How Much Do StatsCan Numbers Matter?

Even casual market observers have noticed the extraordinary performance in most pulse markets so far in 2015/16. Lentil prices are spiking while yellow pea prices are close to record levels and moving higher. Even chickpeas have shown signs of life. Prices for dry beans are the only ones that aren’t doing much these days. Normally, we watch the “final” StatsCan production estimates closely for possible reactions but in this hot market, we wonder if these numbers will have much, if any, influence.

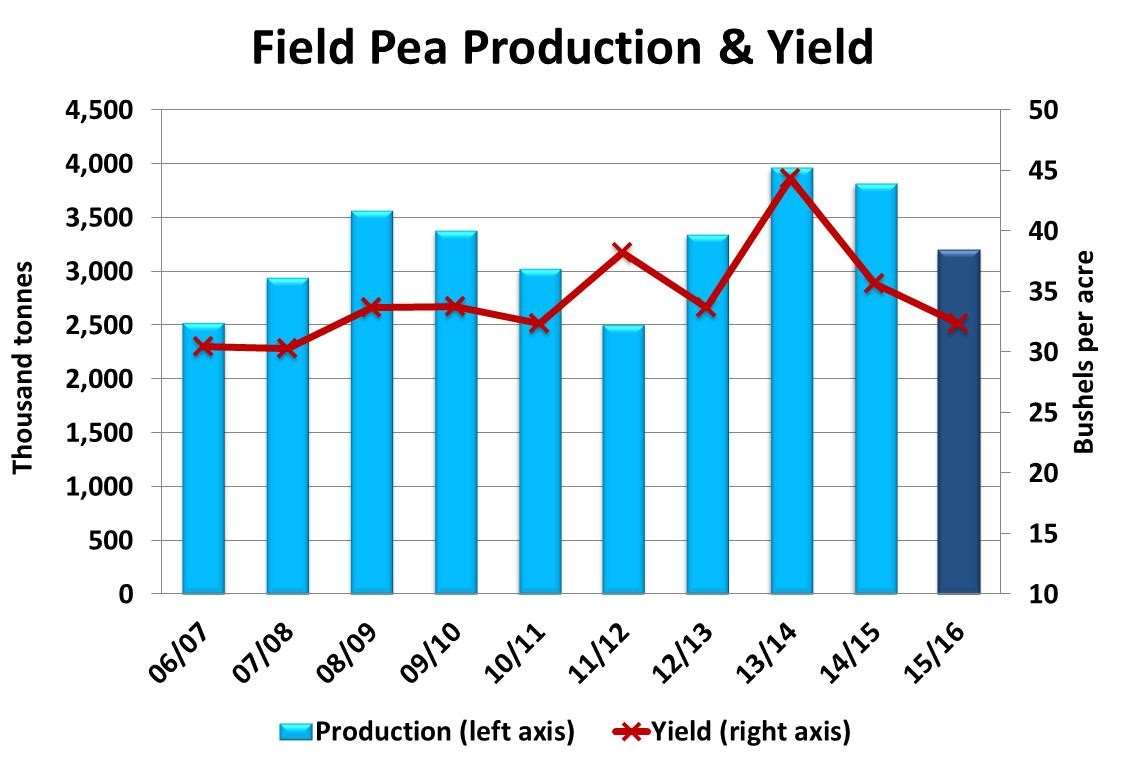

For peas, StatsCan pegged the crop at 3.2 million tonnes. That’s 16% less than last year, but 50,000 tonnes more than StatsCan’s October estimate. While there are probably more peas out there than reported to StatsCan, this production number was quite close to the average trade guess, so no one’s too surprised. We had expected green pea production would decline more than yellows but the StatsCan numbers showed both dropped about the same amount, which won’t help reduce heavy green pea supplies.

Normally, when a crop estimate is smaller, that’s considered bullish but yellow pea prices are already trending higher so this number may not get noticed much. Overseas demand is so strong that an extra 50,000 tonnes (or more) will be chewed through in a hurry. Based on the export pace so far, there won’t be many yellow peas left at the end of the year, even if the StatsCan number is understated. For green peas however, supplies are heavier and the possibility that the 2015 crop is bigger than expected will keep green pea prices from following yellows higher.

When it comes to lentils, the overall crop was 2.37 million tonnes. That’s 200,000 tonnes more than StatsCan’s October estimate and slightly above what most traders were expecting. And just like peas, more lentils were likely grown than what was reported to StatsCan. According to StatsCan, each of the various classes of lentils increased by the same percent, so no surprises there.

Demand for all classes of lentils has been exceptionally strong in the first few months of 2015/16. In October alone, Canada exported 628,000 tonnes of lentils. This type of movement means that even though the StatsCan estimate was larger than expected, those extra tonnes will all be exported and won’t add any pressure to prices.

The 2015 chickpea crop was already expected to be considerably smaller than the previous year and the latest estimate from StatsCan of 90,000 tonnes (including some in Alberta) means there’s even fewer chickpeas available. The one knock on chickpeas had been the heavy supplies carried over from previous years, but now that chickpea exports are finally moving at the stronger pace, the smaller crop now means the stockpiles are shrinking. In this case, the StatsCan number may actually provide additional support for chickpea prices.

For dry beans, StatsCan estimates are a little patchy because of small sample sizes in some provinces. Once all of the blanks are filled in, 2015 dry bean output in Canada (just like the US) is close to last year’s crop. The official numbers won’t have much effect on the market.

In all cases, markets have already been dealing with actual supplies of crops which means the current price behaviour is actually a better indicator of crop size than the official numbers. That’s why in most cases, the StatsCan estimates are viewed with interest but ultimately won’t change the direction of the market.

Source : AlbertaPulse