By Nick Paulson, and Jim Baltz et.al

Department of Agricultural and

Consumer Economics

University of Illinois

Farmland prices in Brazil have increased significantly over the last 3 years, driven by the combination of higher net farm income, low-interest rates, and strong demand from investors. The record appreciation of land has been driven by high commodity prices, robust global demand, and a favorable exchange rate for Brazilian exporters – leading to positive operating margins for corn and soybeans, despite high costs in agriculture. This article presents an overview of farmland prices in Brazil since 2019 and perspectives for the future under an economic scenario with higher interest rates and lower commodities prices.

Price of Land by Use and Occupation

The most significant appreciation in the land market in Brazil occurred in areas used for grain production, followed by sugar cane and coffee, according to the S&P Global Commodity Insights report (see Figure 1). From 2019 to 2022, the average cropland for grain production value increased 128%, from $1,875 to $4,271 per acre. In the same period, the price of sugar cane land rose 94%, from $1,915 to $3,710 per acre, and the coffee land value went up 133%, from $1,514 to $3,534 per acre. The lowest appreciation was in the pasture and planted forest land areas, which increased 61% and 54%, respectively (see Figure 1).

Farmland values follow the growth of Brazil’s Gross Value of Agricultural Production, which reached $235 billion in 2022, the second highest in more than 30 years. According to data from the Brazilian government, crop revenue was $161 billion, and $74 billion from livestock. Soybean, corn, sugarcane, coffee, and cotton typically represent about 80% of crop revenue in Brazil. For 2023, the Gross Value of Agricultural Production is expected to go up at least 6% from the previous year, driven primarily by growth in soybean production, which should reach a record of 5,645 million bushels, according to data from the National Supply Company (Conab).

High Prices of Soybean and Corn Boost Farmland Market

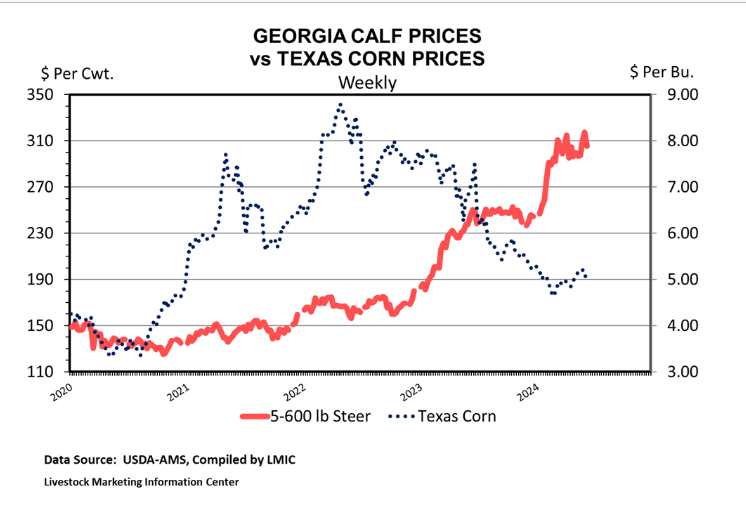

The appreciation of cropland in Brazil in recent years is consistent with the rise in soybean and corn prices in the Brazilian market. From January 2019 to December 2022, the soybean price went up 146%, and the corn price rose 121%, according to data from the Center for Advanced Studies in Applied Economics of “Luiz de Queiroz” College of Agriculture (Cepea/Esalq) at the University of São Paulo (see Figure 2).

Several factors that have driven higher prices in the U.S. have also led to historical levels in Brazil, such as the pandemic in 2020, strong international demand, low ending global stocks, and the Russian invasion of Ukraine in 2022. Depreciation of the Brazilian currency relative to the dollar has also contributed to strong demand and growth among exporters for Brazilian commodities. From January 2019 to December 2022, the Brazilian currency depreciated by about 30% in relation to the dollar (moving from BRL 3.94 to BRL 5.16 per USD).

