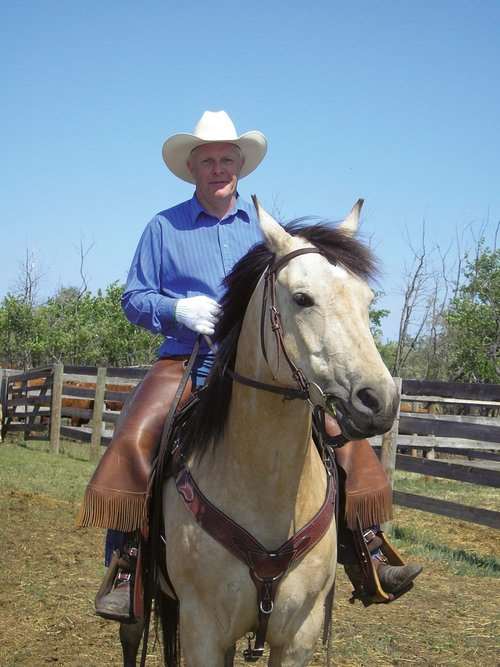

Ted Nibourg discusses land rental agreements and custom rates

By Diego Flammini

Assistant Editor, North American Content

Farms.com

About one million acres of Alberta crops remain unharvested due to early snow in the fall and a wet spring.

And the longer the crops remain unharvested, the more challenges producers face.

When it comes to land rental agreements, crops left in fields could become the responsibility of new tenants.

“The old tenants just couldn’t get that crop off,” Ted Nibourg, a business management specialist with the Ag-Info Centre, told Call of the Land¸ a radio program put on by the Alberta Ministry of Agriculture. “So the new tenant was going to be faced with handling those unharvested acres and some land owners were having to look at discounting some of the rents…”

But if landowners consider burning the fields down to be an option to get the remaining crops off, that responsibility falls on them.

The land owner “really needs to stay in contact with their tenants and understand what they’re doing,” Nibourg said.

Unharvested acres can also pose challenges related to custom rates, says Nibourg.

“As we went into the winter we had some unusual timing of customer requests, (including) combining in February and baling in March,” he said, adding some producers requested vertical tillage equipment to handle rutting.

This year is going to be all about give and take, Nibourg said.

Farms.com has reached out to producers in Alberta to get insight into how they’re managing unharvested crops.