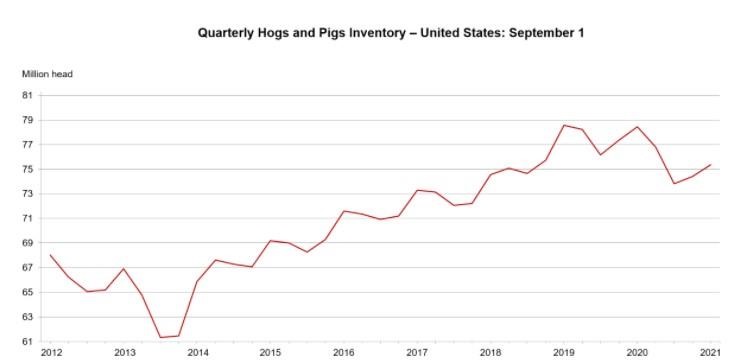

As of Sept. 1, there were 75.4 million hogs and pigs on U.S. farms, down 4% from September 2020 but up 1% from June 1, 2021, according to the Quarterly Hogs and Pigs report published today by the U.S. Department of Agriculture’s National Agricultural Statistics Service (NASS).

Other key findings in the report were:

- Of the 75.4 million hogs and pigs, 69.2 million were market hogs, while 6.19 million were kept for breeding.

- Between June and August 2021, 33.9 million pigs were weaned on U.S. farms, down 6% from the same time period one year earlier.

- From June through August 2021, U.S. hog and pig producers weaned an average of 11.13 pigs per litter.

- U.S. hog producers intend to have 3.00 million sows farrow between September and November 2021, and 2.96 million sows farrow between December and February 2022.

- Iowa hog producers accounted for the largest inventory among the states, at 24.4 million head. Minnesota had the second largest inventory at 9.00 million head. North Carolina was third with 8.30 million head.

Source : usda.gov