By Josh Maples

USDA released the annual Acreage report last week. The report showed estimates of 92.7 million acres of corn in the U.S. This would be about 2 percent higher than in 2020 and is 1.6 million acres more than USDA estimates of Prospective Plantings back in March. The corn market reaction to the report was bullish on June 30th. Despite the increase in corn acres in the report, it wasn’t as big of an increase as many expected and futures prices jumped sharply. December corn futures increased by 40 cents last Wednesday.

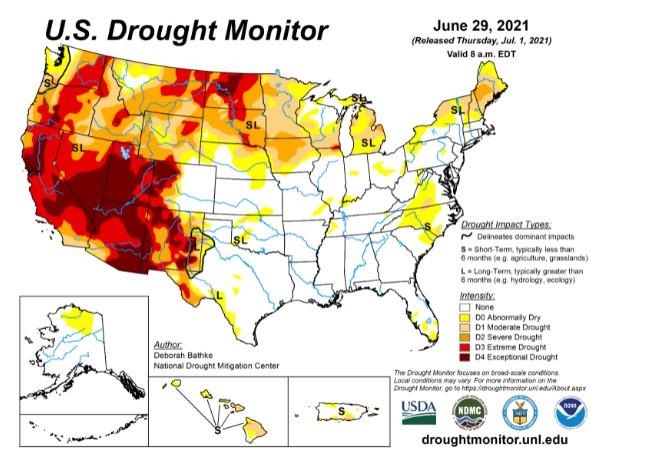

However, that same contract is limit-down (40 cents) in trading today (7/6/21). The December corn contract is currently trading around $5.40 per bushel. Much needed rains and cooler weather are a key reason for the drop today. The weather forecast for growing corn in the Midwest is much improved since last week. The map above shows the precipitation forecast over the next seven days. Compared to the drought map at the bottom of this newsletter, the rainfall is expected in corn areas that really need it.

These events show the complexity in trying to forecast corn prices during the growing season. Both acreage and yield are important to estimating supply. The USDA acreage number was lower than many market participants expected, and prices increased on this new information. Concerning yield, the improved weather conditions and outlook over the weekend provided a boost to yield expectations and pushed the market lower.

For cattle producers, a large corn crop and potentially lower feed costs would be welcomed though that is far from certain at this point. Both feeder cattle and live cattle futures prices have shown strength in recent weeks. The August CME Feeder Cattle contract is trading near $160 at the time of this writing. The November contract is at $166. All of the 2022 feeder cattle futures contracts are trading in the mid to upper $160s.

For CME Live Cattle futures, the August contract is trading near $122 today but later months show the market’s expectation for higher prices in the future. The December contract is trading near $132 and the April 2022 contract is trading near $139. Fed steer prices are typically at their seasonal low during August or September. There is also the expectation that fed cattle supplies will begin to tighten in the coming months which is providing support to live cattle futures prices later in 2021 and into 2022.

In summary, the acreage report was not the big boost to expected corn production that many cattle producers hoped. However, favorable weather could be just as important. Any decline in corn prices combined with the possibility of tightening fed cattle supplies over the second half of 2021 could provide support for cattle prices.

Source : osu.edu