By Faith Parum

Trade is a hot topic with a lot of uncertainty. Trade policy decisions made in Washington, D.C., will impact farmers and ranchers in the countryside. This Market Intel is part of a series exploring agricultural trade, including the potential impacts of trade policy changes.

International trade has long been a lifeline for American agriculture, providing markets for surplus production and supporting millions of jobs across the economy. For decades, China stood at the center of that story, purchasing tens of billions of dollars in U.S. farm goods and emerging as the largest buyer of American soybeans.

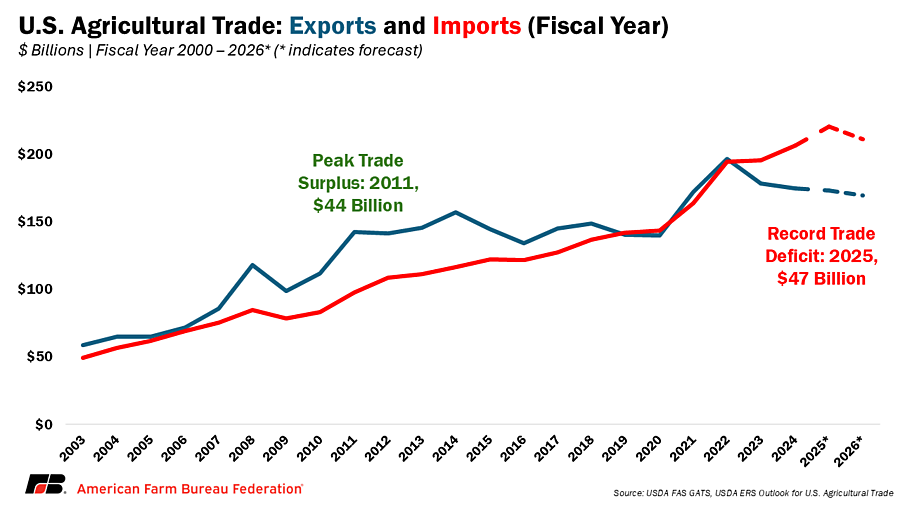

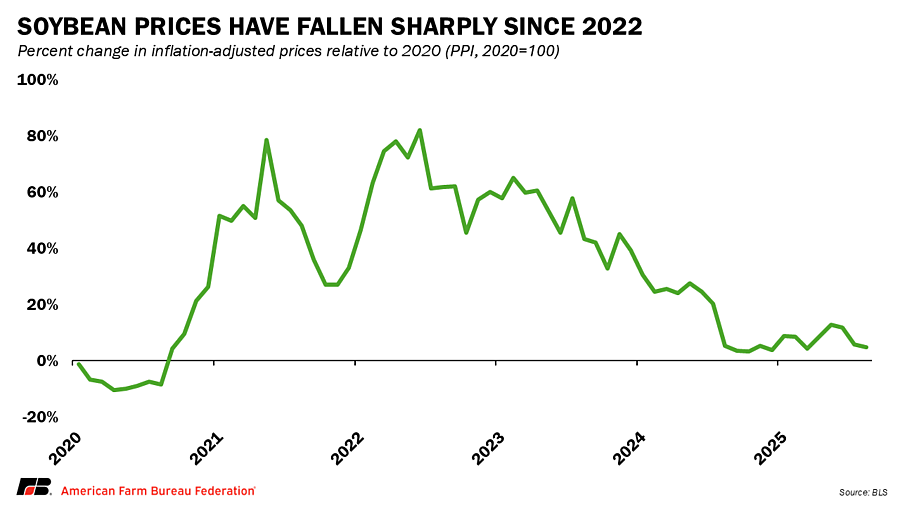

But the trend over the past decade says times are changing. Even when U.S. farmers produce crops that are priced competitively, China has steadily reduced its reliance on the United States, turning instead to Brazil, Argentina and other suppliers. The slowdown of sales in 2025 is not an isolated event: it is part of a longer trajectory in which China is diversifying away from American agriculture. For U.S. farmers, this shift has meant fewer sales, a growing agricultural trade deficit and greater uncertainty about the future role of China as a market for American agriculture.

China and Soybeans: A Shrinking Market

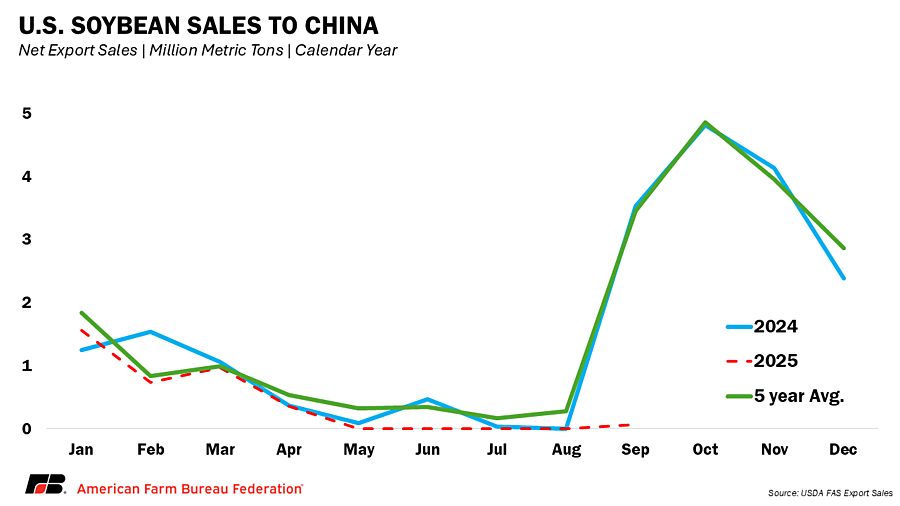

Soybean markets have become the clearest signal of stress in U.S. agricultural trade. From January through August 2025, U.S. soybean exports to China totaled just 218 million bushels, down sharply from 985 million bushels in 2024, when China purchased about half of all U.S. soybean exports. During June, July and August, the U.S. shipped virtually no soybeans to China and China has not purchased any new-crop soybeans for the upcoming marketing year.

By comparison, Brazil exported about 2.5 billion bushels of soybeans to China over the same period, underscoring how South America has stepped in to dominate the market and displace U.S. farmers. Argentina also sought to boost sales by briefly removing its soybean export tax, only to reinstate it days later after export revenues hit a $7 billion threshold. China’s soybean imports are not shrinking; in fact, they have reached record levels, but the bulk of that demand is now being met by competitors. The ripple effects of trade tensions are showing up in crop markets. Ample global supplies and weaker export demand are weighing heavily on prices for U.S. corn, soybeans, and wheat, cutting into farm revenues despite strong harvests. This is compounded by low water levels in the Mississippi River that is increasing transportation costs.

Click here to see more...