By Dr. Kenny Burdine

Cattle slaughter got a lot of attention in 2020 as the sector raced to deal with labor challenges in the spring that greatly impacted processing volumes. At its lowest point, federally inspected cattle slaughter was down by more than one-third from 2019. But the processing industry showed a lot of resiliency through summer as slaughter levels picked back up, despite the challenges the pandemic created.

While cattle slaughter is often considered as a whole, I want to focus this discussion on cow slaughter for three reasons. First, cow slaughter was not impacted the same as steer and heifer slaughter during the pandemic. Secondly, cull cow prices were relatively strong last year, which created additional incentive for culling. And third, 2020 cow slaughter volumes impact beef cow numbers in 2021. This final point should be reflected in USDA’s cattle inventory estimates that will be released on January 29th.

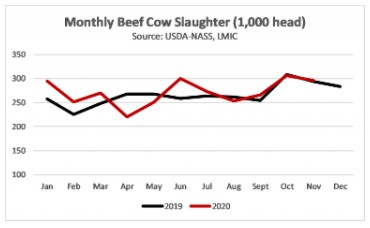

The beef cow slaughter chart that I am sharing this month compares beef cow slaughter in 2019 and 2020. The sharp drop in slaughter levels from March to April is clear in the chart. However, cow slaughter was not impacted as drastically during this time as steer and heifer slaughter. Some have pointed out that cow slaughter plants tend to be smaller in scale, which is generally true. I would make two other points that are likely part of the reason for this. First, processing of cull cows is a less complicated process in the sense that fewer cuts are likely being made. This probably allowed for easier spacing out of workers than at traditional steer / heifers processing plants. Secondly, and perhaps most significantly, cow plants tend to be less regionally concentrated. Since the pandemic impacted different regions at different times, the labor impacts on cow slaughter facilities were more spaced out. The beef cow slaughter chart includes 2020 slaughter data through November. Some may find it surprising that beef cow slaughter was 2.5% higher during the first eleven months of 2020, than it was in 2019.

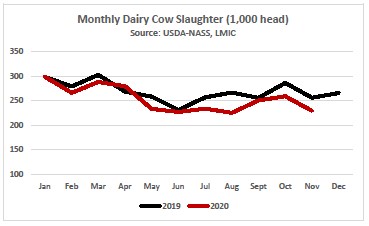

I also wanted to share the dairy cow slaughter chart for comparative reference. Dairy cow slaughter can be an under-appreciated aspect of the beef production system. Even though there are way fewer dairy cows than beef cows in the US, the higher culling rates in the dairy sector actually lead to very similar total slaughter volumes. The same factors that impacted beef slaughter (labor constraints, demand for ground beef, farm level profitability challenges, etc.) also impacted dairy cow slaughter last year.

USDA will release their January 1 cattle inventory estimates on the afternoon of January 29th. Profitability challenges at the cow-calf level certainly have impacted beef cow number in the US during the last year. And, continued weather challenges in the Western half of the country have had major impacts as well. But I would also point to 2020 cow slaughter as another indicator. We culled the herd pretty hard during 2019 and actually saw cow slaughter increase from 2019 to 2020. This was the case even though the beef cow herd was a bit smaller last year, and we had to deal with significant labor challenges in the spring. I find this very telling and another sign that we will see another drop in beef cow number in the January report. While it often takes time, this is a necessary step in building strong calf prices.

Source : osu.edu