast predicts declines in net cash and net farm income

By Diego Flammini, Farms.com

The United States Department of Agriculture’s (USDA) Economic Research Service released its 2015 Farm Sector Income Forecast to provide a clearer picture of how profitable the industry has been for farmers in past years.

Highlights from the forecast include:

- A forecasted decline in net cash and net farm income after highs in 2013. Farm income is forecast to drop by 38.2%. If that turns out to be true it would be the largest single-year decline since 1983.

- Livestock receipts could drop by 12%, or $25.4 billion.

- The forecast shows an increase in government payments to $10.8 billion in 2015.

- Feed expenses could be down more than $5 billion as feed prices have lowered.

- Seed, pesticide and fertilizer expenses are expected to fall by $3.2 billion in 2015.

USDA Secretary Tom Vilsack said despite challenges including the avian flu and drought in California, American farmers continue to produce food for global markets.

“[The] projections provide a snapshot of a rural America that continues to remain innovative, stable and resilient in the aftermath of the worst animal disease outbreak in our nation's history and as the western United States unloosens itself from the grip of historic drought,” he said. “American agriculture continues to enjoy some of the strongest years in our nation’s history and positioning the United States as a reliable supplier of high-quality goods for domestic and foreign markets alike.”

Join the conversation and tell us your thoughts about the USDA’s Farm Income Forecast. What changes have you had to make in your agricultural operations to ensure your farm is as profitable as it can be?