By Gary Schnitkey and Jonathan Coppess

Department of Agricultural and Consumer Economics

University of Illinois

Carl Zulauf

Department of Agricultural, Environmental and Development Economics

Ohio State University

Farmland prices have increased by large amounts over last year’s prices. Even given these increases, farmland prices still are near levels suggested by the historical relationship between farmland prices, farmland returns, and interest rates. Significant declines in farmland prices could occur if 1) commodity prices fall from current expectations or 2) interest rates increase because of Federal Reserve Bank (FED) actions to fight inflation.

Farmland Price Increases in 2022

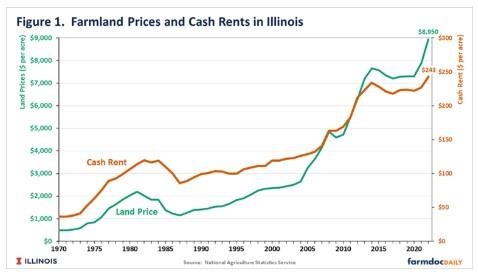

The National Agricultural Statistics Service released land values and cash rents for states in the U.S. For 2022, average Illinois cropland prices are estimated at $8,950 per acre, a record level 13% higher than the 2021 level of $7,900 per acre (see Figure 1). The last time Illinois land values increased by more than 13% was in consecutive years in 2011 (16% increase), 2012 (15%), and 2013 (14%). Since 1970, land values have increased more than the 2022 increase in 19% of the years, suggesting that the increase in 2022 is high but also is not a unique event.

Other studies confirm rising land prices in the Midwest. The Chicago Fed’s AgLetter indicates land values in the northern 2/3 counties of Illinois increased by 18% between the second quarter of 2021 and the second quarter in 2022. A Purdue Agricultural Economics Report indicates Indiana land values increased by over 30% from June 2021 to June 2022. A Farmland Value Benchmark Study prepared by appraisers at Farm Credit Illinois evaluated 20 benchmark farms over the southern 60-counties of Illinois. From July 2021 to July 2022, land values averaged a 28% increase on Farm Credit Illinois’s benchmark farms.

Overall, much of the land price increase appears to have occurred before April 1. The Chicago Fed, for example, indicated that land values in Illinois did not change between April 1 and July 1, 2022. Likewise, most of Indiana’s increase occurred in the last half of 2021 rather than the first six months of 2022.

Factors Impacting Farmland Prices

Most economists believe the price of farmland should equal the discounted sum of all future returns to farmland (see here for more detail). Obviously, returns and discount rates in the future are not known with certainty. Expected future returns are proxied by cash rents, with the presumption that current rent levels provide some indication of future rent levels. Current interest rates are often used to measure discount factors, also under the assumption they represent market expectations for the future. Cash rent levels and interest rates are discussed in the following two sections. The combined effects of the two factors are then evaluated in the “Capitalized Values and Farmland Values” section.

Farmland Returns

Higher cash rents usually lead to higher farmland prices. NASS estimated the average cash rent in Illinois for 2022 at $243 per acre, up by 7% over the 2021 level of $227 per acre (see Figure 1). The $243 rent for 2022 was the highest rent level in the history of Illinois.

Overall, rising and high 2022 cash rents are the result of high returns to farmland caused by:

- high commodity prices in recent years (see farmdoc Daily, August 2, 2022) and

- ad hoc Federal payments from the Market Facilitation Program (MFP), Coronavirus Food Assistance Program (CFAP), Wildfire Hurricane Indemnity Program-Plus (WHIP+), and Economic Relief Program (ERP).

Higher non-land costs also have occurred, but not to levels that offset higher commodity prices and ad hoc Federal payments. Returns for 2023 likely will be positive if corn prices are in the mid-$5 range and soybean prices are in the high-$12 range. At this point, fall 2023 bids are at those levels, suggesting that there will not be downward pressure on cash rents.

Interest Rates

An increase in interest rates generally lowers asset prices, particularly long-lived, non-depreciable assets such as farmland. In addition, higher interest rates increase farm mortgage costs, thereby increasing the costs of acquiring farmland. And higher interest rates correlate with higher returns on alternative investments, making farmland less attractive as an investment.

