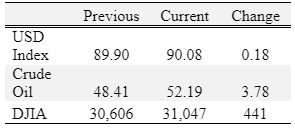

Overview

?Corn, cotton, and soybeans were up and wheat was mixed for the week.

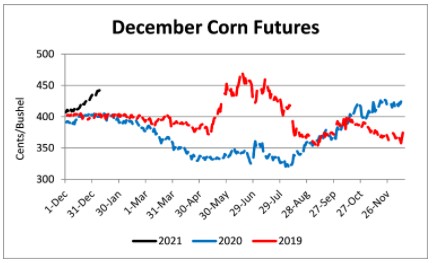

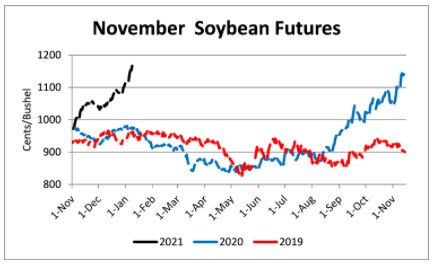

March corn futures breached $5.00 this week, up 52% ($1.71 ¼) since August 12. March soybean futures closed the week at $13.74 ¾, up 55% ($4.48 ½) since August 12. Nearby futures prices are now at their highest level since 2014. The upward trend remains well intact with new highs being set almost every week. The high futures prices and strong basis across Tennessee have likely caused many producers to sell most (or all) of the remaining crop in storage (a prudent decision given where prices were just 5 months ago). A few will continue to wait to see how high prices will go before selling the remainder of the crop, accepting the associated risk (a riskier move with potentially greater payoffs).

Looking forward many producers will consider starting or increasing 2021 crop pricing. December 2021 corn is at $4.40 and soybeans are $11.60, very strong price offerings compared to 2015-2020 new crop prices at the same time of the year, when prices only occasionally exceed $4 for corn and $10 for soybeans. While starting to price the crop is recommended producers should caution themselves not to sell their way out of this rally. Pricing more than 50% of production before planting may limit a producers ability to take advantage of additional rallies, particularly if on farm storage post-harvest is an option. An incremental approach to pricing into this rally should be considered with clearly defined stops based on the producers comfort level with pricing production based on the time of the year.

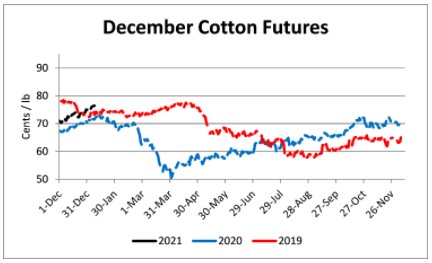

80 cent cotton was not what was predicted based on current global supply and demand fundamentals, but the market broke through that barrier this week. The trend that started back in early April remains in place. New crop cotton futures have rallied along with grains and oilseeds pushing the December contract over 76 cents. While substantially improved, it is unlikely that current cotton prices will attract acres over corn and soybeans. In Tennessee, cotton acres will likely be limited to those with existing investment in cotton infrastructure and harvest equipment.

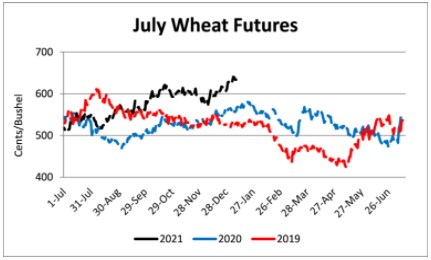

Wheat prices have benefitted from the rally in corn and soybeans. However, unlike corn and soybeans, wheat prices do not have the same tailwinds of tight global stocks and production concerns in Brazil (Brazil typically imports wheat). There are wheat production concerns in Argentina and the US plains. However, wheat is far more diversified in terms of production regions than corn or soybeans (wheat is grown on almost every continent and in both hemispheres). This reduces the chance of large scale production failures compared to crops with greater concentration of production.

