By Isis Almeida

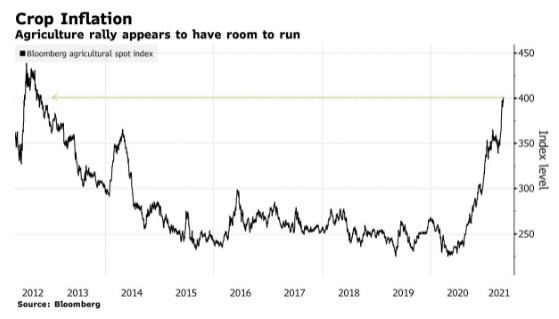

Crop prices are already at the highest levels in more than eight years, and with meat and fuel markets running hot, the rally may still have further to go.

Meat producers and biofuel makers have so far seen a bull market of their own, passing on the increase in grain costs as the world emerges from the pandemic. Executives from Archer-Daniels-Midland Co. and Bunge Ltd., two of the world’s top agricultural commodities traders, say there are very few signs the rally is curbing demand. And the U.S. is approaching summer — peak time for grilling and driving — which should only boost consumption further.

Everything from corn to soybean oil has surged as top commodities buyer China scoops up U.S. supplies just as dry weather in Brazil fuels concerns about the size of crops in the South American agriculture powerhouse. Demand for cooking oils to make green diesel has also been on the rise, sending a gauge of crop prices to the highest since 2012 and exacerbating global food-price inflation.

“What we’ve got going on is a fairly rare circumstance where pretty much everything in the supply chain is profitable,” said Dan Kowalski, vice president of research at CoBank. “So there hasn’t been any reason from a fundamental perspective, at least domestically, for demand to drop off.”

The poultry, cattle and pork industries are all profitable, with hog prices hitting the highest prices in almost seven years. Beef packers are cashing in fat profits, with margins near the record levels reached during the pandemic. Even the beleaguered ethanol market is seeing the highest prices in six years as the car makes a comeback as the preferred transport in the post-covid era.

“In terms of destruction of demand, we haven’t seen that to any degree,” Juan Luciano, ADM’s chief executive officer, said in an earnings call last week. “The only thing you can say: things have become expensive.”

Greg Heckman, who leads rival trader Bunge, also says he is seeing very little sign of demand destruction as “animal profitability continues to be good.” Brazil is one of the few places to see setbacks as the government ordered a reduction in the blending mandates for biodiesel, reducing demand for soy oil.

Brazil Demand

“Brazil is having a very difficult time with Covid, so I think that the overall economy is suffering,” Luciano said. “The government is trying to alleviate some, to alleviate a little bit the pressure on inflation there. But that’s probably the only example I can pinpoint at this point.”

Demand for animal feed in Brazil is unlikely to grow the 4% previously expected as producers of eggs, milk, chicken and hogs have cut down use due to higher costs, according to Ariovaldo Zani, president of animal feed-industry group Sindiracoes.

“We’ve noticed feed demand falling from a year ago probably because animal production has been also reduced,” Zani said. “We may see this rate going down to 2% or 3%.”

India is another place where demand destruction is taking place due to a coronavirus resurgence, Heckman said. Low profits from crushing soybeans in China have also hurt demand for soybean meal, but that has been replaced with wheat, a normal substitution when prices rise.

The first signs of any decline in global demand will likely come from the export markets, when China starts slowing crop purchases, CoBank’s Kowalski said. The Asian nation has already bought a record amount of American corn and soybeans, with traders speculating that some of it will be for state reserves.

Click here to see more...