Overview

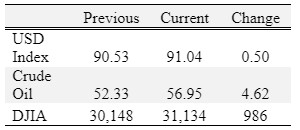

Corn and cotton were up; wheat was down; and soybeans were mixed for the week.

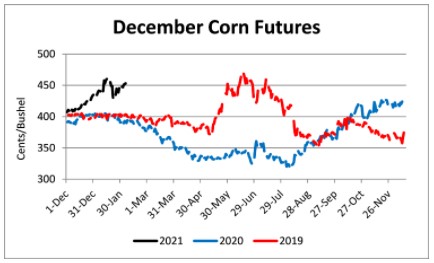

February is the critical crop insurance price determination period for spring planted crops in Tennessee. The projected price will be the average daily close for the harvest futures contract for corn (December), cotton (December), and soybeans (November). As of February 5, the projected prices were: $4.49 for corn, $0.79 for cotton, and $11.55 for soybeans. There is still 3 weeks left in the price determination period so prices will change, but the August-January rally has crop insurance projected prices poised to be at the highest level since 2013 (cotton $0.83; soybeans $12.87) or 2014 (corn $4.62).

In 5 of the last 8 years the December corn price closed February lower than the open. The average change was -4.1 cents with annual changes ranging from -35 to +18.5 cents. November soybean prices closed higher in 4 out of 8 years with an average change of +4.4 cents and a range of -73 to +61 cents. December cotton prices closed higher in 5 out of 8 years with an average change of +0.04 cents and a range of -5.65 to +3.75 cents.

Revenue protection crop insurance protects producer revenue from falling below the revenue guarantee. As such, higher prices, increases the revenue guarantee. For example, a projected price of $4.49 x 170 bu/acre APH x 80% coverage level = $611/acre revenue guarantee. Compared to last year, $3.88 x 170 APH x 80% = $494/acre, this would be a substantial change in the revenue risk faced by Tennessee crop producers for the 2021 crop year. Producers will need to weigh the appropriate buy-up level, premium cost, unit structure, and other crop insurance add-ins when selecting the appropriate crop insurance plan for their operation. Working with a crop insurance agent to identify the best policy for your operation under multiple scenarios is strongly encouraged.

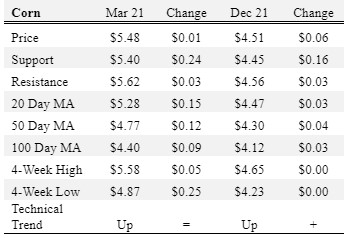

Corn

Ethanol production for the week ending January 29 was 0.936 million barrels per day, up 3,000 barrels from the previous week. Ethanol stocks were 24.316 million barrels, up 0.714 million barrels compared to last week. Corn net sales reported by exporters for January 22-28 were up compared to last week with net sales of 292.8 million bushels for the 2020/21 marketing year –a marketing year high-- and 3.3 million bushels for the 2021/22 marketing year. Exports for the same time period were down 30% from last week at 39.2 million bushels. Corn export sales and commitments were 87% of the USDA estimated total exports for the 2020/21 marketing year (September 1 to August 31) compared to the previous 5-year average of 60%. Across Tennessee, average corn basis (cash price-nearby futures price) weakened at Mississippi River and strengthened or remained unchanged at Northwest, North-Central, West-Central, and West elevators and barge points. Overall, basis for the week ranged from 5 over to 39 over, with an average of 22 over the March futures at elevators and barge points. March 2021 corn futures closed at $5.48, up 1 cent since last Friday. For the week, March 2021 corn futures traded between $5.36 and $5.58. Mar/May and Mar/Dec future spreads were -1 and -97 cents. May 2021 corn futures closed at $5.47, unchanged since last Friday.

December 2021 corn futures closed at $4.51, up 6 cents since last Friday. Downside price protection could be obtained by purchasing a $4.60 December 2021 Put Option costing 48 cents establishing a $4.12 futures floor.

