Why farmers in the US and Canada should care about a potential war and its impacts on agricultural markets

By Devin Lashley

Farms.com Risk Management Intern

A potential war between China and Taiwan, with significant U.S. involvement, would have profound effects on global agricultural markets.

While China has not engaged in major conflicts since the Sino-Vietnamese War in 1979, recent military exercises around Taiwan signal heightened tensions. If these drills escalate into a full-blown war, the repercussions would extend far beyond the immediate region, deeply impacting agricultural trade and food security worldwide.

China is a major player in global agricultural markets, both as a consumer and producer. A conflict would disrupt shipping routes in the Taiwan Strait, one of the world's busiest maritime passages. This disruption would hinder the transportation of agricultural commodities, leading to delays and increased shipping costs. The global supply chain for essential goods like grains, soybeans, and corn would face significant interruptions, causing volatility in prices.

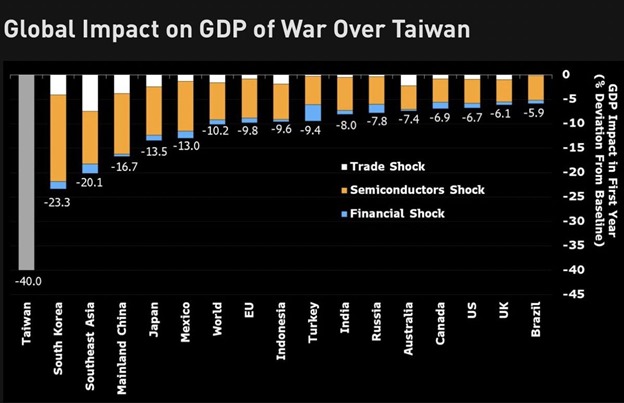

In a war scenario, China and Taiwan's agricultural productivity would likely plummet. Taiwan's economy would suffer a severe blow, with Bloomberg Economics estimating a 40% drop in GDP, severely affecting its agricultural sector.

Similarly, China, facing trade embargoes and loss of access to advanced technologies, would see a 16.7% decline in GDP. Such economic downturns would decrease both countries' agricultural output, exacerbating global food shortages. It could create another Black-Swan event!

A sustained conflict would lead to long-term uncertainties. The U.S. agricultural sector, already strained by trade tensions, would face challenges in meeting demand amidst global supply chain disruptions.

The uncertainty and disruption caused by war would lead to significant fluctuations in agricultural commodity prices. A sharp fall in global economic growth would be very negative for demand and ag prices for at least a brief period.

A conflict involving China, Taiwan, and the U.S. would exacerbate global food security issues. Many countries, particularly in Asia, rely heavily on agricultural imports from these regions.

The disruption of trade routes and decreased agricultural productivity would lead to food shortages and increased prices, disproportionately affecting poorer nations. Humanitarian crises could emerge, requiring international intervention and aid.

The long-term economic consequences of a China-Taiwan war would be profound. According to Bloomberg, a yearlong blockade of Taiwan could reduce global GDP by 5%.

Image credit: X @MichaelAArouet

The agricultural sector, deeply interconnected with global economic health, would not be immune. Reduced productivity disrupted trade routes, and increased costs would create lasting challenges for farmers, consumers, and governments worldwide.

Over time, the economic fallout would exacerbate food security issues and create long-term challenges for the global agricultural sector. The potential for such a conflict underscores the need for diplomatic efforts to maintain stability and prevent catastrophic disruptions to the global food supply.

The biggest shock could be a semiconductor one as Taiwan Semiconductor is one of the largest manufactures of Nvidia’s AI chips.

For daily information and updates on agriculture commodity marketing and price risk management for North American farmers, producers, and agribusiness visit the Farms.com Risk Management Website to subscribe to the program.