By Don Shurley

It’s been a very wild last three weeks. Prices have suddenly found new optimism and bullish momentum. To be frankly honest, few could have seen this coming. Now, few can know how far this will go. There are just so many factors in play—some related to supply and demand fundamentals, some not.

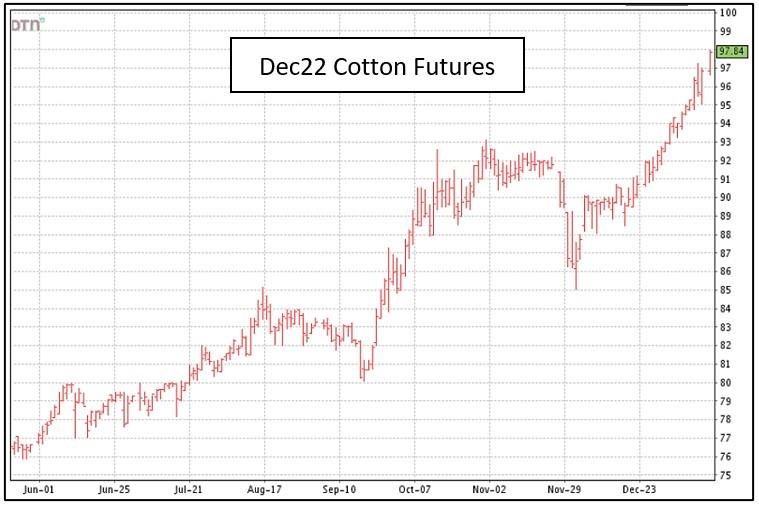

Old crop (2021 crop) March 22 futures has gained roughly 14 cents or about 13% over the past 3-4 weeks. New crop December 22 futures has gained roughly 10 cents or about 11%. Both March and December have set new contract highs. On January 18, Mar22 futures stood at $1.21/lb. and Dec22 at $0.98/lb.

The news of the new OMICRON variant created demand and supply chain fears and dropped prices about 10%. This created a panic with some producers, and rightfully so depending on the situation, deciding to recap or contract a portion of the crop before price fell even more.

Now, almost 2 months later, prices have recovered and moved higher than the pre-OMICRON high. What’s happened? In summary:

- The uncertainties of OMICRON are still out there and numbers make the news, but the initial panic has subsided.

- Speculative buying and bullishness that jumped ship earlier has started to return.

- The US crop reduced 660,000 bales in USDA’s January report.

- World Use (demand) down slightly in the January report; China reduced ½ million bales but India, Pakistan, and Mexico each up slightly. World Ending Stocks reduced.

- Export sales have had some good weeks—sometimes very good, sometimes not so good. The pace of shipments are sometimes a concern.

- Cotton is being supported (being carried along) by strength in other commodities and the stock market.

Having seen what has happened with 2021 crop prices and marketing decisions, producers may be reluctant to price for fear of being too low and too early. The thinking is—if 2021 crop went to $1.20 or better, why not 2022? I fully understand. Also, with costs of production skyrocketing and price and availability uncertain, the farmer needs every cent possible.

But, remaining 2021 crop marketing must wrap up and 2022 crop marketing must begin at some point. This new run we’re seeing in price and the thankful optimism it fuels and the need for high price to cover costs—it all makes for some tough decisions.

Looking ahead to the 2022 crop, there are several factors, opportunities, and concerns:

- For several reasons, it is expected that acreage will increase. If realized, what impact will that have?

- An increase in acreage doesn’t necessarily mean price moves lower. It ultimately depends on weather and production.

- It also depends on demand. Will demand and US exports (our global market share of that demand) continue to be good?

- OMICRON, other commodities, stock market, value of the dollar…. All these also have an impact.

- US-China and US-Russia relations.

Source : ufl.edu