By Joana Colussi and Gary Schnitkey

Department of Agricultural and Consumer Economics

University of Illinois

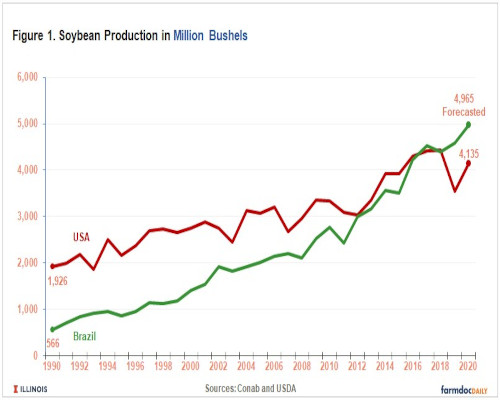

Soybean production in Brazil over the past 30 years has increased almost ninefold, from 566 million bushels for the 1990/91 crop to 4,587 million bushels for the 2020/21 crop, according to data from the National Supply Company (Conab). Harvest is underway, and the forecasts so far are for another record crop in Brazil, despite a dry planting season and excessive rain toward the end of the season. Brazil’s growth in the past three decades results from increases in planted area and increases in yields.

Production in U.S. and Brazil

In the past several years, Brazil has surpassed the United States and has become the largest soybean-producing nation. In the 2020/21 production year, Brazil is projected to produce 4,965 million bushels of soybeans (Conab) while the U.S. produced 4,135 million bushels (USDA).

Brazil’s soybeans exports are 3,049 million bushels valued at $28.6 billion in U.S dollars, ranking second all-time among Brazil’s soybean exports. China purchased 73.2% of Brazilian soybeans exported in 2020, which corresponded to $20.91 billion (Mapa, 2021). The soybean expansion happened within the world context of growth in animal protein consumption. The worldwide market for poultry, pork, and beef has grown significantly in the past decades. That, in turn, drove the increase in the demand for animal feed, normally derived from soybeans and corn.

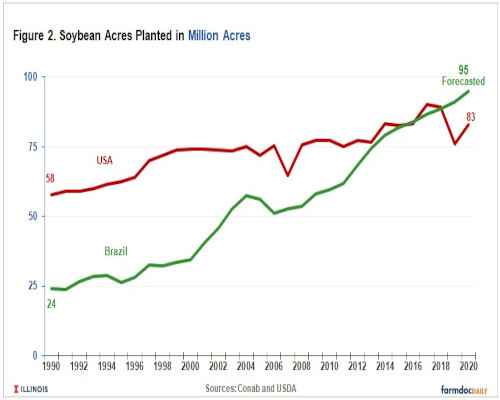

Planted Area

Brazil’s soybean production is directly related to the increase in the planted area over the past 30 years. From 1990/91 to the 2020/21 season, the number of acres planted increased from 24 million acres to 95 million acres, which increased 291%. In the same period, the planted area in the U.S rose 44%, from 58 million acres in 1991 to 83 million acres in 2020 (USDA).

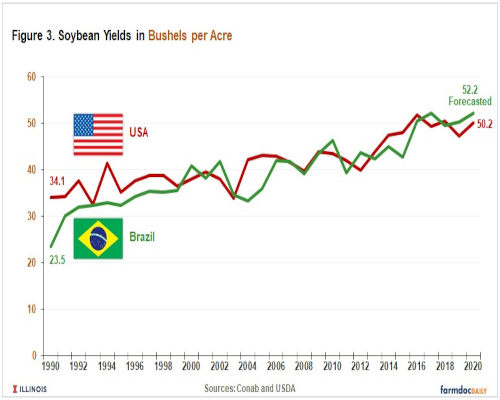

Yields Growth

Similar to the United States, yields have increased in Brazil in the past 30 years. From the 1990/91 season to the 2020/21 season, the average yield increased 121%, from 23.5 bushels per acre to 52.0 bushels per acre. In the same period, the soybean yields in the U.S. rose 47%, from 34.1 bushels per acre in 1991 to 50.2 bushels per acre in 2020, according to USDA (Figure 3).

