By Jonathan LaPorte, Bruce MacKellar, and Dennis Pennington

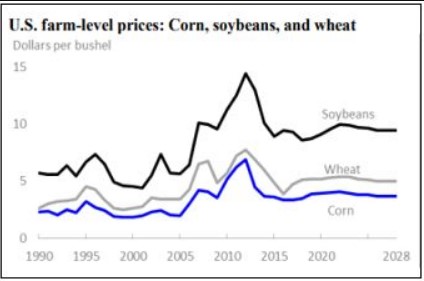

Almost ten years have passed since the record high prices in commodities helped drive farmland rental rates to their own record highs. In recent years, those same commodities have receded to pre-2009 prices with net farm income (NFI) falling to or below where they were during that same period in time. Despite the reduced income, the rents being paid have remained steady, with an upward trend still being seen in irrigated acres. Farm economists are expecting only moderate price increases in the next five to six years, which indicates that there will continue to be lower amounts of income to support the rents being paid. This makes understanding the impacts that rental prices have on cost of production even more vital to a farm’s overall success.

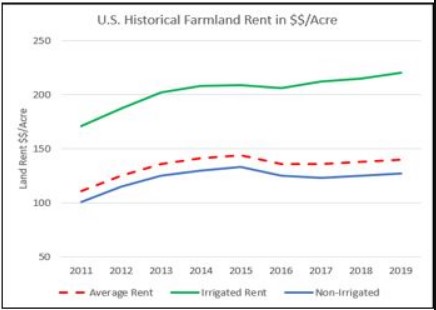

Farmland Rent Paid from 2011-2019

It is important to remember that land rent prices vary tremendously not only from state to state, but also from county to county. In Michigan, the higher productivity soils that are tile drained in areas where specialty crops are grown (such as sugar beets and vegetables) tend to command a higher price. Other factors such as field size, access, soil type, soil fertility, previous cropping history, fencerows, telephone poles, wet spots, and proximity to their farm operation all impact the price that farmers are willing and able to pay for land rent. Looking at data like this will give you a place to start, but may not reflect the true value of the farmland.

U.S. Grain Prices Projected to 2028 (USDA ERS)

One place that both landowners and producers like to use as a starting point is the USDA’s National Agriculture Statistics Service (NASS). It reports information based on surveys sent to and returned by producers across the nation. For the state of Michigan, the average land rent price according to these surveys was $127 per acre in 2019. Non-irrigated farms averaged $120 while irrigated lands were upwards of $220 per acre. The same database contains county level data, which would more accurately reflect rental rates in your area. Michigan is very diverse from north to south, with land rent in southern Michigan often much higher than in the Upper Peninsula.

It’s important to keep in mind that while those surveys are a helpful starting point, they should not be used as the final determination of rent. As outlined previously, there are a lot of differences that exist from one field to another. These differences can be significant in determining the value of land. For example, individual fields can vary on soil type and field quality, making the potential yield and productivity a significant factor in determining value. Quality land with good fertility, well-spaced tile, a good Farm Service Agency base (i.e. base acres for government programs) are all plus factors toward stronger rental rates. Those fields that are capable of producing a higher yield often warrant a higher land rent payment. Exactly how high needs to be reasonable for both the landowner and producer.

The definition of reasonable is often helped by understanding what efforts are made to increase or maintain productivity by all parties. Over the past decade, many farmers have made improvements to the land including installation of tile drainage, removing fencerows and installing irrigation systems. All of these improvements lead to higher long-term yields, which tend to help support higher land rental rates. However, with lower commodity prices, you can expect that the amount of money invested in these improvements paid for by the farm producer will continue to taper off.

Landowners that are looking to maintain their current land rental rates and the yields that supply them may want to consider taking on these investments. Historically, landowners that have not made efforts to assist in maintaining their farmland or invest in improvements generally receive lower farmland rental rates. On average, the rental rates received on these farms are 25 to 30 percent lower than other properties in the same area. This presents an opportunity to discuss what improvements are needed and how they will be implemented to maintain yields and profitability for both parties. Having good communication between the landowner and the farmer-tenant is one of the most important first steps in establishing a win-win farmland rental agreement.

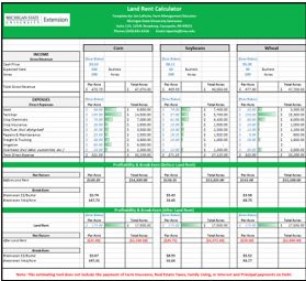

Another consideration on reasonable land rent is what producers can afford to pay. To assist in comparing the impact of land rent payments against the farm's net farm income, MSU Extension offers a land rent calculator. By inputting estimated income and expenses, a producer can determine whether the land rent being paid is reasonable or if a discussion, or even a possible re-negotiation, of the land rent agreement should take place.

If a discussion with the landowner is needed, producers can use the calculator to discuss rental values as well as the challenges and potential impacts to the farm's production and profitability.

So what does the future hold for land rent? Farmers will want to hold onto the land they farm as long as possible. It is hard to make a living if you don’t have any land to farm. If the prices hold for the next year or two, Michigan State University Extension would expect that farmers will need to re-negotiate with landowners about their price and type of rental contract being used. The recent commodity prices and lowered net farm income generates an additional risk to farms as they look to move their businesses forward. Farmers may want to share some of that risk with landowners, so that when crop prices are good, rental prices reflect that, but when prices are down, rental prices go down.

For information on average rental rates in your county, visit the following report based on survey data from the USDA’s National Agricultural Statistics Service for Michigan counties. For a copy of this entire series in a fact sheet format, please visit the MSU Extension Farm Management Website.

Source : msu.edu