By William Loux

One of the top questions the U.S. Dairy Export Council (USDEC) hears whenever we talk with milk producers is: What value do exports hold for U.S. dairy farmers? U.S. dairy export value may have grown by 9% to $6.6 billion in 2020, but what’s the benefit for farmers?

Exports are so important to the U.S. dairy supply chain—from farmers through processors through traders—that we thought it an appropriate topic for National Dairy Month.

What follows is the answer to that No. 1 question: Why are exports essential for U.S. dairy farmers? Over the next few weeks, watch these pages for more answers to farmers’ trade questions.

Essential for balance

U.S. dairy farmers are the best at what they do. To confirm that, you just have to see the growth in U.S. milk production over the last decades with U.S. milk production growing by 15%, or 1.4% per year on average, since 2000.

That increase has been so steady in part because every single year milk production per cow has risen, as farmers have adopted innovative practices in technology, nutrition, genetics and animal care. Indeed, rising productivity isn’t even limited to just more liquid milk per cow. Each hundredweight of milk contains more milkfat, protein and lactose – or milk solids that are used to create the products consumers around the world enjoy.

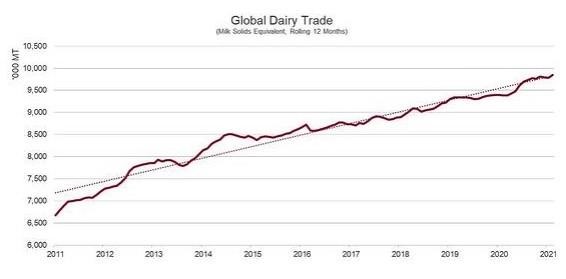

Partially because of those productivity gains, U.S. milk production has been expanding at a faster rate than domestic demand, as you can see on the chart below. This is creating a growing surplus of milk that needs to find a home.

The good news is that exports have filled the gap, ensuring market balance by accounting for over 16 percent of total milk solids production in 2020.

This is a story we’ve told before. But we want to highlight one additional nuance regarding components.

Today, the U.S. is relatively balanced in milkfat, as domestic consumption of milkfat is roughly 97% that of production. Essentially, nearly all the milkfat produced in the U.S. stays in the U.S. That is not the case with skim stream. Domestic consumption of skim solids only accounts for 80% of production.

Put another way, the U.S. cannot be fully balanced in both milkfat and skim solids without either 1) exporting more skim or 2) reducing milk production by 20% to balance out the skim solids, even though that would require importing 20% of total milkfat consumption in the U.S. Essentially, as cows aren’t going to start producing pure cream, we have protein and lactose and other skim solids that need a home.

Essential for growth

As relevant as that argument is, the case for exports is more than just establishing market balance. We at USDEC believe that the best home for the growing milk supply in the United States is the international market – not because we have milk powder, whey and cheese to sell but because customers around the world are demanding more dairy products every year.

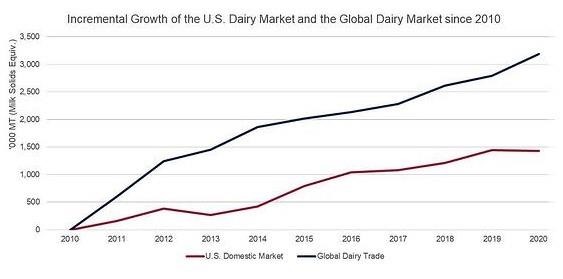

As clearly shown above, many U.S. dairy farmers of all sizes have demonstrated a desire to grow their dairy operations – either through more cows, efficiency gains or often both. In the prior section, we mentioned how this has created a gap between production and domestic consumption today. But as we look towards tomorrow, the international market will become increasingly important for enabling U.S. dairy farmers of all sizes and regions to continue growing.

Simply put, the international market is growing faster than the U.S. domestic market.

Over the past 10 years, global dairy trade grew on average by 3.8% per year on a milk solids equivalent basis. That increase is the equivalent of more than 7 billion pounds of dairy solids or 54 billion pounds of liquid milk! Even a global pandemic failed to slow down international consumers’ appetite for dairy with global dairy trade expanding by 3.9% in 2020, adjusting for leap day.

While we are not ignoring the U.S. domestic market and its importance, exports are increasingly becoming the main driver of growth. Since 2003, over half of all additional milk produced by U.S. farmers has gone to exports. And that figure is growing – an astonishing 75% of the “new milk” produced in 2020 went overseas. Essentially, the international market is crucial to enabling U.S. milk production growth.

But even that impressive fact may undersell the opportunity of the international market. If you look at the chart below where we compare the incremental growth of the U.S. domestic consumption in red and the incremental growth of all the dairy traded internationally in blue, you can see that global dairy markets present a greater opportunity for U.S. dairy to grow.

Looking ahead, we expect global dairy demand to continue its long-term expansion thanks to 96 percent of the world’s population living outside of the U.S. and that global population experiencing rising incomes and a growing appetite for dairy. Seizing the opportunity to increase share in the expanding international market will enable U.S. dairy farmers to grow at a faster pace than if the U.S. relied solely on the domestic market.

Essential for farmers’ milk checks

Finally, exports are essential for dairy farmers across the country, regardless of region or size, because exports support all farmers’ milk check.

Fundamentally, in the Federal Milk Marketing Order system, the milk check is determined by the prices of four products: cheddar cheese, butter, nonfat dry milk (NFDM) and dry whey. Cheddar cheese and dry whey drive Class III prices, and butter and NFDM determine Class IV prices. Those prices also feed into Classes I and II. So, even if a farmer operates in a part of the country where the vast majority of the milk is Class I for fluid milk for domestic consumption, exports are still crucial to that milk check.

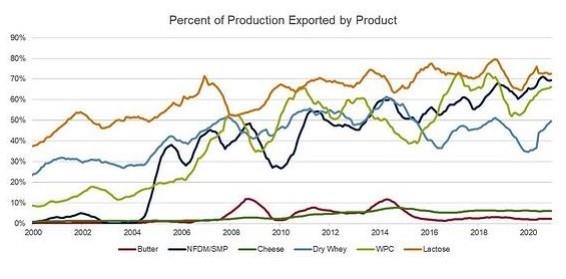

This is because the U.S. exports most of the NFDM and whey we produce. In 2020, we shipped 70% of U.S. NFDM and half of U.S. dry whey overseas. Without international customers, there would be far more milk powder and dry whey in the U.S. market, which would then significantly weigh down U.S. farmgate prices, whether a farmer is in California or Georgia.

Indeed, even when we export the products that don’t feed directly into the formula, it still supports the milk check. Last year, we exported about 70% of the lactose produced in the U.S .and 65% of the whey protein concentrate. If we do not have such export options, we would have much more sweet whey on our hands, which would push down Class III prices.

Click here to see more...