By Edward Johnstonbaugh

The impact of legislation implemented in late 2017 has begun to reshape the solar PV landscape in PA - literally. Act 40 or the “border closing” legislation began the reduction in the number of solar alternative energy credits coming from outside the state. Competitive generation suppliers and regulated electric utilities purchase these credits to meet the alternative energy requirements of the AEPS act of 2004. The result of the 2017 law has been to stop the flood of new out-of-state credits while allowing the oversupply of these credits to be drawn down as existing contracts with out-of-state suppliers expire.

The loss of credits from outside the Keystone State is spawning an expected demand for new capacity originating credits in Pennsylvania. This has caused a quick increase in interest for solar PV capacity considered to be “utility scale”. Utility scale from the standpoint of the AEPS (Alternative Energy Portfolio Standards) act are solar farms greater than 3 megawatts or in limited cases 5 megawatts where the facility can operate parallel to the grid in emergencies. Facilities greater than these capacities are not allowed to net meter under the law and as such must look to the regional transmission operator (in PA the regional transmission operator is PJM). Facilities connected to PJM are generally interconnected at 115,000 volts or greater. That’s quite a jump from the 12,000 to 25,000 volts that a typical largescale net-metering solar facility would be interconnected at. In the case of the PJM interconnected facilities their electricity flows onto the transmission grid, scheduled for delivery to an off taker who has entered into a purchase power agreement (PPA) with the plant operator for some number of years. The demand for the SRECs, now that the borders have closed, sweetens the deal for some developers/plant operators to the point of often the difference between “go” and “no go”.

In addition to receiving the price of the generation supply being purchased by the off taker, the supplier also gets to market the excess SRECs that originate from the plant operation. At a sale price of $50, an SREC is equivalent to an additional 5 cents per kWh. As the oversupply of SRECs that had come from other states is absorbed in the market, the value of Pennsylvania-originated solar credits is likely to rise. This potential has led to a rapid growth in interest in lease options for the development of utility scale solar projects.

Many landowners, with favorable property characteristics, have been approached by aggregators and by developers with an interest in locking up parcels of land for future development. The development process is complicated and can be expensive. So, locking up as much land for the least amount of money is a logical objective for the developers. As the process moves forward, dependent on many factors, much of the land will be found to be not suitable. Inexpensive lease options will be abandoned if the site is less than optimal. Land that is easily accessible with good characteristics for solar development and that has nearby electrical facilities for interconnection will be coveted. Penn State Extension’s online fact sheet titled “Landowner Leasing for Utility Scale Solar Farms” gives further details and information on this topic.

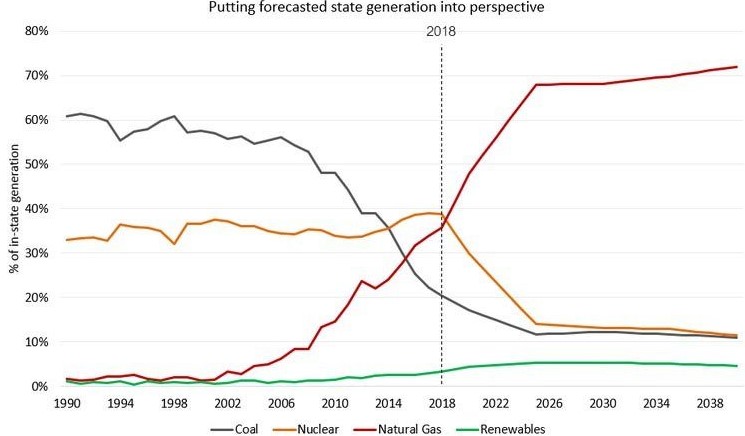

Exactly how much solar PV capacity along with other renewables is needed or will be financially supported remains uncertain. The decline of coal as the fuel of choice for electricity generation has been driven by many interests. From clean air concerns to a reduction in carbon emissions coal use has been in decline for the last two decades. Natural gas has long been the replacement fuel of choice and now holds the place at the top fuel in use for electrical generation. Natural gas has readily filled the void left by coal’s decline accompanied by a sharp drop in the emission negatives that were coal’s calling card.

Even though the gap in electrical generation capacity left by coal is being filled by natural gas there still is an opportunity for renewables created by the AEPS act of 2014.

Recommitting to increase the amount of renewables as a percentage of total generation in the state is on the agenda of both houses of the legislature in PA. The details of the plans continue to be a challenge, with a variety of questions in play, such as support for the nuclear power sector and Regional Greenhouse Gas Initiative (RGGI) or “Reggi”, for short. Details of the state’s proposed participation in Reggi are still not set, and its impact on Pennsylvania’s energy sector is not easy to predict.

Things that we confidently anticipate include: natural gas will continue to provide the bulk of baseload generation and a carve out for renewable generation resources will be part of any legislative extension of the AEPS act extension.

Source : psu.edu