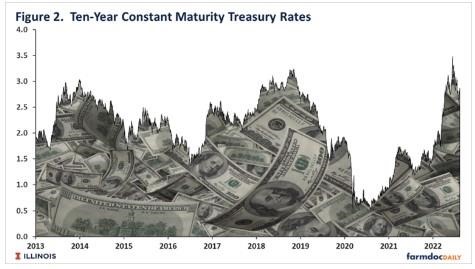

The ten-year Constant Maturity Treasury (CMT) rate is a reasonable proxy for the farmland capitalization rate. The CMT rate has been low since the 2008 financial crisis. From August 2013 to the present, ten-year CMT rates have averaged 2.07% (see Figure 2). Very low rates occurred during 2020 as the Federal Reserve Bank (FED) implemented policies to lower rates to mitigate the economic impacts of the Covid pandemic. Ten-year CMT rates were below 1.5% on some days in June 2020.

In recent months, the FED has made efforts to lower inflation by implementing policies to increase interest rates. As a result, ten-year CMT rates reached 3.31% on June 21. Since June 21, the ten-year rate has declined and is now near 2.70% in early August 2022.

Capitalized Values and Farmland Values

In the past two years, farmland return increases would be expected to increase farmland prices, while interest rate increases would have the opposite impact. Economists often use a capitalization formula to evaluate the combined effects of changes in returns and interest rates. A simple formula often is used as an approximation for the value of farmland:

Capitalized value = cash rent / ten-year CMT rate

Again, this approximation assumes that current cash rents and interest rates represent longer-run expectations into the future. While simple, this formula has worked reasonably well in the past to point at periods when farmland prices appear at odds with fundamental returns and interest rate drivers (see farmdoc daily on August 24, 2012, August 19, 2014, October 20, 2015, December 20, 2016, for previous analyses using this approach). The orange line in Figure 3 shows historic capitalized values calculated using the above formula. The green line shows average farmland prices in Illinois.

When farmland prices are above capitalized values, the fundamental return and interest rate drivers of farmland prices suggest that farmland prices are too high. An extended period with prices well above implied capitalized values occurred in the late-1970s and early-1980s, before farmland prices fell during the agricultural financial crisis. Prices fell from their highs to levels suggested by the simple capitalization formula by the mid-1980s.

Between 1986 through 2006, farmland prices and capitalized values tracked each other closely. Since 2006 however, the capitalized values have been above actual farmland prices. At the beginning of this period, commodity prices rose because of the growing corn use in ethanol. Much of this period also was associated with low and declining interest rates, which market participants may have thought would not last indefinitely. The differences got particularly large in 2020 when the FED pushed interest rates to very low levels. In 2020, the capitalized value was $24,966 per acre, compared to an actual price of $7,300 per acre.

Since 2020, land prices have increased, reaching $8,950 in 2022. Capitalized values have decreased to $9,720, with the decrease caused by higher interest rates. While the difference has narrowed considerably, capitalized values are still above farmland prices.

Outlook

Current farmland price levels do not appear out of line with historical relationships between farmland prices, farmland returns, and interest rates. While concerns of overpriced farmland exist, farmland prices are not likely to have large declines unless either returns fall, or interest rates increase.

Farmland returns could fall, and corn and soybean prices are the most likely cause of those declines. Lower prices could happen, with official USDA and Congressional Budget Office (CBO) forecasts suggesting much lower prices coming in future years (see farmdoc daily, May 31, 2022). Still, prices on Chicago Mercantile Exchange (CME) contracts do not suggest much lower commodity prices in 2023. Continuing increases in non-land costs also could cause farmland returns to decline.

A more likely immediate source of drag on farmland price is higher interest rates. The FED has announced it will attempt to lower inflation by continuing to raise interest rates later this year. Any increase in 10-year CMT rates will place capitalized values below farmland prices. A 3% interest rate for 2022 results in a capitalized value of $8,100 ($243 cash rent / 3% CMT rate), which is $850 per acre below the 2022 price of $8,950. A 5% CMT rate has a capitalized value of $4,860 per acre or almost 50% below the current $8,950 price.

Whether the FED pushes interest rates higher remains to be seen. Even given FED policies, longer termed interest rates may not increase because expectations may be for a relatively short period of FED action on inflation rates. As an example, the 10-year CMT has declined during the first weeks of August even given expectations of rising interest rates. Similarly, farmland prices may not react much even if 10-year CMT rates increase because of expectations of lower rates in the future.

Summary

Farmland prices have risen a great deal in the past year. Still, higher farmland prices appear to be in line with current farmland returns and interest rate levels. Farmland prices could decline in the next year, likely caused by either lower commodity prices or higher interest rates. Higher interest rates seem more possible at this point, but higher interest rates are not a foregone conclusion.

Source : illinois.edu