We’ll spare you the long story of how 2020 was difficult for everyone – assuming you aren’t a time-traveler or a visitor from outer space, you already know it. And if you follow this column, you’ll know that consumers turned to dairy in difficult times, from baking at home to stocking up on fluid milk in the COVID-19 pandemic’s earliest days.

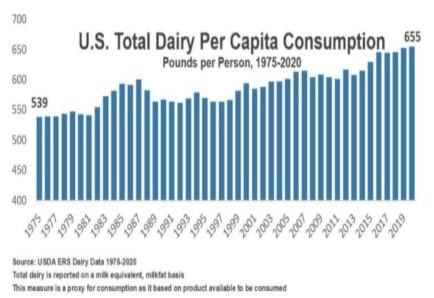

But the final consumption data for 2020 is now in, and the spreadsheet confirms what we already knew in our hearts: For the third consecutive year, U.S. per-capita dairy consumption increased, to 655 pounds per person from 653 pounds in 2019, showing a resilience in dairy that reflects that of those who relied on it.

No eye-poppers in this year’s report. A small uptick in yogurt, a gain in butter as it marches back to 1960’s-level consumption, increased buying of both full-fat and lower-fat ice cream – because what’s a lockdown without ice cream? And fluid milk consumption held steady, belying the haters who always use receding prominence as fake evidence of the “death of dairy” even as gains among other dairy products more than outpace any fluid losses.

Click here to see more...