More than 12 inches of snow fell in four states

By Diego Flammini

Assistant Editor, North American Content

Farms.com

Wheat crops in four Midwest states are buried after a late April storm brought more than 12 inches of snow.

Fields in Oklahoma, Kansas, Colorado and Nebraska are almost completely white due to the snow. The damage appears to be significant.

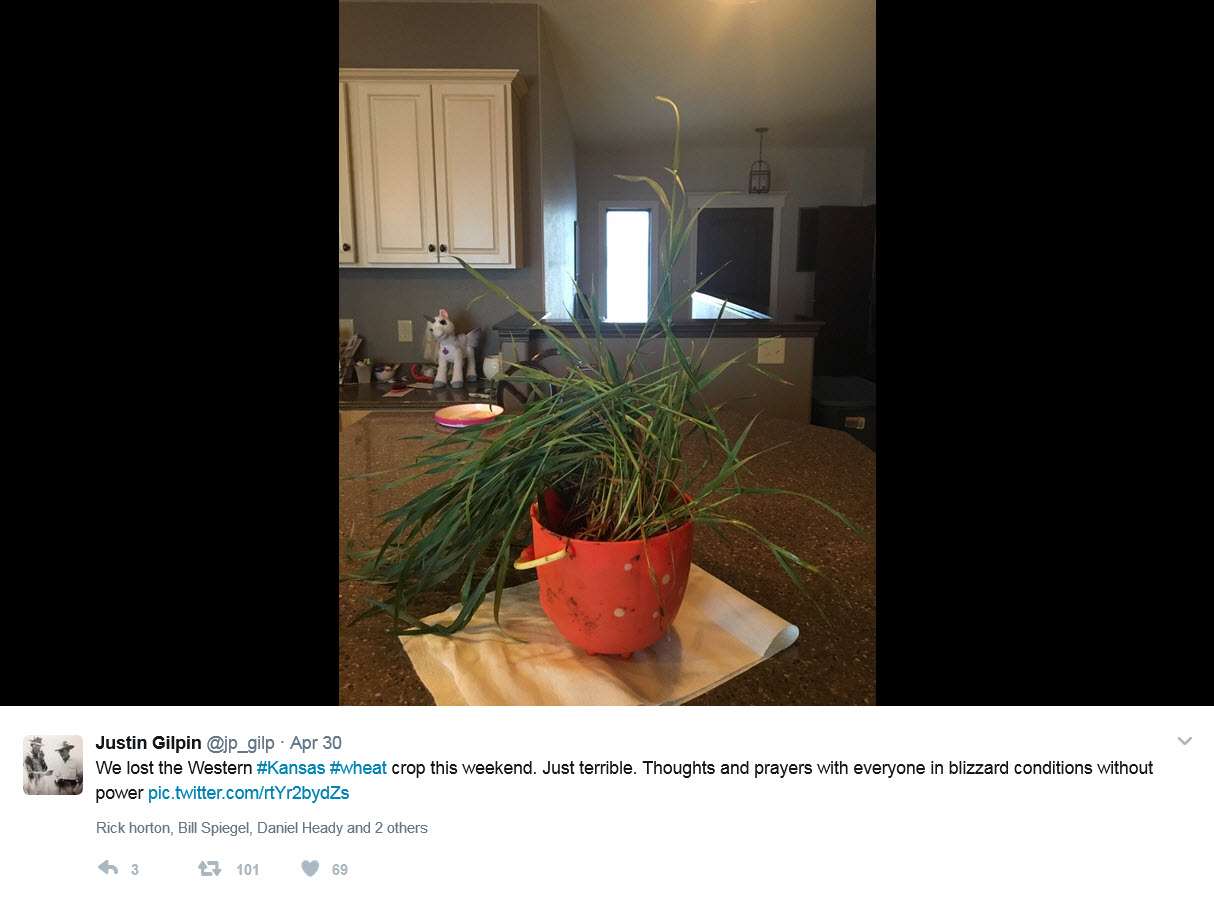

“We lost the Western #Kansas #wheat crop this weekend. Just terrible,” Justin Gilpin, CEO of Kansas Wheat, said on Twitter.

An estimated 50 million bushels were lost in Kansas alone and that number could rise to 100 bushels, Peter Meyer, a senior director with New York’s Pira Energy, a diversified marketing company, told Bloomberg.

In Nebraska, field assessments continue.

It will take about a week before final conclusions can be made on the state’s wheat crop, Caroline Brauer, executive director of the Nebraska Wheat Grower’s Association, told WNAX.

Due to its earlier stage of growth, Brauer suggests wheat in the Northern Panhandle may have weathered the storm better than crops in the Southwest.

Market reaction

Wheat futures jumped by almost 7 per cent after the snow fell.

July futures for hard red winter wheat increased 6.5 per cent to $4.6575 (per bushel) on the Chicago Board of Trade before 1:30 p.m. Monday, according to Bloomberg.

July futures for soft red winter wheat jumped by 5.5 per cent to $4.56 (per bushel), and corn climbed 3 per cent, Bloomberg reported.