By Bryon Parman

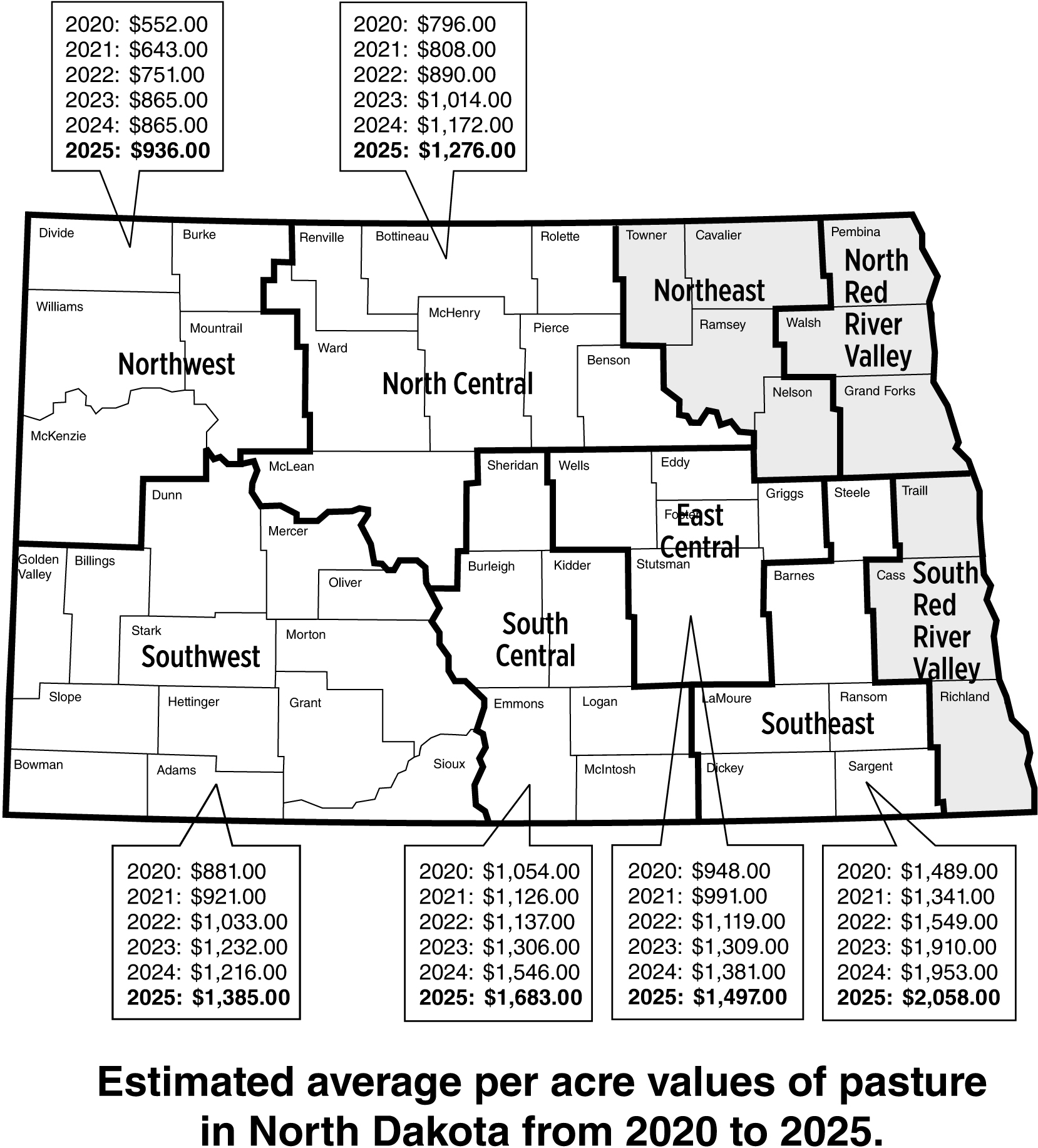

2025 now marks the fifth year in a row that statewide pastureland values and cash rental rates in North Dakota moved upwards, says Bryon Parman, North Dakota State University Extension agricultural finance specialist. From 2024 to 2025, statewide pastureland values increased 8.9% while cash rental rates increased 7.5%. From a dollar value, statewide pastureland values increased from $1,355 per acre in 2024 to $1,473 per acre in 2025, while rents increased from $23 per acre in 2024 to $25 per acre in 2025.

These values are based on survey data in the North Dakota Department of Trust Lands Annual Land Survey. The data, which has been weighted for this article by county acreage count and put into NDSU Extension regions, can be found at https://www.land.nd.gov/resources/north-dakota-county-rents-prices-annual-survey. The NDSU regions do not include values for the southern Red River Valley, northern Red River Valley, or the northeast regions due to very low numbers of reported pastureland rental rates or sales values. Also, single year variation may not reflect actual conditions. It is more useful to look at trends or multi-year movements.

The increase in pastureland values statewide was fairly consistent across regions with the exceptions of the southwest and the southeast regions. In the southwest region, pastureland values increased 13.9%, which was the largest regional increase. The southeast had the lowest increase of 5.4%. The rest of the regions in North Dakota increased between 8.2% and 8.9%, which is close to the statewide average.

Rental rates across the state were a bit more mixed. While every region saw an increase, there was a wide range in the magnitude. The lowest increase in pastureland rents in North Dakota occurred in the southwest region, increasing less than 1%. The largest increase occurred in the southeast, where region rents moved up over 16% from 2024 to 2025. The east central region saw a rental increase of 8.2% per acre, while the northwest region increased almost 9.7%. The increases in the north central and south central regions were a bit lower, increasing 5.5% and 4.7% respectively.

Overall, since 2021, pastureland values are up 51.5% statewide, while cash rental rates are up 18.6% over that same period of time. As a result, and much like cropland values across the state, pastureland rental rates continue to lag way behind pastureland values. As of 2025, pastureland rental rates are 1.7% of the overall market value. While rents for pastureland have typically been a lower percentage of the overall market value compared to cropland rents versus values, 30 years ago pastureland rents were around 6% of the market price. By 2010, this ratio had fallen to 3.64%, and now in 2025, that ratio has fallen to a multi-decade low.

“With 2024 and 2025 experiencing a multi-decade low in cattle inventories, the demand pressure from ranchers to push pasture rental rates upwards hasn’t been there despite record-high cattle prices," says Parman. "It can take years for beef cattle inventories to adjust to market prices, and therefore, high prices in the cattle markets are likely seen in land prices well before they would have an impact on rental rates.”

Source : ndsu.edu