For producers reluctant to forward contract before harvest, with last year’s drought in vivid memory, a put option is worth considering.

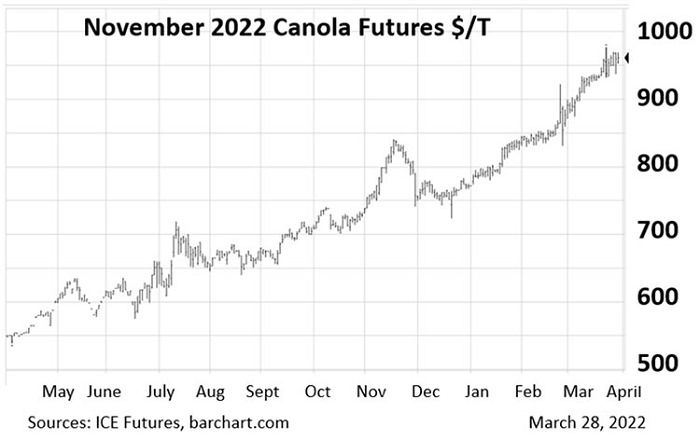

“Canola prices have risen dramatically during the last year to all-time highs, with new crop November 2022 canola futures currently trading near $960/tonne,” says Neil Blue, provincial crops market analyst with Alberta Agriculture, Forestry and Rural Economic Development. “Continuing strong demand for oilseeds across the world, together with the drought-reduced canola crop in Canada and the northern U.S. have pushed prices up.”

Fall-delivered canola contract prices are in the $930 to $960/tonne range, depending on basis levels. Blue points out those are potentially profitable prices, even with the high fertilizer and fuel costs. Weather dependent, there is potential for a resurgence in canola and other oilseed production, and lower prices, this year.

“To the extent that one is confident in their 2022 canola production and seed quality, contracting 10-15% of expected production seems like a good idea. For producers reluctant to forward contract before harvest, with last year’s drought in vivid memory, a put option is worth considering.”

Figure 1: November 2022 Canola Futures

Options are a subset of the futures market and are specific to a certain commodity and futures month for that commodity. For those producers willing to open a futures account, an option may offer hedging advantages. Some grain companies offer a similar product to a put option, but with a delivery commitment attached to their contract.

Purchasing a put option gives the buyer of that option the right, but not obligation, to enter into a “sell” futures position at a predefined price (called the strike price) anytime before that option’s expiry date, and regardless of what the futures price does.

“In other words, you buy the right to lock in a certain futures price, but do not need to lock in that price,” explains Blue. “It is this right that gives the option a value. Buying a put option locks in a minimum futures price for a cost (the premium). There are no margin calls when you buy an option. The only risk is possible loss of the option premium plus some commission.”

Buying a put option through a commodity futures broker does not commit one to a basis or a physical delivery contract. This means that the ability to shop around among buyers for the best basis level remains open and there will be no buyout penalties in case of a crop volume or quality shortfall.

“Because of the historically high futures prices with high price volatility, options are now relatively expensive. However, a consideration is to assess the cost of options at the various futures price levels (strike prices) and perhaps choose a lower level of price than the current futures price. That option will still protect a historically high price and, if the futures price is above that level near expiry, then the price insurance has still done the job of price protection.”

For example, with the November futures price near $960/tonne, the cost for an $830 strike price put option is $22/tonne. Considering that $830 strike price and $22/tonne premium, even if all the premium eroded away by October option expiry, a futures price of $808/tonne ($18.32/bushel) would still be protected. Between now and October, that option could be sold back to the market for remaining premium, be that higher or lower than the cost, if the price protection was no longer wanted.

“In summary, a put option is attractive to producers who are concerned with the alternative of signing a deferred delivery contract, have already forward contracted with physical buyers to their comfort level, or wish to retain their ability to take advantage of possible higher prices while protecting price downside,” says Blue.

Source : alberta.ca