By Alejandro Plastina

Performing custom work can be an additional source of income for farm operators around the state. For others, custom work is a full-time career. When labor is available, and another party has equipment, renting equipment for a short-term is also a common practice. While only a small portion of Iowa farmland is completely custom farmed, many farm operations rent equipment or hire out one or two operations on their farm each year.

The 2020 Iowa Farm Custom Rate Survey canvassed 490 farmers, custom operators, and farm managers from the state, putting together a guide for pricing custom machine work. The survey questionnaire was mailed to 298 people by the US Postal Service and 192 people via email in February 2020.

A total of 106 usable responses, giving 3,022 custom rates were received from Iowa farmers, custom operators, and farm managers. Fourteen percent of the respondents performed custom work, 15% hired work done, 53% indicated doing both, and 18% did not indicate whether they perform or hire custom work.

The publication, which can be found online at the ISU Extension and Outreach Store (FM 1698) or on the Ag Decision Maker website (File A3-10), provides rates for custom work in the following categories: tillage, planting, drilling, seeding, fertilizer application, harvesting, drying and hauling grain, harvesting forages, complete custom farming, labor, and both bin and machine rental. All rates include fuel, repairs, depreciation, interest, labor, and all other machinery costs for the tractor and implement unless otherwise noted.

The average rate and range for each machine work function were compiled into the survey as usual, as well as the median charge and number of responses for each category. The average rate for a work function is calculated as the simple average of all responses for that work function. The median rate is the response that splits all the ordered responses within a work function (from smallest to largest) in half. A newly listed item in 2020 is the extra charge to strip-tillage for simultaneous anhydrous application.

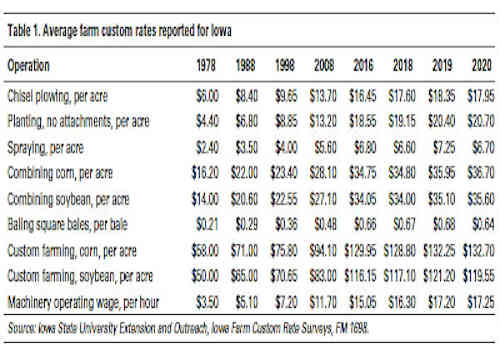

The survey found there was a 3% price decline across all surveyed categories. The change from 2019 to 2020 varied across categories, with complete harvesting and hauling declining by 4%, and bin, machinery rental increasing by 2.3%. Table 1 shows historic rates for a sample of operations from the survey.

Subdued commodity prices, lower fuel prices, and another year of thin profit margins in crop production in the horizon are setting the tone for overall lower expected custom rates in 2020. However, some tasks related to manure management might see some price increases, according to the survey respondents.

The reported rates are expected to be charged or paid in 2020, including fuel and labor. The average price for diesel fuel was assumed to be $2.63 per gallon. The values presented in the survey are intended only as a guide and should not be used as recommended prices by Iowa State University. There are many reasons why the rate charged in a particular situation should be above or below the average. These include the timeliness with which operations are performed, quality and special features of the machine, operator skill, size and shape of fields, number of acres contracted, and the condition of the crop for harvesting. The availability of custom operators in a given area will also affect rates. Any custom rate should cover the cost of operating the farm machinery as well as the operator’s labor.

Source : iastate.edu