Soybeans are Brazil’s main agricultural export product, and soybean export revenues increased by 21% in 2022 compared to the previous year. Despite a decline in the volume shipped compared to 2021’s record levels, revenues from soybean exports totaled $47 billion in 2022 versus $39 billion in the previous year, according to the Foreign Trade Secretariat (Secex). Corn exports, which reached a record of 44 million tons, generated revenues of $12 billion, almost triple the amount registered in 2021, when total exports had been affected by drought (see farmdoc daily, March 16, 2023).

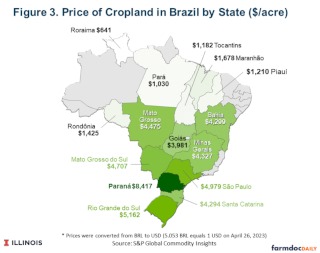

Cropland Prices in Paraná Similar to Illinois

Although farmland prices have increased all over Brazil, the Southern states stand out, with most land prices above the national average. In the South, agriculture is structured in a system of cooperatives providing assistance, storage, processing, and production distribution. In addition, the soil quality and the proximity of ports are other relevant factors that add value to the land in the southern states. Moreover, there is less land to convert from pasture to farmland than in other regions such as in the Northeast. In the state of Paraná, for example, the price went up 188% in the last years, from $2,918 per acre in 2019 to $8,417 per acre in 2022 (see Figure 3).

The cropland prices in Paraná are similar to the average in Illinois, the top soybean producing state in the United States. For 2022, average Illinois cropland prices were estimated at $8,950 per acre, a record level 13% higher than in 2021, according to the National Agricultural Statistics Service (see farmdoc daily, August 16, 2022).

In the state of Mato Grosso, Brazil’s main producer of soybeans and corn, the price of cropland skyrocketed from 2019 to 2022, reaching $4,475 per acre – more than doubling over the three-year period. Another leap happened in the state of Bahia, in the Northeast of Brazil, where the value of the land shot up 183% in the same period, reaching $4,299 per acre. Bahia is part of the Matopiba region, considered the new agricultural frontier in Brazil. Matopiba is formed by the Brazilian state of Tocantins and parts of the states of Maranhão, Piauí, and Bahia (see farmdoc daily, July 12, 2021).

The expansion of soybean production to Matopiba occurred primarily due to the low cost of land compared to the Center-West and the South of Brazil, areas that typically have a better infrastructure. The average cropland prices in Matopiba ($2,092 per acre on average) is roughly one-third of the average cropland value in the South of Brazil ($5,957) and less than half of the average in the Center-West ($4,387). Usually, investors buy cheaper degraded pastureland in Matopiba to improve it and then convert it to grain crops. The terrain there is flat, with productive soil, a favorable climate, and plenty of water for irrigation. However, the biggest challenge is logistical, which in part is being attenuated with the development of ports in the north (see farmdoc daily, January 19, 2022).

Perspectives for the Future

The record increases in cropland values in Brazil in recent years are unlikely to be repeated in 2023. The main limit will come from the prices of corn and soybeans, which are low in the Brazilian market in the face of a record harvest and high cost of transportation. Brazilian soybean port premiums have recently fallen to historical lows due to weak Chinese demand while the country reaches a record crop. The premiums fell to their lowest point in two decades, around $2 per bushel, according to data from Cepea/Esalq at the University of São Paulo.

In addition to the fall in soybean and corn prices, higher interest rates will also tend to hold back the rise in farmland prices in Brazil. Currently, the benchmark SELIC interest rate in Brazil is 13.75% per year, with no signs of a sharp drop in the short term. An increase in interest rates generally lowers asset prices, particularly long-lived, non-depreciable assets such as farmland. In addition, higher interest rates increase farm mortgage costs, thereby increasing the costs of acquiring farmland, and the cost of short-term financing for operations. Higher interest rates also correlate with higher returns on alternative investments, making farmland less attractive as an investment (see farmdoc daily from August 16, 2022).

The fiscal risk associated with the expansion of public spending by the Luiz Inácio Lula da Silva administration, uncertainties about the growth dynamics of the global economy, and lower net operating margins for grains compared to previous years are also likely to constrain the increase in farmland prices in Brazil in the coming years.

Source : illinois.edu