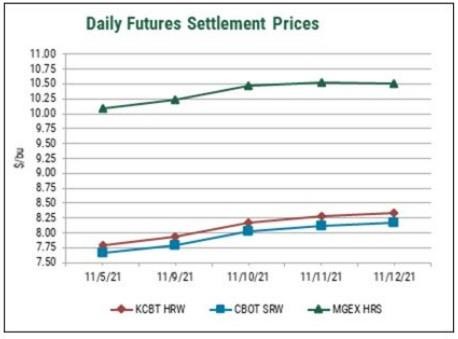

Wheat futures roared back this week with all futures ending higher on Friday. CBOT soft red winter (SRW) futures gained 51 cents to $8.17/bu. KCBT hard red winter (HRW) futures were up 55 cents to end at $8.33/bu. MGE hard red spring (HRS) futures gained 41 cents to close at $10.50/bu. CBOT corn futures were up 24 cents to $5.77/bu. CBOT soybean futures rose 42 cents to close at $12.34/bu.

· High futures prices continued to pressure basis in both the Gulf and Pacific Northwest (PNW) this week. Slow export demand is leaving little room for basis to go higher.

· U.S. Wheat Associates (USW) will not publish a Price Report on Friday, November 26th in observance of Thanksgiving in the United States.

· According to USDA, U.S. farmers have planted 91% of the total intended winter wheat area for harvest in 2022, even with the 5-year average. As of November 7, 74% of the country's winter wheat had emerged.

Commercial Sales

· Net U.S. wheat commercial sales of 285,900 metric tons (MT) for the week ending on November 4 for delivery in 2021/22 were down 29% from last week's 400,100 (MT) and within trade expectations of 200,000 MT to 500,000 MT. Year-to-date commercial sales for delivery in 2021/22 total 13.3 million metric tons (MMT), 22% lower than last year at the same time. USDA expects 2021/ 22 U.S. wheat exports will reach 23.4 MMT, 13% lower than last year if realized.

U.S. Drought Monitor

• Much of the wheat-growing portion of the U.S. was dry this week, with small pockets of rainfall in south-central Kansas and western South Dakota. Temperatures in those areas were above normal, too, with the Dakotas recording 6° to 10° F above normal. In the PNW, below normal temperatures and heavy precipitation improved conditions for Oregon and Washington. Eastern Montana remained dry while some improvements to drought were noticed in western Montana.

• This week, Russia’s agriculture minister said the government is considering revising its formula for calculating the export tax on wheat. The tax is intended to stabilize domestic flour and wheat prices. Inflation this year hit a 5-year high. The government expects to implement an export quota on wheat during the second half of the marketing year, starting in mid-February. The exportable volume will be determined by the volume of wheat left from the total export potential, minus the amount exported through July-January reported AgriCensus. The USDA this week increased Russian wheat exports by 1.0 MMT to 36.0 MMT. Russia exported its lowest wheat volume in five years during October, down 30% year-on-year. The government updated the wheat tax for the November 17-23 period to $77.70/MT, a $10.30 increase week-over-week.

• Ukraine’s grain exports are running at a fast pace this year, up 17% compared to last year. Wheat exports are up nearly 2 MMT year-on-year and are more than 50% of the export limit of 24.5 MMT agreed between grain traders and government officials. USDA this month estimated Ukraine’s wheat exports will total 24 MMT, up nearly 8 MMT compared to last year.

• FranceAgriMer lowered its forecast for French soft (non-durum) wheat exports in the 2021/22 season as wheat prices rally and international competition limits exports. The analyst now forecasts France, the largest wheat producer in the European Union (EU), to export 9.4 MMT, down 200,000 MT from October. This month, the USDA forecast EU wheat exports to increase 23% compared to 2020/21. French wheat prices hit a record both Wednesday and again Thursday, peaking at $339.39/MT, the highest in 14 years.

Click here to see more...