The growth rate in Brazil results from investments in technology (such as machines, seeds, pesticides, and fertilizers) and the efficiency of scientific research. Over the past decades, several technologies have positively affected yield on a global scale. The next cutting-edge likely is digital technology. Recently, the collective confluence of the Internet of Things (IoT), big data, accessible cloud computing, and advances in artificial intelligence are driving digital transformation (Siebel, 2019). The use of the data in agriculture can contribute to both economic gain and reduction of environmental impact (Sonka, 2016).

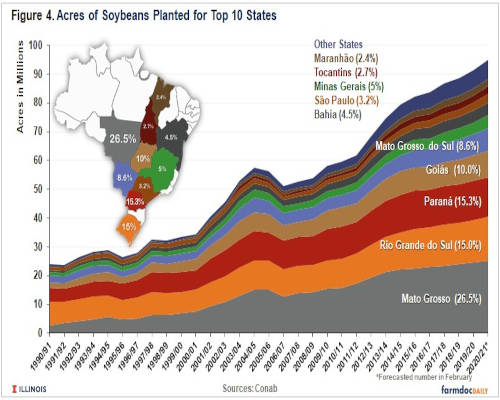

Migration of Soybean Planted Area in Brazil

Figure 4 shows the ten largest states in terms of soybean acres. In 2020/21, Mato Grosso has the most acres with 26.5% of Brazilian acres. Mato Grosso is in the Midwest region of Brazil. In terms of acres, the second and third states were the Rio Grande do Sul with 15.7% and Paraná with 14.6%. Rio Grande do Sul and Paraná are southern states.

While acres have expanded in most states, there has been a migration in production share from the southern states to Midwest states. Acres in Mato Grosso — a Midwest state — grew from 2 million acres in 1990/92 to 25 million acres in 2020/21. Mato Grosso’s percent of Brazilian acres grew from 10.3% in 1990/91 to 26.5% in 2020/21. Acres also grew in the southern states but not as fast as in Mato Grosso. In Rio Grande do Sul – a southern state — acres grew from 8 million acres in 1990/92 to 15 million acres in 2020/21, an almost doubling of acres. While acres grew, Rio Grande do Sul share of Brazilian acres declined from 33.6% in 1990/91 to 15.0% in 2020/21. Similarly, Paraná acres increased from 5 million acres in 1990/91 to 14 million acres in 2020/21, which is more than doubling acres. In this southern state, Paraná’ percent of Brazilian acres declined from 20.2% in 1990/91 to 15.3% in 2020/21.

The majority of the future expansion of Brazilian soybean acres likely will occur in the Midwest, North, and Northeast of Brazil (see Figure 4). Farmers looking for larger areas to farm tend to move to the agricultural frontiers, such as Matopiba (a region formed by four Brazilian states: Maranhão, Tocantins, Piauí, and Bahia). Most of the recent land cultivation in this region has occurred through highly mechanized and professional operations, a stark contrast with the historical patterns of agricultural frontiers in Brazil.

Farmers were able to plant in the Midwest and Northern states of Brazil because of the development of seeds suited to the particular climates. Great strides have been made in growing in the savanna, a vegetation type that grows under hot, seasonally dry climatic conditions. The variation in land prices also stimulated migration to new frontiers. In the 1990s, for example, land in the North or Northeast was ten times less expensive than in the South. Another factor was the availability of credit in this period, public and private, to buy agricultural land (Embrapa, 2017).

Summary

Soybean production continues to grow in Brazil. While soybean production has expanded in traditional Brazilian production areas, acres have greatly expanded in the Midwest regions, with prospects of continued expansion in the Midwest and Northern states. Yields also have increased in Brazil and are now equivalent to national yields in the United States.

Source : illinois.edu