By Daniel Munch

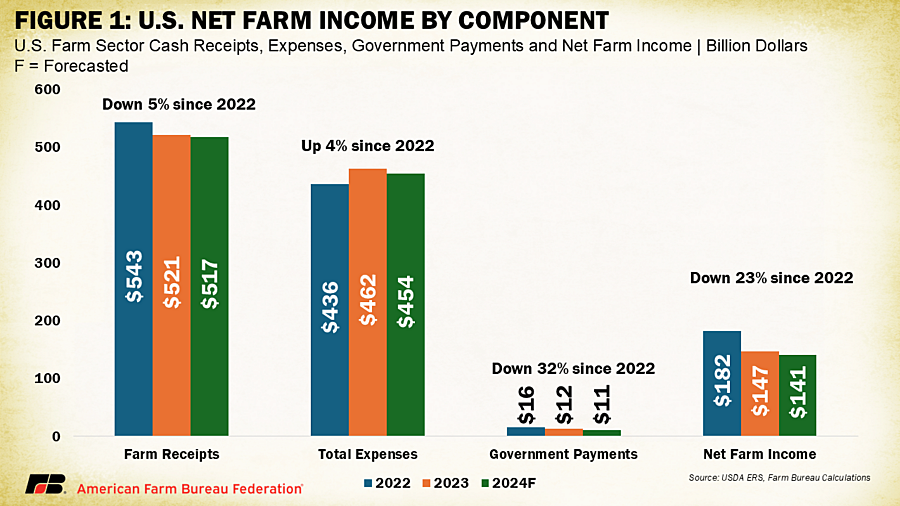

USDA’s December 2024 farm income forecast confirms just how tough a year it’s been for American agriculture, with slightly revised projections offering little relief to farmers, who are losing nearly a quarter of their income in two years. Net farm income is now projected at $140.7 billion for 2024, down $6 billion (4.1%) from 2023 and $41.2 billion (22.6%) from the $181.9 billion peak in 2022. While these updated figures show a marginal improvement over September’s forecast, which projected a 4.4% decline for 2024 to $140 billion, the December revision does little to alleviate concerns about the financial pressures farmers face heading into 2025, and the overall figure masks the dramatic decline in returns for crop farmers.

When adjusted for inflation, the drop in net farm income becomes more pronounced, with a projected decline of $9.5 billion (6.3%) from 2023. Although the updated 2024 figure remains above the 20-year average, the metrics paint a challenging picture, particularly for crop producers, who face substantial revenue declines. While some sectors, most predominantly livestock, are seeing stronger receipts, the December forecast underscores that agriculture remains in the red, with few signs of immediate relief for farmers already navigating tight margins.

Crop Receipts: Declines Deepen

Crop producers will continue to bear the brunt of the economic downturn. Total crop receipts for 2024 are now projected to decline by $25 billion (9.2%) from 2023 to $246.2 billion, a slight improvement from September’s forecasted $27.7 billion drop. This marks the second straight year of significant declines in crop cash receipts, reflecting weaker global demand, falling prices and increased competition from international markets.

Corn receipts are expected to fall $16.6 billion (20.8%), exceeding the already dire September projection of a $16 billion, or 20%, decline. Soybean receipts are likewise forecast to fall $6.9 billion (12.3%), improving marginally from the previously anticipated 14.6% decline, but still representing a sharp downturn. Cotton farmers, meanwhile, face a particularly bleak outlook, with receipts forecast to decline by $1.9 billion (26.9%), a further deterioration from the 23.6% decline predicted in September.

While small gains in vegetable and melon receipts — up $1.7 billion (6.7%)—and rice receipts — up $0.2 billion (4.5%) — offer some bright spots, these increases pale in comparison to the broader losses. Farmers have been forced to contend with declining prices for major commodities, compounded by rising costs for labor, interest and other key inputs.

Livestock Receipts: Bright Spots Amid the Gloom

Livestock producers are faring comparatively better, with total receipts for animal and animal products expected to grow by $21 billion (8.4%) to $270.6 billion in 2024, an improvement over September’s 7.1% forecasted increase. Cattle and calf receipts, bolstered by higher prices, are projected to rise by $7.3 billion (7.2%), exceeding earlier predictions. Milk receipts are expected to grow by $5.3 billion (11.5%), also outpacing the 9.4% increase forecast in September. Pork producers are projected to see receipts increase modestly by $1.5 billion (5.7%), driven by both higher prices and quantities sold.

Egg producers, who initially faced grim projections earlier in the year, continue to see significant gains, with receipts now expected to rise by $7 billion (39.4%), reflecting higher prices and increased demand. However, not all sectors of the livestock industry are thriving. Turkey producers are expected to experience a $2.8 billion (43.3%) decline in receipts, worsening from September’s already bleak forecast of a 41.5% drop.

