By Ryan Hanrahan

Market Watch’s Kirk Maltais reported Tuesday that “production of corn and soybeans out of Argentina are forecast to be lower as weather there batters its newly planted crops, the U.S. Department of Agriculture said. In its latest World Agricultural Supply and Demand Estimates report published Tuesday, the USDA changed its outlook for South American corn and soybean crops which grain traders have been watching closely in recent months to determine the competition U.S. exports face on the world market.”

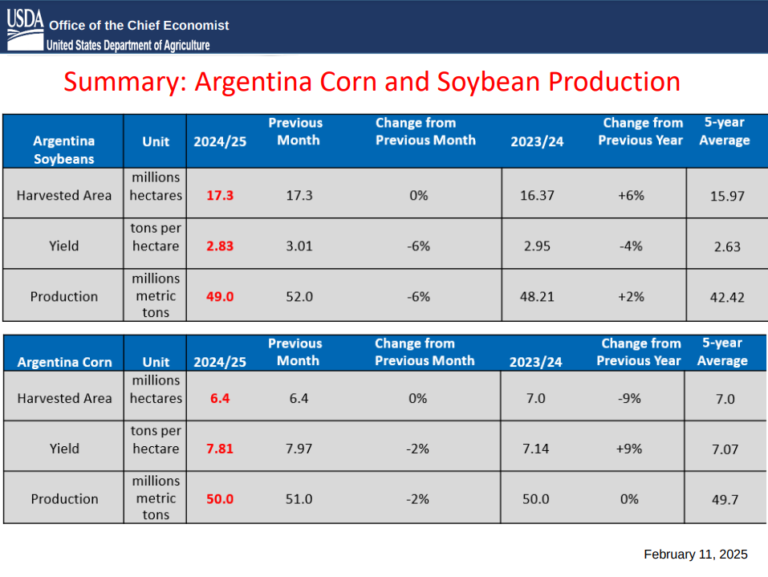

“Argentina’s projected corn crop was cut by 1 million metric tons to 50 million tons in 2025, while the outlook for its soybean crop was reduced by 3 million tons to 49 million tons,” Maltais reported. “Brazil’s corn-crop projection was also cut by 1 million tons to 126 million metric tons in 2025, but the estimate for its soybean crop was left unchanged at 169 million tons. For both Brazil and Argentina, excessive rain in some areas, combined with drought in others, have impacted the size and health of their row crops.”

“Movements in the USDA’s forecasts for U.S. corn and soybeans in South America are having a minor effect on price movement, says Brian Hoops of Midwest Market Solutions,” Maltais reported. “‘South American production is closely looked at and while Argentine and Brazil production is larger than last year, so far supply is down from last month, so a minor supportive feature.'”

US Ending Stocks Lowered for Wheat

Successful Farming’s Cassidy Walter reported Tuesday that “USDA defied expectations for 2024/2025 U.S. corn, soybean, and wheat ending stocks. Corn and soybeans were held steady when the average trade expectation was for lower ending stocks. Concerning wheat, USDA went lower when the average trade expectation was for higher ending stocks.” For corn, US ending stocks remained at 1.54 billion bushels. For soybeans, ending stocks remained at 380 million bushels. For wheat, ending stocks were lowered to 794 million bushels, well below the trade prediction of 801 million bushels.

Walter reported that Jeremy McCann, account manager for Farmer’s Keeper said that “I was surprised to see the USDA did not change domestic ending stocks for corn or soybeans whatsoever while they did decide to lower wheat. We have been posting good export demand particularly for corn recently so no decrease is what caught me (and the market) off guard.”

On the production side, Maltais reported that “for U.S. crops, the USDA left its outlook for corn and soybeans unchanged. The corn-production estimate stayed at 14.87 billion bushels, while the soybeans projection remained at 4.37 billion bushels.”

Chinese Imports Lowered

Reuters’ Karen Braun reported that “the U.S. Department of Agriculture on Tuesday slashed Chinese grain imports for 2024-25, certainly not surprising given China’s recently lighter market involvement.”

“The agency now pegs China’s 2024-25 corn and wheat imports at 10 million and 8 million metric tons, respectively, down nearly a quarter from the January estimates. These volumes would be down 57% and 32% from the respective averages of the previous four seasons,” Braun reported. “China’s predicted grain hauls will still be historically large, though some global grain exporters may need to block out the memories of what used to be and focus on a newer normal.”

“China’s corn and wheat harvests were both record-large in 2024-25. As such, stocks-to-use is set for levels that any other country would consider tremendously burdensome, some 65% for corn and 86% for wheat,” Braun reported. “However, those are 11- and nine-year lows, respectively, which could eventually favor China’s return to global grain trade. By comparison, some analysts cannot agree whether U.S. corn stocks-to-use at 10% is bullish.”

“But China’s economic growth is seen slowing this year and again next year, which typically does not bode well for agricultural purchases in general,” Braun reported. “China last week delayed imports of up to 600,000 tons of mostly Australian wheat, emphasizing its retreat as an importer. It also has a negligible amount of U.S. corn on the books for export in 2024-25, the volume being the lowest for this time of year in eight years.”

Source : illinois.edu