Winter wheat can often be found to survive short freeze thaw events throughout the winter. However, there are concerns about crop damage and survivability, particularly in those fields that were planted late last fall and those fields that were covered in ice for prolonged periods.

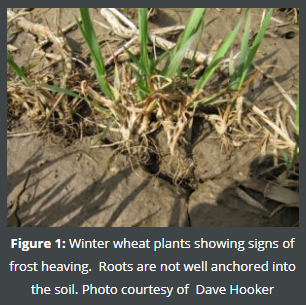

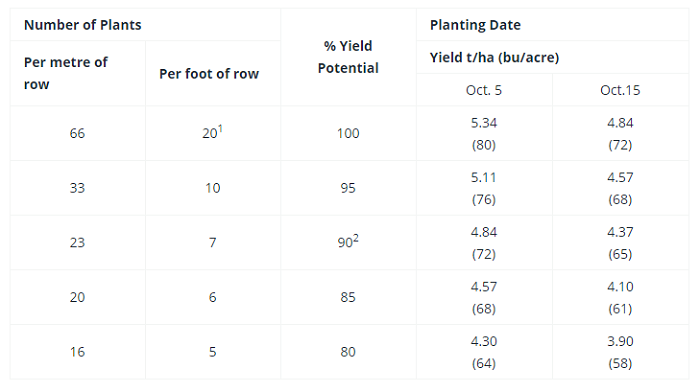

When making assessments for winter survival, fields are typically walked after a week or two of warm weather. This usually occurs in late April to early May after growth resumes, with the replant decision to another crop being made as late as possible. Fields that should be prioritized include: those that were planted shallow, had frost heave problems (planted too shallow!) (Figure 1), planted with a variety that has poor winter hardiness, were planted late or had ponding and ice throughout the winter. When evaluating wheat stands you need to count the number of plants per foot of row. Table 1 shows the yield potential for various plant stand counts.

Table 1. Determining Yield Potential for Various Plant Stand Counts

Source: Smid, Ridgetown College, University of Guelph, 1986-90.

1Full stand.

223 plants/m (7 plants/ft) of row, healthy and evenly distributed plants.

It is also important to assess the health of the plants themselves to determine whether plants are actually going to survive or not. Are the plants well anchored into the ground or is the seed lying on the soil surface with the plant holding on by a single root? If plants are not well anchored, do not include them in your stand counts as they are less likely to survive.

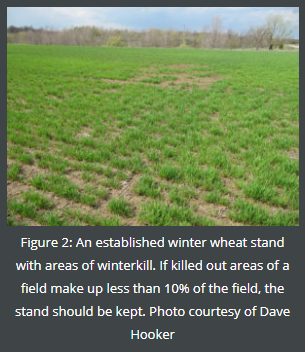

When making assessments do not focus on bad spots in the field. Conduct a number of stand counts and plant health assessments throughout the entire field to get a broader perspective of what is happening. If 5% of the field is in poor condition and the remainder of the field is in good condition, do not take the wheat out (Figure 2). Also, be sure to consider the planting date. If the wheat was planted early, it has more yield potential.

Source : fieldcropnews