By Don Shurley

USDA’s June 30 Acreage Report said US cotton growers planted 12.185 million acres this year. Using that planted acreage and assuming average yield and abandonment for the past 10 years, last week’s Crop Production report estimates the 2020 crop at 17.5 million bales—2.4 million bales less than last year.

I know of no particular reason why 10-year averages are used. If the 5 year average yield and abandonment were used, for example, 12.185 million acres planted would produce an 18.6 million bale crop. But, let’s look at the numbers in a more practical way and see the implications. Let’s go with the 12.185 million acres planted number. Using the 10-year abandonment of 16%, we would harvest 10.25 million acres as shown in last weeks report with abandonment of almost 2 million acres (1.935 million acres).

Texas is said to have planted 6.615 million acres of the 12.185 US total. To have almost 2 million acres abandoned (that’s what the assumption of 16% gives us), wouldn’t at least 1 ½ million of that need to come from Texas?

So, I asked around. Is it possible that Texas growers could abandon 1 ½ million acres or more? That would be abandonment of 23% in Texas. I am told, yes, it’s possible and maybe more. I’m told some acres have already been zeroed out.

USDA’s August reports will be the first based on actual producer survey. The market will move based on crop conditions between now and then and how August numbers compare to what we were given last week. Compared to last year’s 19.91 million bale crop, a smaller crop and perhaps significantly so, now seems more and more likely.

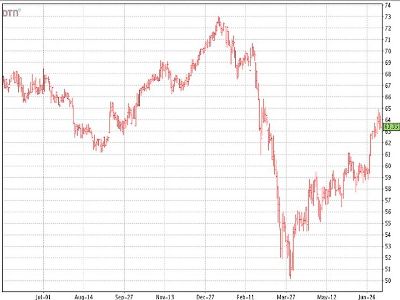

The increased likelihood of a reduced crop should add support to the recovery experienced in recent weeks but may not be enough to take prices where we would really like to see them.

Highlights of last week’s report

- US exports for the soon to be completed 2019 crop marketing year were raised 200,000 bales to 15.2 million bales. This drops beginning stocks for the 2020 crop year by that same amount.

- Exports for the 2020 crop year were lowered 1 million bales to 15 million. This may be due to lower supply/production as well as the 200,000 bale increase in this year’s exports.

- World production for 2020 was lowered 2 ½ million bales from the June estimate—2 million of that accounted for by the US.

- World Use (demand) was lowered slightly from the June estimate. Use is projected to increase 12% from the 2019 crop year but will still be 2 million bales less than production for 2020.

- World Ending Stocks will increase by 2 million bales.

- There were no changes in production, Use, and imports for China from the June estimates.

US export shipments continue to do well. Shipments for the 7-day period ending July 2 were 346,700 bales. Shipments for the 2019 marketing year now total 13.74 million bales. With 4 reporting weeks remaining, shipments must average 366,000 bales per week to meet USDA’s new projection of 15.2 million bales. 2020 crop year sales already total 3.64 million bales—1.25 million so far to China.

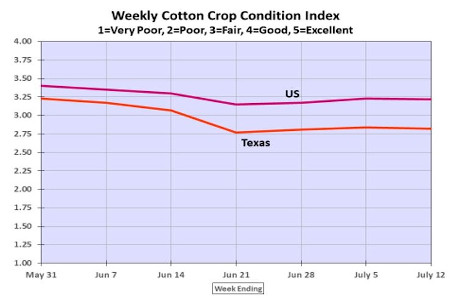

I am told the situation in Texas is worse than USDA crop conditions are showing. USDA shows 41% in poor to very poor condition. Missouri is 20% poor to very poor, South Carolina is 17%.

Source : ufl.edu