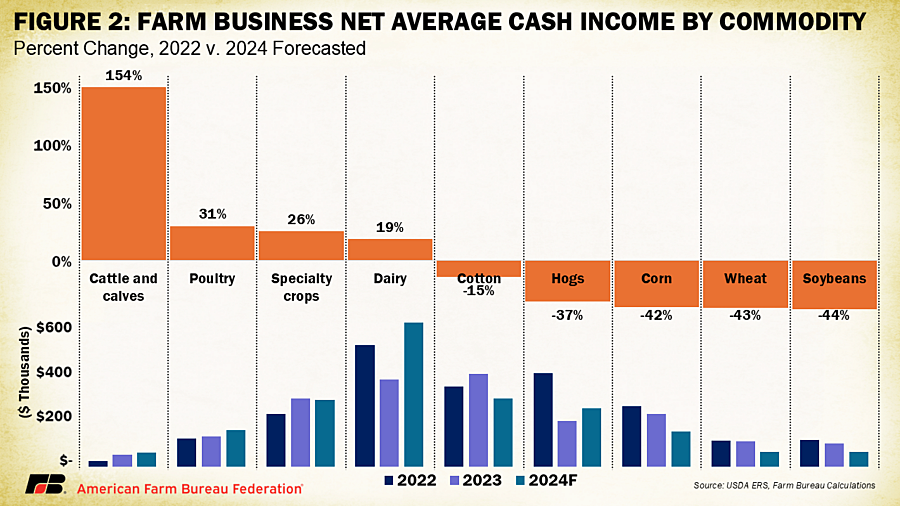

Sharp Contrasts in Commodity Profitability

USDA's metric, Farm Business Average Net Cash Income by Commodity Specialization, offers valuable insights into the financial performance of farm businesses based on their primary commodity focus. Figure 2 highlights both the change in net cash income — calculated as the difference between cash revenues and cash expenses — and the overall net cash income for farm operations specializing in major commodities between 2022 and 2024.

During this period, farm businesses specializing in soybean production experienced a significant 44% decline in net cash income, while those focused on wheat saw a 43% decline, and corn-focused operations experienced a 42% decline. In stark contrast, farm businesses specializing in cattle and calves achieved a remarkable 154% increase, while those focused on poultry saw substantial growth, with net cash income rising by 31%. Income for dairies dropped starkly between 2022 and 2023 but rose dramatically in 2024 – up 19% over 2022. These trends illustrate the dramatic variability in financial outcomes across commodity sectors, influenced by shifts in market conditions, input costs and revenue streams over the observed timeframe.

Diminishing Government Payments Lower Farm Income

Direct government payments are forecast to decline by $1.7 billion (13.6%) in 2024 to $10.6 billion, largely due to lower Dairy Margin Coverage payments resulting from stronger milk prices and the continued reduction in ad hoc disaster programs. This decline underscores diminished federal support for agricultural disaster relief at a time when farmers struggle with mounting losses. Since 2022, uncovered crop and rangeland losses have exceeded $20 billion, a figure that continues to climb as damage from recent hurricanes is assessed. Exacerbating the issue, safety net programs like Agriculture Risk Coverage and Price Loss Coverage have become increasingly ineffective, with outdated formulas failing to provide adequate support during periods of low prices and revenue.

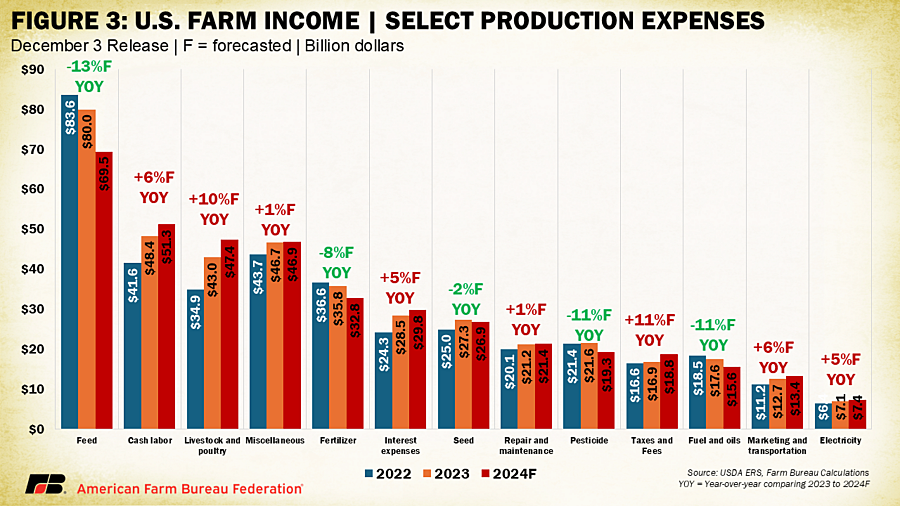

High Costs Persist Despite Expense Relief

Farmers are expected to spend slightly less on production in 2024, with total production expenses forecast to decline by $8 billion (1.7%) to $453.9 billion, an improvement over September’s forecasted $4.4 billion decline. Lower costs for feed, fertilizer and fuel contribute to this reduction, with feed expenses projected to fall $10.5 billion (13.2%), fertilizer expenses down $3 billion (8.4%) and fuel costs declining by $2 billion (11.3%). Given low crop prices, drops in expenses most closely associated with crop production are not unexpected.

Rising costs in key categories like labor and interest continue to offset these savings. Labor expenses are expected to rise by $3 billion (6.1%), while interest expenses climb $1.8 billion (4.1%), reflecting higher debt levels and sustained high interest rates. These rising costs add to the financial strain on farmers, who are already grappling with shrinking margins and limited liquidity.

Farm Sector Equity, and Debt on the Rise

Despite declining net farm income, USDA projects farm sector equity — the difference between assets and debt — to rise by 5.2% to $3.68 trillion in 2024, reflecting growth in real estate values. Total farm sector assets are expected to increase by 5.1% to $4.22 trillion, with real estate comprising 84% of this total. Meanwhile, farm sector debt is forecast to climb 4.5% to a record $542.5 billion, with increases in both real estate and non-real estate debt. While solvency metrics such as the debt-to-asset ratio are expected to improve slightly, reduced liquidity — indicated by a 6.9% decline in working capital — points to ongoing financial strain, particularly as debt levels continue to grow.

Click here to see more...