December Hogs and Pigs Report: Breeding Inventory Slightly Higher than a Year Ago; Fourth-Quarter Litter Rate Up Strongly.

The Quarterly Hogs and Pigs report released by USDA on December 28th told pork industry observers two important things about the direction of hog production in 2013: first, that U.S. breeding inventories have not declined, despite very high feed costs; and secondly, that U.S. litter rates have not yet topped out. Relatively strong fourth-quarter 2012 litter rate gains could well extend into 2013.The report estimated the December 1st inventory of all hogs and pigs to be down fractionally from a year earlier: -0.02 percent. The inventory of market animals declined slightly (-0.04 percent). However, the inventory of breeding animals was slightly higher than a year earlier by 15,000 head. In the current market environment of high feed costs, the breeding herd could have been expected to decline; the fact that it did not suggests that pork producers are assuming that high feed costs are temporary, and that pork demand in 2013 will continue strong. Even in light of USDA’s Grain Stocks report, released on January 11, hog producers’ apparent assumptions are supported by calculated spreads between live hog prices and feed costs based on USDA price forecasts for 2013. These calculations show a negative spread in the first quarter of 2013, followed by positive spreads for the remaining three quarters of the year. Spreads calculated with current futures market prices show positive quarterly spreads between lean hog prices and feed costs for all quarters of 2013 and for the first two quarters of 2014. It is likely that the stable to slightly higher December inventory of breeding animals reflects producer expectations for lower feed costs—from higher expected 2013 corn production in particular—and for higher average hog prices in 2013, bolstered by declining beef production.

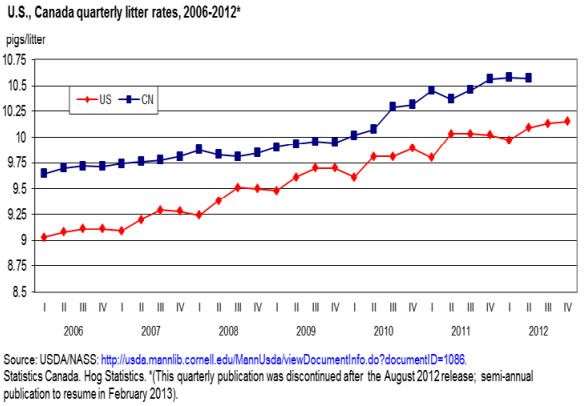

Litter rates for the September-November (fourth) quarter were record-high: 10.15 pigs per litter (ppl). While causal factors are difficult to pinpoint, increases in litter rates likely derive from continued producer adoption of improved genetics, animal handling technology, and enhanced barn management practices. What all this likely means, is that producers are more willing to save pigs that would have died in the past.

A question frequently asked is: How high can litter rates go? Another is: Are U.S. rates reaching their maximum? Given that genetics, technology, and management practices are continually changing, it is probably safe to say that litter rates have not topped out. Even with the current technology and management—which is largely transferable among countries—litter rates in other countries are ahead of those in the United States. Canadian litter rates, in particular, show that there is still room for growth in the United States.

The figure below shows recent quarterly litter rates of the United States and Canada. For the period 2006-2012, the average litter rate for the United States was 9.59 ppl. For Canada, between 2006 and the second quarter of 2012, the average litter rate was 10.02 ppl, a difference of less than half a pig. Part of the difference may be attributable to more favorable climatic conditions, and the ability to space operations at greater distances than in the United States (as in the prairie provinces—Manitoba, in particular, where litter rates have been +11 ppl since early 2011).Differences in labor markets, work rules, and management practices might also account for some of the productivity difference.

Given producer farrowing intentions indicated in the December report, together with expectations for continued growth in pigs per litter, slightly higher pork production is forecast in 2013. Stronger litter rates are expected to more than offset any year-over-year farrowing reductions. A small increase in the 2013 pig crop will most likely lead to slightly higher slaughter, which is expected to more than offset small reductions in year-over-year estimates for average dressed weights. U.S. pork production in 2013 is thus expected to be minimally higher than in 2012: almost 23.3 billion pounds, up less than 1 percent from 2012.

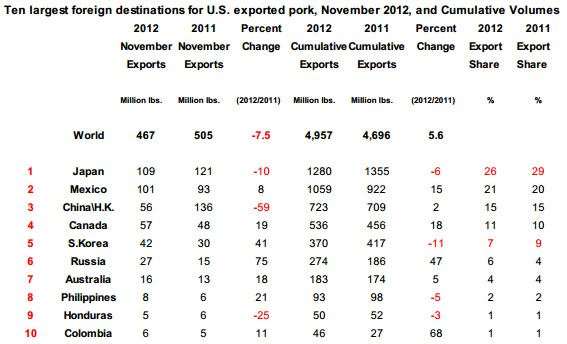

November Exports Lower than a Year Ago

Almost 467 million pounds of U.S. pork were exported in November, a quantity 7.5 percent below November 2011. A table of the 10 largest foreign destinations for U.S. pork products for the January-November 2012 period is listed below. As the table suggests, lower shipments to Japan and China in November largely account for the year-over-year decline. With respect to Japan, Japanese Government data indicates that imports of pork and beef from all sources were lower in November. Part of the reason for lower red meat imports was likely the sharp depreciation of the Japanese yen that began in October.

When exchange rates depreciate, imported goods tend to become more expensive in local currency terms. Analysis from Oxford Economics notes that the Japanese economy had slipped back into recession in the third quarter of 2012 and is expected to grow at a rate of less than 1 percent in 2013.

Source: USDA