Corn

Ethanol production for the week ending January 1 was 0.935 million barrels per day, up 1,000 barrels from the previous week. Ethanol stocks were 23.284 million barrels, down 0.220 million barrels compared to last week. Corn net sales reported by exporters for December 25-31 were down compared to last week with net sales of 29.5 million bushels for the 2020/21 marketing year. Exports for the same time period were down 23% from last week at 40.5 million bushels. Corn export sales and commitments were 65% of the USDA estimated total exports for the 2020/21 marketing year (September 1 to August 31) compared to the previous 5-year average of 53%. Across Tennessee, average corn basis (cash price-nearby futures price) strengthened at Northwest, North-Central, Mississippi River, West-Central, and West elevators and barge points. Overall, basis for the week ranged from 5 over to 40 over, with an average of 23 over the March futures. March 2021 corn futures closed at $4.96, up 12 cents since last Friday. For the week, March 2021 corn futures traded between $4.79 and $5.02. Mar/May and Mar/Dec future spreads were 1 and -56 cents. May 2021 corn futures closed at $4.97, up 14 cents since last Friday.

Corn | Mar 21 | Change | Dec 21 | Change |

Price | $4.96 | $0.12 | $4.40 | $0.06 |

Support | $4.89 | $0.33 | $4.36 | $0.10 |

Resistance | $5.03 | $0.13 | $4.45 | $0.08 |

20 Day MA | $4.55 | $0.17 | $4.25 | $0.08 |

50 Day MA | $4.34 | $0.07 | $4.11 | $0.04 |

100 Day MA | $4.09 | $0.08 | $4.00 | $0.04 |

4-Week High | $4.02 | -$0.83 | $4.44 | $0.08 |

4-Week Low | $4.18 | $0.04 | $4.07 | $0.03 |

Technical Trend | Up | = | Up | = |

December 2021 corn futures closed at $4.40, up 6 cents since last Friday. Downside price protection could be obtained by purchasing a $4.50 December 2021 Put Option costing 48 cents establishing a $4.00 futures floor.

Soybeans

Net sales reported by exporters were down compared to last week with net sales of 1.4 million bushels for the 2020/21 marketing year –a marketing year low-- and 2.9 million bushels for the 2021/22 marketing year. Exports for the same period were down 24% compared to last week at 68.2 million bushels. Soybean export sales and commitments were 91% of the USDA estimated total annual exports for the 2020/21 marketing year (September 1 to August 31), compared to the previous 5-year average of 73%. Across Tennessee, average soybean basis strengthened at West-Central, Mississippi River, West, North-Central, and Northwest elevators and barge points. Basis ranged from 1 under to 40 over the March futures contract. Average basis at the end of the week was 24 over the March futures contract. March 2021 soybean futures closed at $13.74, up 63 cents since last Friday. For the week, March 2021 soybean futures traded between $13.01 and $13.86. Mar/May and Mar/Nov future spreads were -3 and -213 cents. May 2021 soybean futures closed at $13.71, up 65 cents since last Friday. March 2021 soybean-to-corn price ratio was 2.77 at the end of the week.

Soybeans | Mar 21 | Change | Nov 21 | Change |

Price | $13.74 | $0.63 | $11.61 | $0.50 |

Support | $13.32 | $0.63 | $11.37 | $0.52 |

Resistance | $14.07 | $0.86 | $11.81 | $0.66 |

20 Day MA | $12.62 | $0.47 | $10.95 | $0.25 |

50 Day MA | $11.87 | $0.29 | $10.53 | $0.16 |

100 Day MA | $10.94 | $0.23 | $10.05 | $0.12 |

4-Week High | $13.86 | $0.66 | $11.69 | $0.51 |

4-Week Low | $11.50 | $0.07 | $10.39 | $0.17 |

Technical Trend | Up | = | Up | = |

November 2021 soybean futures closed at $11.61, up 50 cents since last Friday. Downside price protection could be achieved by purchasing an $11.80 November 2021 Put Option which would cost 104 cents and set a $10.76 futures floor. Nov/Dec 2021 soybean-to-corn price ratio was 2.64 at the end of the week.

