By Chad E. Hart

The upward pricing pattern for corn and soybeans that established itself during the latter half of 2020 subsided as we entered 2021, but the price volatility that supported the price gains remains. The markets have experienced large price swings in both directions since New Year’s. Both bears and bulls have found reasons to trade so far this year. And both types of traders can find reasons to support their outlook in the market data.

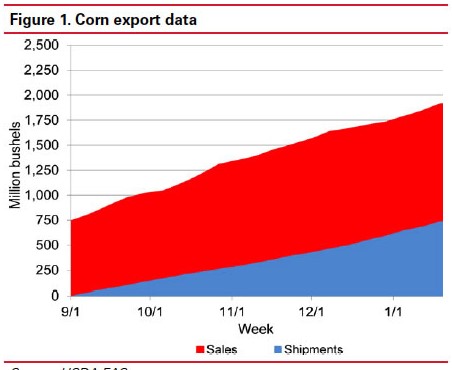

Bulls point to the strong pace of export sales for both crops. Bears are concentrating on the pace of actual shipments and the potential for sales cancellations. Figures 1 and 2 highlight these issues for corn and soybeans. For corn, the pace of international sales this year has been much stronger than in the previous couple of years. With sales approaching two billion bushels already, the data is supportive of USDA’s projection of 2.55 billion bushels of corn exports. But while, corn sales have been robust. Corn shipments (actual deliveries of those export sales) have been lagging behind. At the end of January, less than 750 million bushels of corn had been delivered to international markets. Roughly 40% of sales have been converted to shipments. Thus, the corn market does face some risk from trade cancellations. Burrowing into the individual country data, China and Mexico have received approximately half of their corn purchases, running ahead of the overall average. Out of our top markets, it’s Japan and Taiwan where outstanding sales are much larger than accumulated exports.

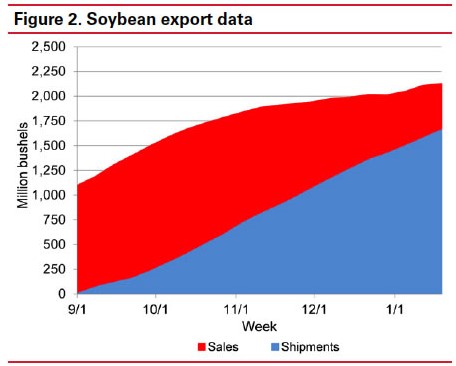

Soybeans face a different issue in the export markets. Shipments have been brisk throughout the fall and winter, while sales have slipped. The early rush for beans has put the market already very close to USDA’s export target, but the sales pace has raised some concern in the trade. Overall, roughly 80% of soybean export sales have been shipped. So the threat of cancellations is smaller for soybeans than for corn. For China, the dominant market in the arena, shipments stand at 90%. Countries where shipments are lagging include Japan (65%), Taiwan (58%), and Mexico (56%).

Both the corn and soybean markets will remain extremely sensitive to export news. Corn traders will focus on the pace of actual shipments and the potential for cancellations. Soybean traders are looking for some additional sales before the global markets turn toward the South American crops.

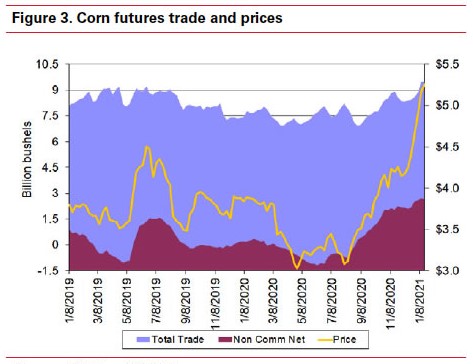

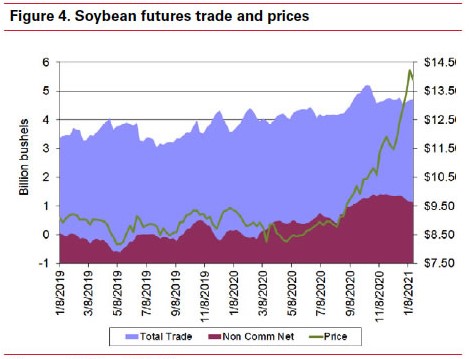

Another feature that has supported prices over the last few months and has definitely added to the volatility in the crop markets has been the strength of speculative trade in the crop markets. As we discussed last month, outside investors have moved significantly into agriculture over the past several months, flipping from being short in both corn and soybeans to establishing long positions (the longest we have seen in the past couple of years) for both crops.

Figures 3 and 4 provide updates on speculative positions. For corn, speculative interest has plateaued over the last month. That support has helped hold corn prices in the $5 range.

Meanwhile, for soybeans, speculators have been shrinking their net long position over January. The pullback in speculative interest coincides with a pullback in soybean futures prices. Overall, speculators remain bullish on soybeans, holding a billion bushel net long position, but they have shaved that position down noticeably over the past few weeks.

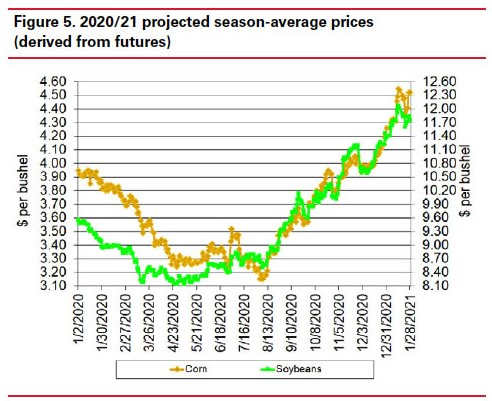

Farmers have enjoyed an incredible run in crop prices since the derecho. Figure 5 shows the evolution of the 2020/21 season-average price since the beginning of last year. The roughly $1.50 per bushel swing in corn and $4 per bushel bump in soybean prices have improved the financial outlooks for many. While January has been turbulent, crop prices remain at very strong levels. Corn has been able to weather the mid-month jitters and finished the month with the highest price projection for the marketing year. Soybeans were not as fortunate, coming down from a peak earlier in the month.

As we move forward into February and March, traders will begin to shift their focus to the prospects for the 2021 crops. Weather conditions, such as the lingering drought in the Great Plains, will add to the volatility mix in the markets. Traders in both the corn and soybean markets are preparing for roughly 90 million acres planted to each crop. An increase in overall planted area is expected, but with the potential for diminished soil moisture, questions will center on the potential for additional crop production. As farmers look to gear up to meet the greater crop usage we have seen over the past several months, traders will be watching for and will be wary of the potential for that usage to slip, especially from the international perspective.

Source : iastate.edu