One farmer said he could see 45 per cent rate increases if he doesn’t reduce his usage

By Diego Flammini

Staff Writer

Farms.com

Ontario producers are receiving phone calls to lower the amount of electricity they’re using or face stiff rate increases.

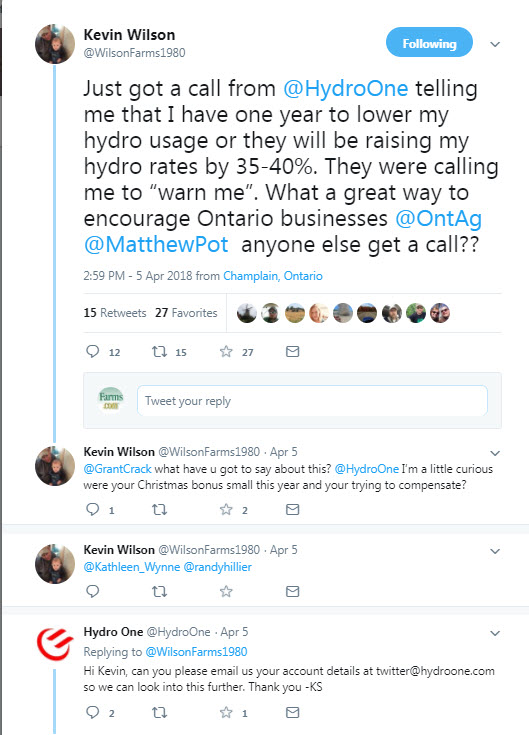

Kevin Wilson, a cash crop and beef producer from Vankleek Hill, Ont., said a Hydro One representative contacted him on Apr. 5 to warn of a potential rate increase if he didn’t cut his electricity usage.

“There was line work being done on the road, so I figured the call had something to do with that,” he told Farms.com today. “But no, I was notified that if I didn’t do something about my usage, that my rates in 2019 would be increasing by between 35 and 45 per cent.”

Twitter screenshot

Between the farm and the grain elevator at the farm, Wilson estimates he paid about $60,000 in hydro bills last year. An increase of that magnitude could add another $23,000 to his operating costs, he said.

“It doesn’t make sense,” he said. “There’s nothing (Hydro One) is doing to bring me more power and nothing that’s costing them more to deliver this power. They are just taking advantage of someone who’s using a lot of electricity.”

Wilson posted a message on Twitter after his conversation with the Hydro One employee.

Two other farmers indicated they received similar calls, and someone from Hydro One’s official Twitter account contacted Wilson to further the conversation.

Since then, Wilson has been going back and forth with other Hydro One representatives to give them a better idea of how his farm operates.

“I explained to them that my grain elevator runs 24 hours a day,” he said. “I can’t really shut it off. Hydro One is supposed to send someone out here to do an energy audit.”

Receiving a threat of a rate increase is a classic case of Hydro One not understanding the needs of rural Ontario, Wilson said.

Farms.com has reached out to other farmers who have received calls from Hydro One. Farms.com has also contacted Hydro One for comment.