By Gary Schnitkey and Krista Swanson et.al

Department of Agricultural and Consumer Economics

University of Illinois

By Carl Zulauf

Department of Agricultural, Environmental and Development Economics

Ohio State University

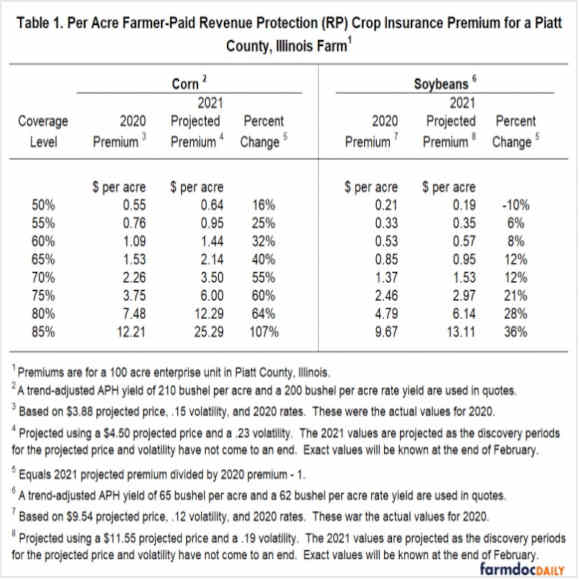

Crop insurance premiums for all products will likely be much higher in 2021 than in 2020 because projected prices and volatilities will be higher in 2021 compared to 2020. These higher premiums could impact crop insurance decisions, particularly at higher coverage levels. The 2021 premiums for 85% Revenue Projection (RP) could double compared to the 2020 premiums. Guarantees will be higher in 2021 compared to 2020.

Higher Premiums

Table 1 shows 2020 actual and 2021 estimated premiums for a farm in Piatt County, Illinois. These premiums are calculated for both corn and soybeans using 100 acres in an enterprise unit. The 2020 premiums use actual rates, projected prices, and volatilities for 2020. The 2021 premiums are estimated using 2021 rates; however, projected prices and volatilities are not yet known. The 2021 premiums are estimated using prices and volatilities that persisted during the first week of February:

- For corn, the projected price is set at $4.50 per bushel, and the volatility is .24. The actual projected price will be the average of the settlement prices during February of the December 2021 corn futures contract traded on the Chicago Mercantile Exchange (CME). The volatilities will be based on the last five trading days of February.

- For soybeans, the projected price is set at $11.55 per bushel, and the volatility is .19. The actual projected prices will be the average settlement prices of the November 2021 CME contract. The volatilities will be based on the last five trading days of February.

While exact values will not be known until the end of February, prices during the first week of February give a good indication of 2021 values.

For corn, the Piatt county farm had a $12.21 per acre premium for an 85% coverage level in 2020. The 85% coverage level is estimated to have a $25.29 per acre premium in 2021, more than double the 2020 premium. Two reasons exist for this higher premium:

- The projected price for 2021 is estimated at $4.50 per bushel, a $.62 per bushel increase from the $3.88 level in 2020. This will account for roughly 20% of the premium increase between the two years.

- The volatility for 2021 is projected at .23, much higher than the .15 volatility in 2020. The increase in volatility accounts for roughly 80% of the premium increase.

The volatility will be set during the last five days of February. Large changes are possible between now and the volatility setting periods. Still, it seems prudent to expect higher volatilities in 2021 as compared to 2020.

Volatility measures the market’s estimate of potential variability in prices, with higher volatilities indicating higher price variability. Higher price variability increases the chance of crop insurance payments, with higher coverage levels being more impacted by price variability. As a result, changes in premiums are less for lower coverage levels. For the 80% coverage level, the 2021 premium at $12.29 per acre is 64% higher than the 2020 premium, less than the 107% increase for the 85% coverage level. Estimated increases are 60% for the 75% coverage level, 55% for the 70% coverage level, and so on (see Table 1).

Soybean increases are less pronounced than for corn. The 85% coverage level premium was $9.67 in 2020 and estimated at $13.11 for 2021, an increase of 36%. Premium increases result because:

- The projected price for 2021 is estimated at $11.55, almost $2 higher than the 2020 projected price of $9.54

- The 2021 volatility is projected at .19, higher than the .12 volatility for 2020.

Impact on Crop Insurance Decisions

Many farms purchased 85% coverage levels in 2021. In northern and central Illinois, an 85% RP policy was between $10 to $17 per acre last year. Those policies likely will be in the mid $20s in 2021.

For the additional cost, the policy’s coverage will be higher in 2021 than in 2020. Using a trend-adjusted Actual Production History (APH) yield of 210 bushels per acre and a $4.50 projected price, the RP minimum revenue guarantee this year will be $803 per acre:

$803 = 210 TA APH yield x $4.50 projected price x .85 coverage level

The $803 guarantee will be over $100 higher than the guarantee for an 85% coverage level in 2020 of $693 per acre:

$693 = 210 TA APH yield x $3.88 projected price x .85 coverage level

Many farmers will likely find the coverage level worth the addition in premium, particularly given the high volatilities this year. With those high volatilities, there is a higher chance of large price declines than in previous years when volatilities were lower.

Summary

Farmers likely will find crop insurance premiums to be higher in 2021 compared to 2020. Both higher projected prices and volatilities lead to these higher premiums. Higher projected prices also would result in higher guarantees. Many farms will find the higher coverage levels offset the higher premium.

Source : illinois.edu