Cotton

Net sales reported by exporters were down compared to last week with net sales of 153,100 bales for the 2020/21 marketing year. Exports for the same time period were down 2% compared to last week at 270,000 bales. Upland cotton export sales were 79% of the USDA estimated total annual exports for the 2020/21 marketing year (August 1 to July 31), compared to the previous 5-year average of 73%. Delta upland cotton spot price quotes for January 7 were 77.26 cents/lb (41-4-34) and 79.51 cents/lb (31-3-35). Adjusted World Price (AWP) increased 2.22 cents to 65.25 cents. March 2021 cotton futures closed at 79.77, up 1.65 cents since last Friday. For the week, March 2021 cotton futures traded between 78.25 and 80.93 cents. Mar/May and Mar/Dec cotton futures spreads were 0.78 cents and -3.58 cents. May 2021 cotton futures closed at 80.55 cents, up 1.85 cents since last Friday.

Cotton | Mar 21 | Change | Dec 21 | Change |

Price | 79.77 | 1.65 | 76.19 | 1.32 |

Support | 79.06 | 1.97 | 75.64 | 1.21 |

Resistance | 80.74 | 1.83 | 77.12 | 1.65 |

20 Day MA | 76.94 | 1.94 | 74.09 | 1.26 |

50 Day MA | 73.75 | 0.75 | 71.71 | 0.54 |

100 Day MA | 70.63 | 0.80 | 69.21 | 0.62 |

4-Week High | 80.93 | 2.54 | 76.89 | 1.64 |

4-Week Low | 71.86 | 0.79 | 70.90 | 0.71 |

Technical Trend | Up | = | Up | = |

December 2021 cotton futures closed at 76.19 cents, up 1.32 cents since last Friday. Downside price protection could be obtained by purchasing a 77 cent December 2021 Put Option costing 6.16 cents establishing a 70.84 cent futures floor.

Wheat

Wheat net sales reported by exporters were down compared to last week with net sales of 10.1 million bushels for the 2020/21 marketing year and 0.2 million bushels for 2021/22 marketing year. Exports for the same time period were down 4% from last week at 15.4 million bushels. Wheat export sales were 78% of the USDA estimated total annual exports for the 2020/21 marketing year (June 1 to May 31), compared to the previous 5-year average of 79%. March 2021 wheat futures closed at $6.38, down 2 cents since last Friday. March 2021 wheat futures traded between $6.34 and $6.64 this week. March wheat-to-corn price ratio was 1.29. Mar/May and Mar/Jul future spreads were 2 and -7 cents. May 2021 wheat futures closed at $6.40, up 1 cent since last Friday.

Wheat | Mar 21 | Change | Jul 21 | Change |

Price | $6.38 | -$0.02 | $6.31 | $0.03 |

Support | $6.25 | $0.22 | $6.18 | $0.18 |

Resistance | $6.56 | -$0.06 | $6.45 | $0.03 |

20 Day MA | $6.22 | $0.17 | $6.14 | $0.13 |

50 Day MA | $6.08 | $0.02 | $6.04 | $0.02 |

100 Day MA | $5.91 | $0.06 | $5.89 | $0.05 |

4-Week High | $6.64 | $0.20 | $6.46 | $0.17 |

4-Week Low | $5.67 | $0.02 | $5.71 | $0.01 |

Technical Trend | Up | = | Up | = |

In Tennessee, new crop wheat cash contracts ranged from $6.16 to $6.54. July 2021 wheat futures closed at $6.31, up 3 cents since last Friday. Downside price protection could be obtained by purchasing a $6.40 July 2021 Put Option costing 54 cents establishing a $5.86 futures floor.

Source : tennessee.edu