By Gary Schnitkey and Krista Swanson

Department of Agricultural and Consumer Economics

University of Illinois

By Carl Zulauf

Department of Agricultural, Environmental and Development Economics

Ohio State University

Corn and soybean prices for 2022 fall delivery are at high levels. During the first two weeks in May, fall delivery bids in central Illinois averaged $7.39 per bushel for corn and $14.52 for soybeans. Significant changes in prices going into fall are possible. History suggests that there is a 5% chance that cash prices for corn in October will be below $4.60 per bushel. There is a 5% chance of cash prices below $10.56 per bushel for soybeans. Conversely, there also is a chance of higher prices. There is a 5% chance that October cash prices exceed $10.50 per bushel for corn and $18.49 for soybeans.

Framework Used to Evaluate Possible Price Changes

Our objective is to present possible fall prices for corn and soybeans. To do this, we evaluated changes in both futures and cash prices from May to October. The analysis provides a perspective on both futures and cash markets. While futures and cash prices are highly correlated, cash prices tend to move down more in years of falling prices. Analyses are first presented for corn in the following section and then for soybeans in the second.

Corn

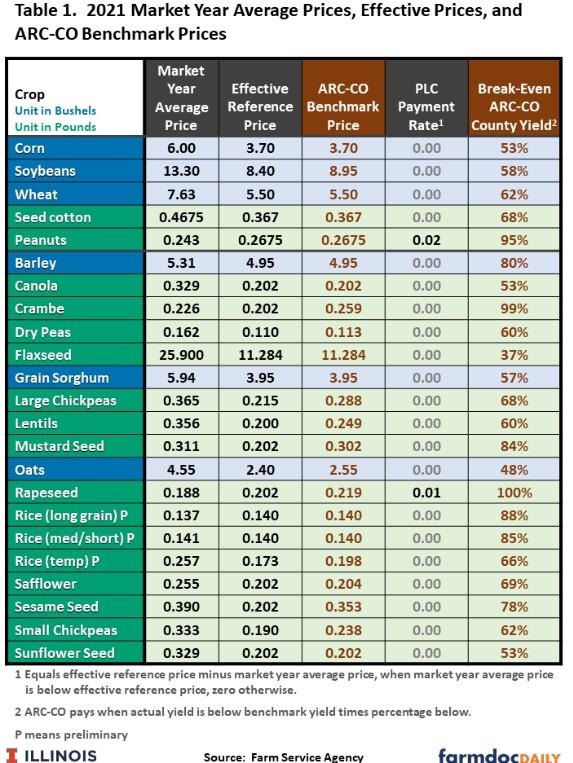

Table 1 shows historical prices from 2001 to 2021. The panel labeled “May” gives average prices during the month of May and includes three columns. The “Dec CME” column shows the average settlement prices of the December Chicago Mercantile Exchange (CME) contract. From 2001 to 2021, futures prices averaged $4.00 per bushel. For the first two weeks of May in 2022, the December contract has averaged $7.39, well above the historical averages. The $7.39 average was the highest of all prices since 2001. In May, the fall delivery price for central Illinois averaged $3.74 per bushel from 2001 to 2021 as shown in the “Fall Delivery Bid” column. The “Basis” column shows the difference between the futures and fall delivery price averaged -$.26 per bushel. There is variably in the basis, ranging from -$.50 in 2008 to -$.13 in 2012. In 2022, the basis is -$.29 per bushel.

The panel labeled “October” give an average of daily prices during October and includes three columns. For October, the December contract averaged $3.82 per bushel from 2001 to 2021 as shown in the “Dec CME” column. The “Cash bid” column gives the delivery price for grain, while the “Basis” column gives the difference between the CME and cash bid. From 2001 to 2021, the cash bid average was $3.64 per bushel, $.19 below the average December futures contract. Note that the average May basis of -$.26 per bushel is more negative than the October basis of -$.19 per bushel. A more negative basis in May likely is due to a risk premium built into fall delivery bids.

The final panel, “Change”, includes two columns showing changes in both futures and cash prices. Over time, the change in the December contract from May to October averaged -4%. The change in May to October cash prices average -2%.

Historical price changes shown in the final two columns of Table 1 are used to calculate the probabilities of low and high prices. These probabilities are calculated by ordering the changes from low to high and then calculating price change percentiles. Results are shown in Table 2. For a .05 probability, the futures price change is -31%. From 2001 to 2021, 5% (or 2 out of 20) of the changes in future prices were at or below -31% (i.e., -34% in 2008 and -31% in 2004). In 5% of years, we would expect price to decrease by at least -31%. From the current $7.39 level, the resulting October futures price would be $5.14 per bushel ($7.39 x (1 – .31).

For cash prices, the probabilities in Table 2 suggest:

- $4.00 — The chance of having a $4.00 price or lower is below .05.

- $5.00 — The chance of a $5.00 or lower price is between a .1 and .15 probability, interpolated to be 12%.

- $6.00 — the chance of a $6.00 or lower price is between .15 and .25, approximately 23%.

There also is considerable upside potential. For example, in Table 2, the price that corresponds to a 0.75 probability is $7.59 for cash corn. In other words, there is a 25% chance of prices being above $7.59 in October.

The .95 probability in Table 2 suggest a 5% chance of cash prices exceeding $10.50 per bushel in October.

Soybean

Historic soybean prices are shown in Table 3. The November CME futures contract is used for soybeans. Highlights are:

- May 2022 prices are $14.84 for the November CME futures contract, and the fall delivery price is $14.52 per bushel, giving a basis of -$.32 per bushel. Basis in May has averaged -$.30 per bushel historically.

- In October, the basis between the November CME contact and cash prices averaged -$.25 per bushel, less negative than the -$.30 basis in May.

- Over time, the change in May and October futures prices has averaged 0% from 2001 to 2021, ranging from a decline of 29% to an increase of 30%.

- The percent change in cash prices between May and October has averaged 1%, ranging from -29% to 31%.

The probability of soybean price changes are shown in Table 4. For cash prices:

- $10 per bushel — There is less than a 5% chance of soybeans being below $10 per bushel

- $11 per bushel — The chance of less than $11 per bushel cash prices is near 8%.

- $12 per bushel — The chance of less than $12 cash prices is 20%.

Higher prices also are possible. Historic price changes suggest that cash prices could exceed $18.49 with a 5% probability.

Summary

History suggests that large changes in prices are possible from May to October. We quantified possible price chances using history as a guide.

Source : illinois.edu