Many areas reported soil conditions too wet for fieldwork

By Diego Flammini

Assistant Editor, North American Content

Farms.com

About a quarter of Manitoba’s total crops have been seeded, according to Manitoba Agriculture’s May 8 Crop Report.

Farmers continue to plant cereals, field peas, canola and corn. And most of the province’s total seeding occurred in the South Central region.

Field conditions vary throughout the province, with some producers reporting soil conditions too wet for machinery to enter fields, the report says.

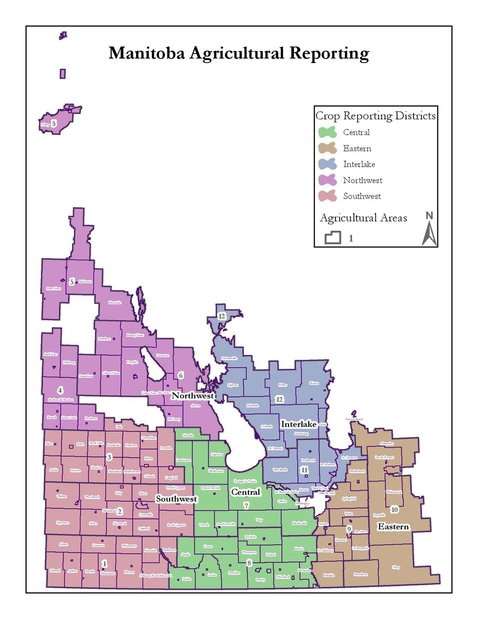

Manitoba agricultural map

Photo: Manitoba Agriculture

REGIONAL HIGHLIGHTS

Southwest

- Seeding is between 10 and 15 per cent completed, with cereals, field peas and canola making up most of the planted crops.

- Winter wheat and fall rye are re-growing in most areas.

- Weeds are growing due to recent warm weather. Pre-seed burn off treatments are being applied.

Northwest

- Field operations are just beginning as producers determine which fields are suitable for fieldwork.

- Many producers still have unharvested canola, peas and corn.

- No concrete number of seeding was provided by Manitoba Agriculture, but the majority of seeded acres are field peas and spring wheat.

- Stinkweed, dandelions and wild oats are growing throughout the area.

Central

Eastern

- Very little of the winter wheat crop survived. Between 75 and 95 per cent of the crop was winterkilled.

- 30 per cent of spring seeding is complete.

- Producers are expected to make rapid progress if weather permits.

Interlake

- Seeding is the southern part of the region is between 30 and 40 per cent complete, with over half of spring cereals seeded.

- 20 to 30 per cent of canola acres are seeded and some soybeans are planted, too.

- Producers in the northern part of the region have seeded up to 7 per cent of their acres, with cereals accounting for a majority of the acreage.