'Buy Canadian' sentiment is nice, but may not be realistic in agriculture

This year may not be the year to buy a brand-new John Deere X Series combine. No matter how great it would be to raise harvest capacity by 45 percent, Canadian farmers may put off their purchase until later.

Rising farm equipment prices due to trade disruptions will alter farmers' replacement decisions says FCC.

While farmers are already cautious about per-acre equipment costs, uncertainty surrounding tariffs is adding further hesitation, potentially altering equipment replacement decisions.

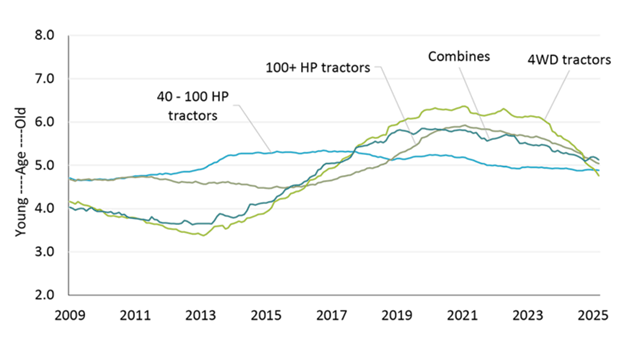

FCC reports that despite current trade concerns, the Canadian farm equipment fleet is in relatively good shape, with the estimated age of most equipment at multi-year lows. However, in the longer term, investment in new machinery will be necessary to maintain efficiency and productivity

Proxy age of new farm equipment replacement cycle

*The proxy for farm equipment age is calculated using a rolling average of 5-year sales relative to 10-year sales to estimate the replacement cycle age.

Tariffs and Their Ripple Effect

The U.S. government's steel and aluminum tariffs were originally intended to boost domestic production and increase capacity utilization above 80%, according to FCC. However, these measures have indirectly contributed to higher farm equipment costs. When raw material prices rise, manufacturing costs follow suit, reducing affordability for farmers.

For now, farmers may not feel an immediate impact, as equipment manufacturers typically secure steel through fixed-price contracts. However, once these agreements expire, companies will need to renegotiate prices, potentially leading to cost increases that will filter down to buyers

To manage production costs and inventory, equipment manufacturers are taking a cautious approach—reducing production levels and adopting a "wait-and-see" strategy in hopes of favorable trade resolutions.

A Shift in Buying Behavior

Sales figures indicate that trade disruptions have already influenced purchasing patterns. In the first two months of this year, U.S. farm equipment sales dropped by 18.4%, while Canadian sales fell by 5.7%. Many farmers are delaying new equipment purchases, opting instead to maintain existing machinery or invest in used equipment, further increasing demand for second-hand machines.

The uncertainties surrounding tariffs are contributing to a more conservative purchasing landscape, with farmers hesitant to commit to pre-orders for new models.

The Reality of "Buying Canadian"

While supporting Canadian manufacturing is an appealing idea, FCC notes that Canada’s agricultural equipment sector remains relatively niche. Most farm machinery is sourced from the U.S., making it difficult for farmers to exclusively buy Canadian-made equipment.

Moreover, the ongoing U.S.–China trade war has further escalated costs for imported components from China, adding another layer of unpredictability for the farm equipment industry.

Although the industry faces near-term challenges, FCC believes Canadian farmers are well-positioned to navigate this period of uncertainty. However, if trade tensions persist, investment in new equipment will become unavoidable to maintain long-term operational efficiency.

For now, farmers and manufacturers alike are watching closely, hoping for trade resolutions that will ease pricing pressures and restore confidence in equipment markets.

Sources: AEM, and FCC Economics

Photo Credit: John Deere