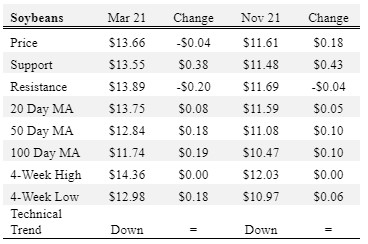

Soybeans

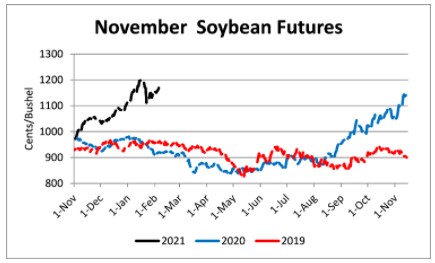

Net sales reported by exporters were down compared to last week with net sales of 30.3 million bushels for the 2020/21 marketing year and 23.3 million bushels for the 2021/22 marketing year. Exports for the same period were down 11% compared to last week at 72.1 million bushels. Soybean export sales and commitments were 97% of the USDA estimated total annual exports for the 2020/21 marketing year (September 1 to August 31), compared to the previous 5-year average of 77%. Across Tennessee, average soybean basis weakened or remained unchanged at West-Central, West, North-Central, and Northwest and strengthened at Mississippi River elevators and barge points. Basis ranged from 5 under to 33 over the March futures contract. Average basis at the end of the week was 18 over the March futures contract. March 2021 soybean futures closed at $13.66, down 4 cents since last Friday. For the week, March 2021 soybean futures traded between $13.41 and $13.83. Mar/May and Mar/Nov future spreads were -1 and -205 cents. May 2021 soybean futures closed at $13.65, down 2 cents since last Friday. March 2021 soybean-to-corn price ratio was 2.49 at the end of the week.

November 2021 soybean futures closed at $11.61, up 18 cents since last Friday. Downside price protection could be achieved by purchasing an $11.80 November 2021 Put Option which would cost 88 cents and set a $10.92 futures floor. Nov/Dec 2021 soybean-to-corn price ratio was 2.57 at the end of the week.

Cotton

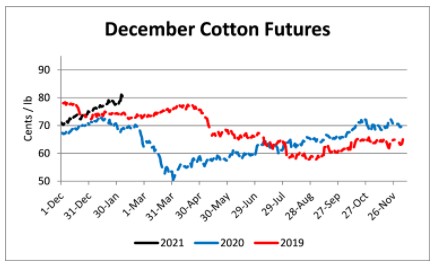

Net sales reported by exporters were down compared to last week with net sales of 286,700 bales for the 2020/21 marketing year and 3,800 bales for the 2021/22 marketing year. Exports for the same time period were up 16% compared to last week at 319,000 bales. Upland cotton export sales were 91% of the USDA estimated total annual exports for the 2020/21 marketing year (August 1 to July 31), compared to the previous 5-year average of 79%. Delta upland cotton spot price quotes for February 4 were 82.28 cents/lb (41-4-34) and 84.53 cents/lb (31-3-35). Adjusted World Price (AWP) decreased 1.21 cents to 66.38 cents. March 2021 cotton futures closed at 82.74, up 2.1 cents since last Friday. For the week, March 2021 cotton futures traded between 79.8 and 84.89 cents. Mar/May and Mar/Dec cotton futures spreads were 1.28 cents and -2.1 cents. May 2021 cotton futures closed at 84.02 cents, up 2.18 cents since last Friday.

December 2021 cotton futures closed at 80.64 cents, up 2.95 cents since last Friday. Downside price protection could be obtained by purchasing an 81 cent December 2021 Put Option costing 6.89 cents establishing a 74.11 cent futures floor.

Wheat

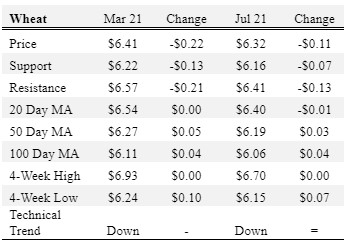

Wheat net sales reported by exporters were up compared to last week with net sales of 23.6 million bushels for the 2020/21 marketing year and 3.4 million bushels for the 2021/22 marketing year. Exports for the same time period were down 2% from last week at 18.3 million bushels. Wheat export sales were 84% of the USDA estimated total annual exports for the 2020/21 marketing year (June 1 to May 31), compared to the previous 5-year average of 85%. In Tennessee, spot wheat prices ranged from $6.74 to $6.81. March 2021 wheat futures closed at $6.41, down 22 cents since last Friday. March 2021 wheat futures traded between $6.25 and $6.71 this week. March wheat-to-corn price ratio was 1.17. Mar/May and Mar/Jul future spreads were 4 and -9 cents. May 2021 wheat futures closed at $6.45, down 17 cents since last Friday.

In Tennessee, new crop wheat cash contracts ranged from $6.15 to $6.78. July 2021 wheat futures closed at $6.32, down 11 cents since last Friday. Downside price protection could be obtained by purchasing a $6.40 July 2021 Put Option costing 55 cents establishing a $5.85 futures floor.

Source : tennessee.edu